Dealers are pushing harder on used car finance business to offset falling margins on used cars.

Dealers are pushing harder on used car finance business to offset falling margins on used cars.

That’s the view of online technology specialist iVendi, which said values of high quality stock remaining high but retail prices were under pressure. It said there was “a definite increase” in activity designed to create additional profits around the sale of the vehicle.

“Many dealers are finding it tough to maintain a good level of profitability from simply selling cars and it looks as though this situation will persist for a while, with no real sign of the used market losing its buoyancy any time soon,” said iVendi COO Richard Tavernor

Tavernor said he was seeing “definite efforts” to increase penetration both online and in the showroom.

“Certainly, we are seeing some reviewing of lending panels going on and an accent on providing a good spread of products designed to meet changing customer needs, especially when it comes to used car PCP.

“However, the main thrust of activity is occurring around creating a strong link between motor finance and the vehicle both online and in the showroom,” he said.

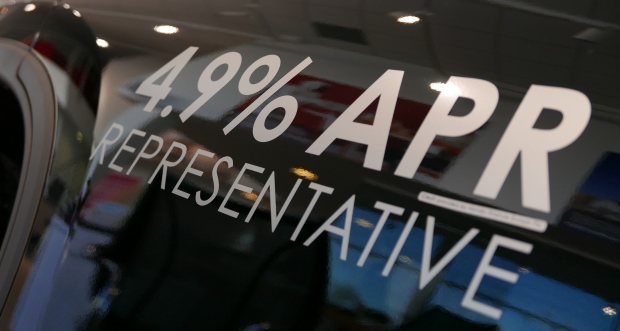

Dealers are boosting finance sales by having an illustrative finance example shown alongside the vehicle whenever the customer views a page.

“This doesn’t just underline the affordability of the vehicle but provides a click through for the buyer to find out more information about the finance product and progress their interest by using a calculator, prequalifier and even to make an application,” he said.

“Technology can be used in a similar way in the showroom. For example, allowing customers to access motor finance tools online while they are looking at a vehicle in the metal provides them with the means to take greater control of the process by letting them work through the options available in their own time,” he said.