The serially loss-making Aston Martin Holdings Ltd. is purring again. At least, that’s the conclusion you might draw from the few financial figures the luxury carmaker hands out to journalists each quarter.

Revenue jumped by half last year thanks to swish new models such as the DB11. The private-equity and Kuwaiti-owned company’s 87 million pounds ($116 million) of reported pretax profit, plus positive free cash flow, will have whetted the appetite of investors ahead of a possible IPO later this year. While first-quarter earnings, published on Monday, were a little less high-octane because of planned model changeovers, the British manufacturer said it still eked out a small profit.

Nevertheless, amid talk of a possible 5 billion pounds ($6.7 billion) IPO valuation — putting its earnings multiples on a par with Ferrari NV — it’s worth unpicking how a business that’s been insolvent several times has managed to transform its finances so quickly.

Indeed, Aston Martin’s

annual accounts, filed with the U.K.’s Companies House, show a less rosy picture than the one presented by its effusive press releases.

In a Bloomberg television interview, chief executive Andy Palmer described last year’s quarter-billion pound improvement in pretax profit as a “quite remarkable swing.” Indeed it was, but it was enabled by some pretty helpful accounting.

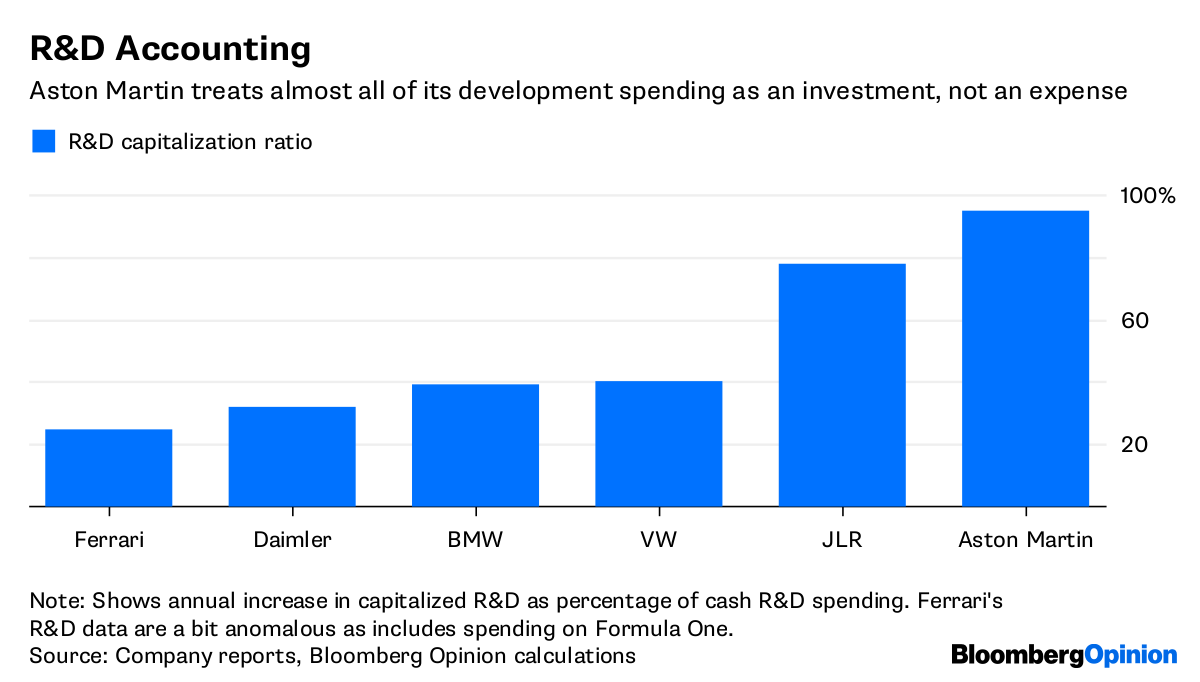

Aston Martin spent 224 million pounds on R&D last year (one-quarter of sales) but only 11 million pounds of that was expensed in the profit and loss statement. The rest — some 95 per cent — was capitalized on its balance sheet. If Aston Martin was based in the U.S., where GAAP accounting rules usually prohibit companies from capitalizing R&D costs, it would have reported another full-year loss.

In fairness, Aston Martin isn’t the only European carmaker to benefit from the more flexible R&D accounting under IFRS. And there are good arguments why some R&D should be considered an asset rather than a one-off expense. Still, the proportion of R&D capitalized by Aston Martin is high.

R&D Accounting

Aston Martin treats almost all of its development spending as an investment, not an expense

Source: Company reports, Bloomberg Opinion calculations

Importantly, this has an impact on more than just the profit and loss account. Capitalized R&D represents about half of the 930 million pounds of intangible assets on Aston Martin’s balance sheet. It also boosts owners’ equity (148 million pounds at the end of 2017) and therefore improves financial ratios such as debt-to-equity — which is vital given the carmaker’s large liabilities.

Elsewhere in the accounts, one could also ask how come Aston Martin reported positive free cash flow when spending is so high. The answer comes from its ability to collect deposits from customers well in advance of production — something Tesla Inc. also employs effectively. Unlike Tesla ($854 million) or Ferrari (167 million euros), Aston Martin doesn’t say exactly how much of its customers’ cash it is holding, but it’s clearly a lot. By my estimate, the company has probably collected almost 100 million pounds upfront for its Valkyrie hypercars alone.

What’s wrong with that? In theory this is just astute management of working capital. Aston Martin’s wealthy customers are effectively extending it a form of free finance. But those receipts, which contributed to a 150 million pounds inflow from working capital last year, arguably paint a flattering picture of Aston Martin’s ability to generate cash flow from building cars. It’s questionable whether it will be able to keep repeating the hypercar deposit trick ad infinitum.

This is a reminder that Aston Martin has to pull

every available financial string to keep up with richer rivals. Daimler AG, a 5 percent shareholder, supplies engines, powertrains and electronics. That keeps costs down but doesn’t exactly project financial strength or independence. Palmer acknowledges that Aston Martin can only be very profitable by having a “big brother.”

There’s no doubt the company is in much better shape these days. A more than doubling of prices since 2007 has boosted gross margins and the launch of an SUV in 2019 bodes well for growth. The yield on Aston Martin’s debt has narrowed since a refinancing last year.

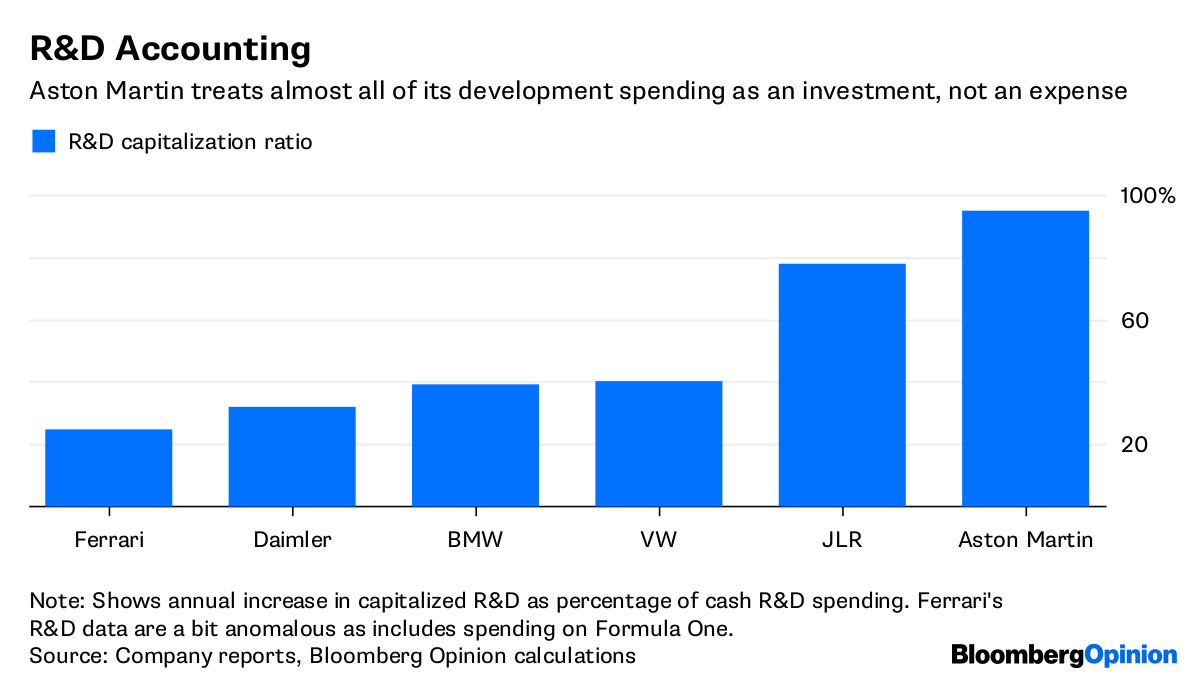

Growing Confidence

The yield on Aston Martin’s sterling-denominated debt has narrowed since a refinancing in 2017

Source: Bloomberg

But blindly applying a Ferrari-style multiple to its earnings and coming up with an eye-popping valuation ignores some big constraints. As always with luxury motors, it pays to look under the hood.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Chris Bryant at cbryant32@bloomberg.net

To contact the editor responsible for this story:

James Boxell at jboxell@bloomberg.net

Go to Source