The Chinese founder of the world’s biggest maker of electric-vehicle batteries and his top lieutenant became billionaires Monday after their company’s shares soared during the first day of trading in Shenzhen.

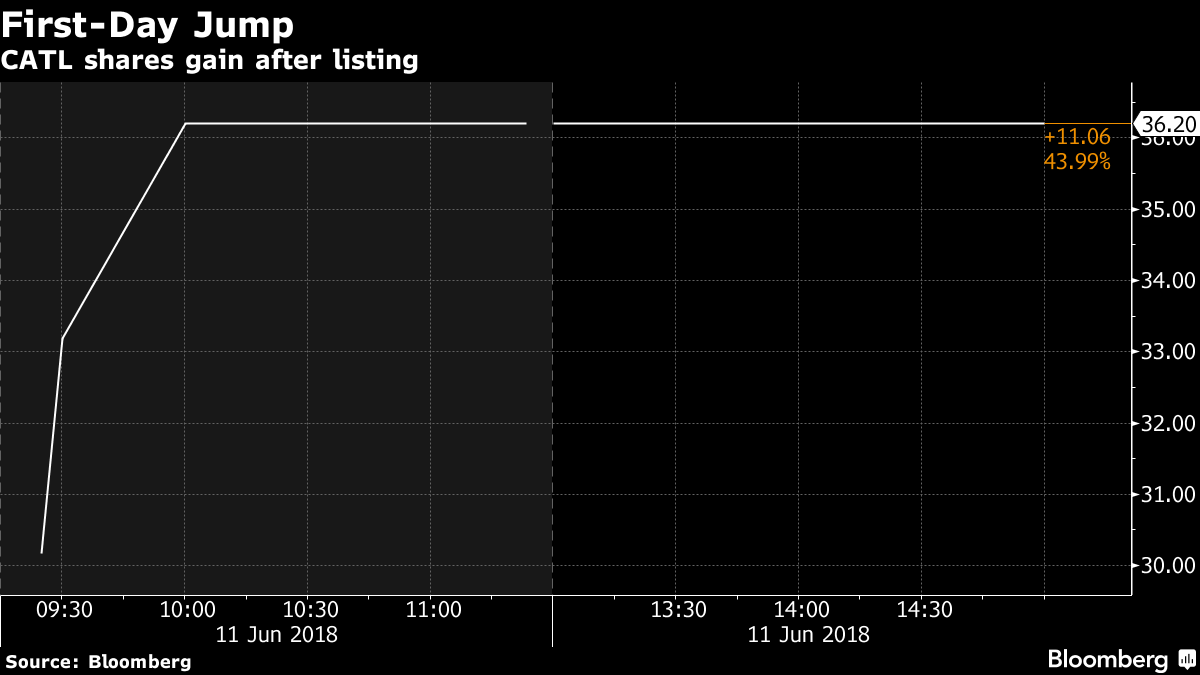

Contemporary Amperex Technology Co. Ltd. jumped by the maximum 44 percent allowed by the exchange, valuing the company at about $12.3 billion. That cemented the position of Zeng Yuqun, CATL’s founder and top shareholder, on China’s rich list with an estimated net worth of about $3.4 billion, according to the

Bloomberg Billionaires Index.

Investors are confident that CATL can fend off rivals

Panasonic Corp., which makes power packs with

Tesla Inc.; Warren Buffett-backed BYD Co.; and

LG Chem Ltd. as the increasing popularity of EVs boosts demand for the batteries that move them. CATL, whose customers include

Volkswagen AG, previously cut the size of its IPO by more than half, compared with its original ambitions, because of declining margins and a cap imposed by Chinese authorities on price-earnings ratios in IPOs.

The IPO made CATL the biggest company on China’s Nasdaq-style ChiNext list. Zeng, a 50-year-old engineer who started CATL seven years ago, owns a 26 percent stake. Vice Chairman Huang Shilin holds 12 percent and has an estimated net worth of $1.7 billion.

Macquarie Bank Ltd. in Hong Kong

rated CATL outperform on Monday and set a price target of 90 yuan, more than double Monday’s closing price of 36.20 yuan.

Read more about CATL’s rise into battery colossus

CATL, which also supplies

Nissan Motor Co.,

Hyundai Motor Co. and

BMW AG, last year overtook Panasonic as the world’s largest supplier of EV batteries by sales thanks to increasing domestic demand.

The government’s generous subsidies for new-energy vehicles and restrictions on gasoline cars in some cities will help battery demand quadruple in the next four years in China, Bloomberg New Energy Finance said in a

report Monday. CATL is best-positioned to benefit because of its advantages in capacity and customer base, BNEF said.

Zeng was born in a mountain village an hour away from CATL’s headquarters in Ningde city, Fujian province, and sometimes organizes employee excursions to his birthplace. For most of his career, he worked on lithium-ion batteries for consumer electronics, including the iPhone, at a subsidiary of Japan’s TDK Corp. that he helped set up.

Zeng’s decision to found CATL in 2011 marked a gamble on Chinese policy. Just 1,014 alternative-energy vehicles were sold in China that year, according to Bloomberg Intelligence, but Zeng’s prediction that the government’s push for alternative-energy cars would boost demand for lithium-ion batteries proved correct.

Still, challenges lie ahead. CATL lowered battery prices to gain market share after the government reduced EV subsidies, and that weighed on profitability, Zeng said last month during an online roadshow.

CATL will, during the next three years, “grasp the opportunities of the fast growth in the global lithium-ion battery market, and maintain our leading position in technologies, manufacturing, capacity and talents,’’ Zeng said.

CATL will use the IPO proceeds to help finance a new 24 gigawatt-hour factory in Ningde and to develop more-advanced battery technologies. CATL is supplying cells to a slew of new cars being introduced by global automakers in China, including

Hyundai’s plug-in version of the Sonata and Toyota Motor Corp.’s

ix4, a rebadged pure EV developed by its Chinese partner

Guangzhou Automobile Group Co.

CATL is also investing in other companies in the electric-vehicle ecosystem. The battery maker was one of the investors taking part in the

latest funding round of Byton, the Chinese electric-car startup founded by BMW veterans.

In Europe, CATL is nearing a decision to build a battery factory in Germany, planting a flag on the home turf of car giants Volkswagen, BMW and

Daimler AG, people familiar with the matter

said last week.

— With assistance by Pei Yi Mak, and Venus Feng