Sergio Marchionne once defined his mission at Fiat Chrysler Automobiles NV — a company formed via the unlikely union of two hobbled automotive also-rans — in almost biblical terms.

“We need to be able to cross the desert,” the CEO told investors in 2016 as he looked at the technological revolution facing the industry. “We need to be able to get to the other side.”

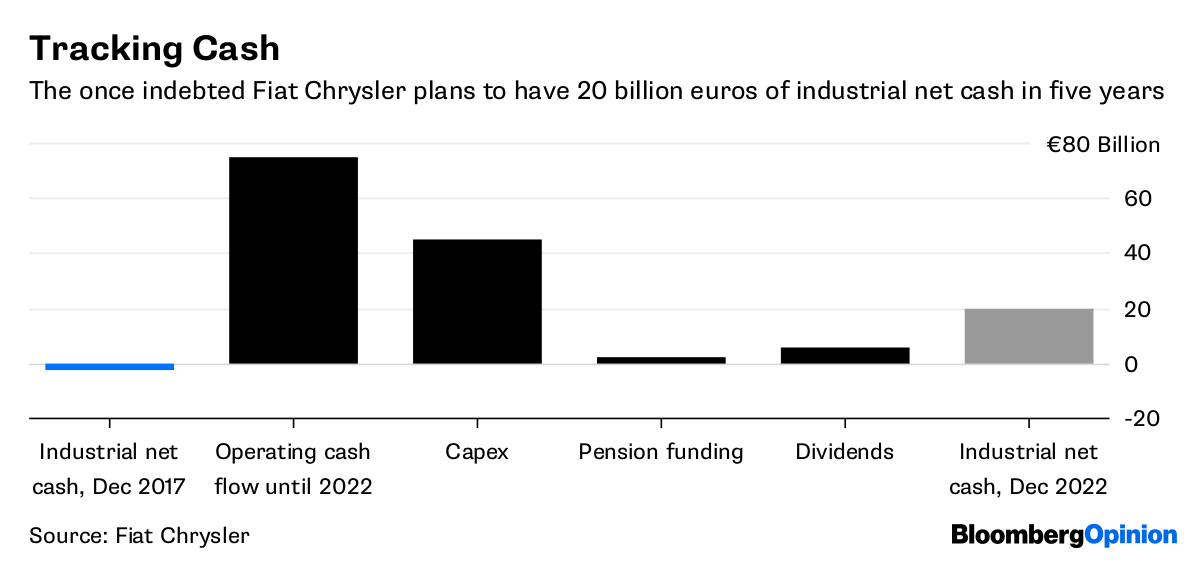

Marchionne’s message, in a presentation setting out new five-year targets for sales and earnings on Friday, was that salvation is near at hand in the form of bumper cash flows.

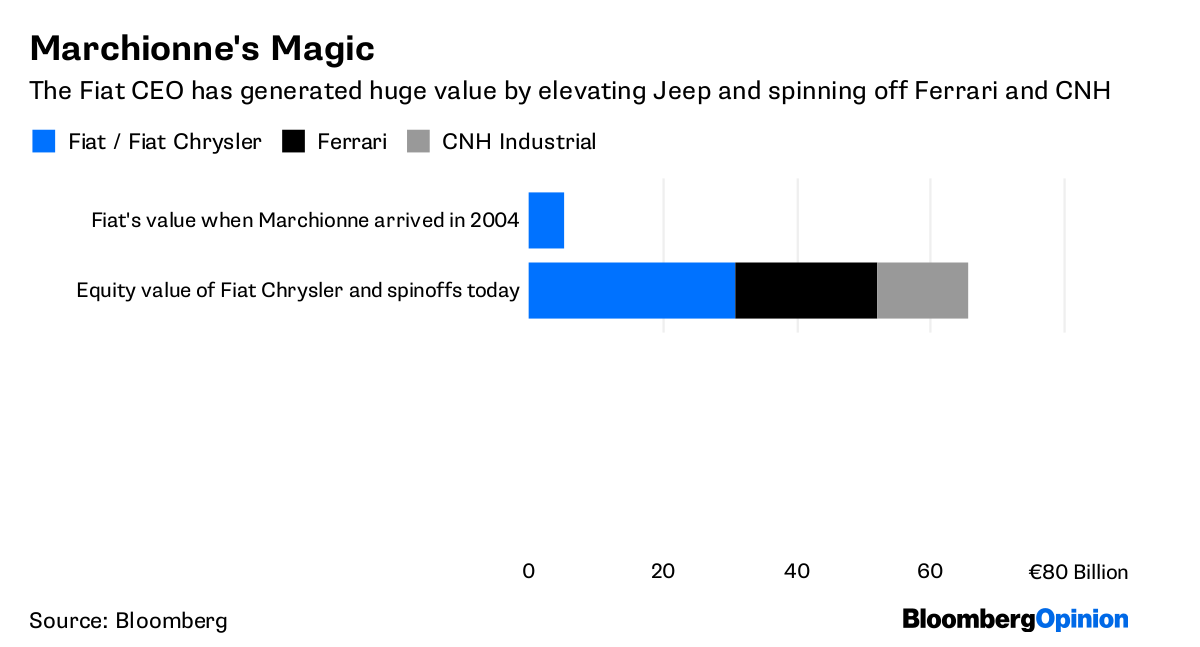

The CEO won’t actually be able to join shareholders in the Promised Land, though. His 14-year stewardship of Fiat, during which he increased the value of its assets by more than ten times, ends later this year.

Analysts have on occasion begged Marchionne to soldier on into his dotage but, alas, his mind seems made up. The consolation is that with net debt now all but eradicated, investors have good reason to think that Fiat will finally start to resume dividends, and possibly buybacks. At least, that’s the plan.

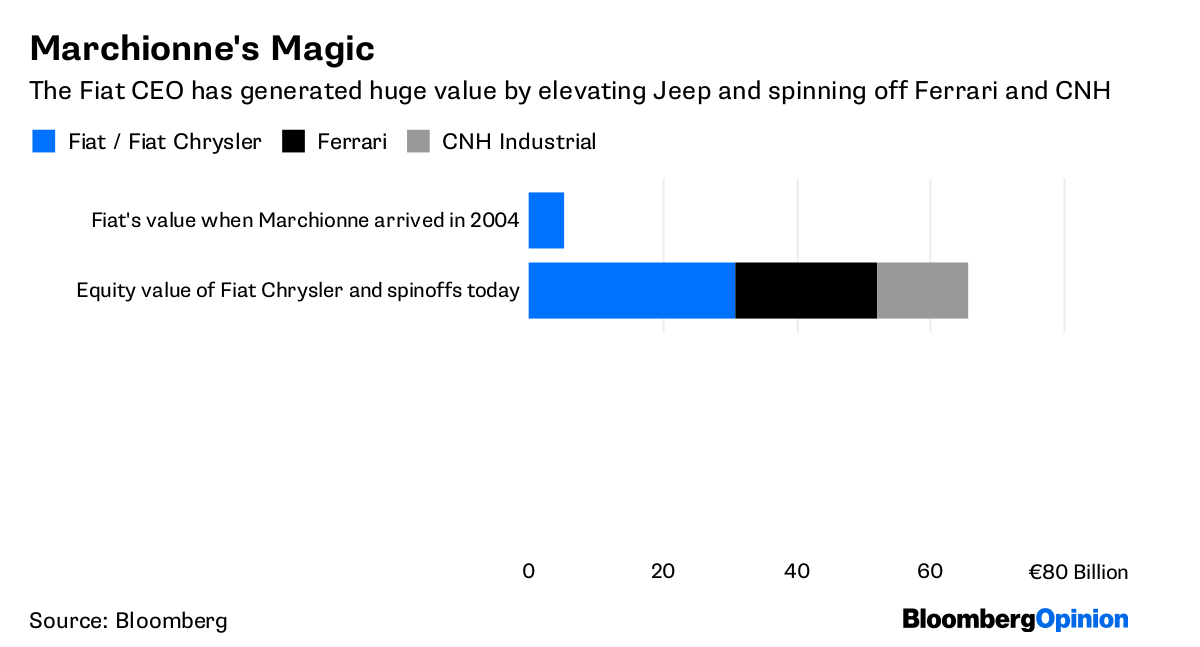

Marchionne’s Magic

The Fiat CEO has generated huge value by elevating Jeep and spinning off Ferrari and CNH

Source: Bloomberg

It’s difficult to overstate what Marchionne has achieved at Fiat, which was burning cash and had a mountain of debt when he took charge in 2004. His genius was spotting the value inherent in Fiat’s businesses — and later Chrysler’s too — and allocating capital accordingly.

Marchionne realized Fiat would only make real money if it prioritized selling Jeeps and luxury Alfa Romeos, Maserati and Ferrari vehicles. In terms of profit, the namesake Fiat and Chrysler brands have long since become less important.

It is by growing the core businesses, and repositioning the manufacturing footprint, that Marchionne thinks Fiat can generate about 8 billion euros ($9.3 billion) of adjusted operating profit in 2018 — and potentially twice that by 2022. All that implies Fiat will generate 30 billion euros of free cash flow from making cars, allowing it to resume payouts.

Tracking Cash

The once indebted Fiat Chrysler plans to have 20 billion euros of industrial net cash in five years

Source: Fiat Chrysler

Is that realistic? So far, analysts’ skepticism about Marchionne’s previous goals — “fantasyland” was how one described them — has been largely proved wrong.

But his latest plan is based on the perhaps optimistic assumption that global car sales will remain in good shape. A slump would cause Fiat to bleed several billion euros of cash due to its negative working capital position. (I explained this process in more detail here; Fiat says there are plenty of levers it could pull to remain profitable.)

The company’s big bet is that low fuel prices are a “permanent condition” and will continue to drive sales of big Jeeps and Ram trucks. But this looks a questionable assumption in the wake of recent rises in the price of oil.

It’s awkward, too, that Marchionne is exiting before Fiat has overcome some of the major challenges the industry faces, especially reducing emissions as well as the growth of ride-hailing and autonomous vehicles.

Regulators are breathing down Fiat’s neck over its diesel engines, some of which far more nitrogen oxides on the streets than in the laboratory. Marchionne has promised to phase out diesel engines by 2021 but, that doesn’t obviate the risk of fines for any sins of the past. (Fiat denies wrongdoing.)

Fiat has still got much catching up to do to cut carbon dioxide emissions and hence avoid regulatory fines in Europe for non-compliance, even if it did outline plans for a big electrification push on Friday.

That program will require an increase in capital expenditure, which will limit cash flow growth over the next couple of years.

Similarly, plans to set up a captive car finance company in the U.S. — something Fiat also lacked funds for in the past — will consume cash too, though, in the long-term, it should boost profit.

Marchionne’s successor may decide that all these demands are too much for a company that sells fewer than 5 million cars a year to meet on its own. But whereas Marchionne was once forced to shop around for a merger partner from a position of weakness (to no avail), his successor will be left holding much stronger cards. That is no mean achievement.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Chris Bryant at cbryant32@bloomberg.net

To contact the editor responsible for this story:

Edward Evans at eevans3@bloomberg.net

Go to Source