In this digital era, disruptions have become routine. But not many disruptions are as deep and comprehensive as those facing the automobile industry.

To be sure, these upheavals have been in the works for a decade now. In 2009, China overtook the United States in car sales, signalling the decline of Detroit as the world’s car production centre and the shifting of centre of gravity from the West to the East.

That was just a trailer of the coming tectonic shift. Amid technological progress, concerns over fossil fuel emissions and global warming, the century-old internal combustion engine is facing an existential crisis and dirty fuel, diesel, is being abandoned as electric vehicles become the buzzword.

Shared mobility platforms — from Ola to Uber — are also impacting the behaviour of potential car buyers. The meteoric rise of Tesla and China Inc’s electric vehicle ambitions are just the two important markers of how the status quo in the auto industry is fast altering.

These battles are now playing out on Indian roads. The size of the world’s fourth-largest car market is expected to grow from $40 billion in 2017 to $265 billion by 2030. With 3% of global car sales today, India is expected to drive half the additional global demand. Expectedly, Motown India is recalibrating its strategy through acquisitions, alliances, diversification, re-alignments and even market exits.

In the mid-1990s, as India’s economy opened up, a bevy of short-lived partnerships — from Tata Motors-Mercedes-Benz to Mahindra-Ford — were stitched up to chase growth. That trend is reviving with the M&M-Ford partnership. Most MNCs, still making losses, have found India a tough battleground to crack. Additionally, from Hero Motocorp, M&M to Hyundai, companies are betting on new technologies like electric vehicles and new platforms like shared mobility to gain a good grip on Indian roads.

Here is a flavour of how some of those strategies are unfolding.

M&M RETOOLS FOR ROAD AHEAD

Stitching alliances, making acquisitions, launching and buying shared mobility Mahindra & has laid out a multipronged strategy gear up for the coming disruption in automotive industry.

The most recent move is its collaboration with Ford Motors to develop and cross-sell cars, including an electric sports utility vehicle. It will help both the players reduce product development cost and also gain economies of scale.

This is the second time the two have come together. In 1995, Ford entered India in partnership with M&M and rolled out the Escort sedan. Multiple acquisitions have happened on the way. In 2010, it acquired homegrown electric car company Reva. In 2011, it bought out majority stake in SsangYong, the South Korean automobile manufacturer. And in 2015, it did the same with Italian carmaker Pininfarina SpA, which will now help M&M launch an electric hypercar.

“We have strong belief in electric mobility. EVs will play a vital role in changing the industry. We are strongly committed to it,” says Mahesh Babu, CEO, Mahindra Electric Mobility. M&M is also preparing for the coming structural shifts in the automobile industry, thanks to trends such as shared mobility.

Earlier this year, it entered the ride-sharing business with electric car hailing service Glyd. It has already invested a significant sum in the self-drive car rental startup Zoomcar that is growing briskly in India.

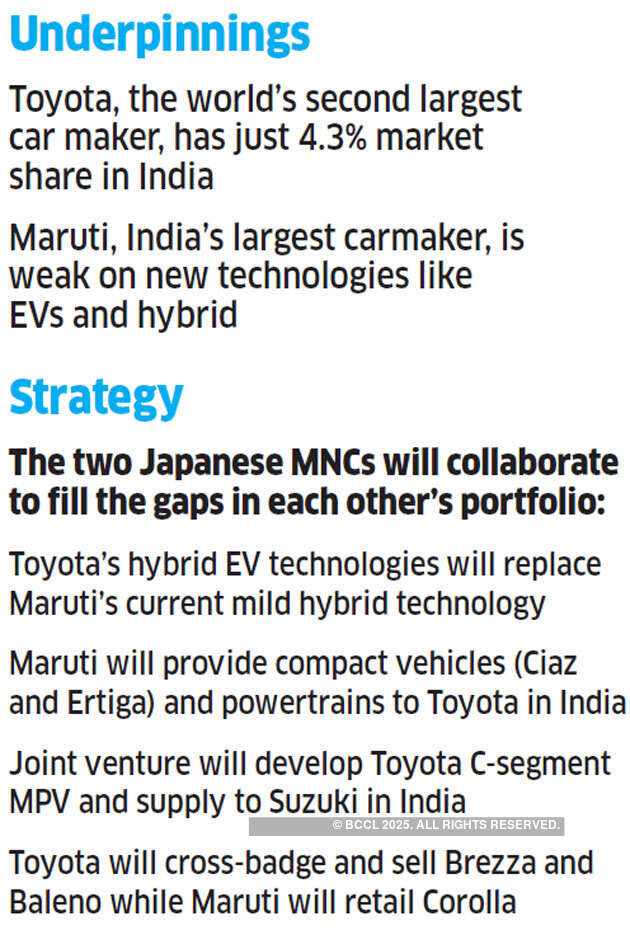

TOYOTA-MARUTI BROMANCE

India’s largest carmaker Maruti Suzuki and the world’s largest carmaker, Toyota Motors, have joined hands to get a firmer grip on Indian roads. Both have their respective reasons to collaborate.

On the global map, Suzuki is a small player (globally, 86 million cars were sold in 2018 as against Suzuki’s total car sales of 7.8 lakh) in the deep-pocketed car industry. Both size and financial strength have always been important in the automotive industry but it is particularly so now when the internal combustion engine is facing an existential threat due to new technologies such as electric mobility. Volkswagen is spending upwards of $40 billion to electrify its stable. Clearly, Suzuki will need to invest heavily on relevant technologies to maintain its grip on Indian roads.

Toyota has its own reasons. India, the world’s fourth-largest car market, has been a tough battlefield for most of the multinational automobile companies. Even as General Motors exited the Indian market and Ford is recalibrating its presence in the country, virtually every global MNC, including Volkswagen, Nissan Motor Corp and Toyota Motors has single-digit market share here and profitability for many remains elusive.

Partnering with Maruti in India would be the shortest route Toyota can take to get ahead on Indian roads. Maruti’s strengths in cost-efficient small cars and its dealershowroom network offer unparalleled advantage. The alliance will also help the two expand their presence in other emerging markets.

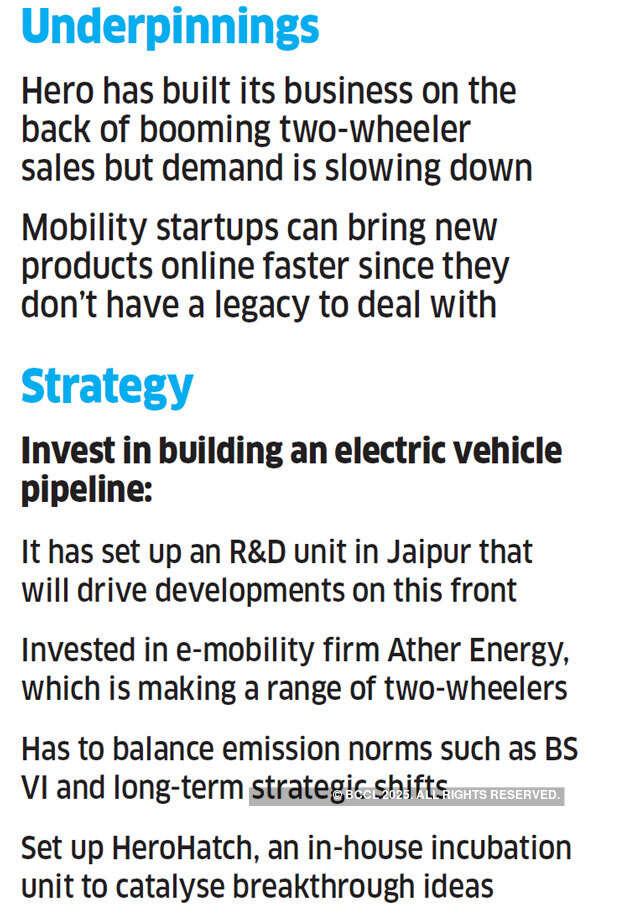

Hero’s Electric Ambition

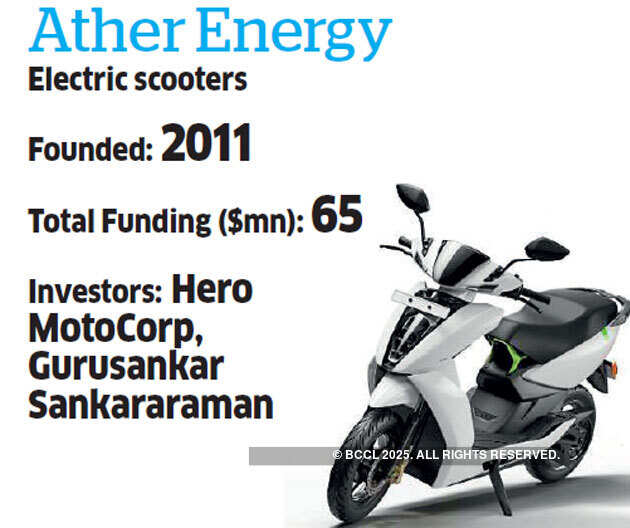

The long-term strategy of Hero Motocorp, India’s biggest two-wheeler maker, may hinge on the success of Ather Energy, a six-year-old electric vehicle maker from Bengaluru.

While Hero has widened its lead at the top, it is also keen to stay ahead of the pack by investing early in the next wave of mobility, in this case by backing Ather’s plans to build a range of electric vehicles and develop its own products in-house at the Centre for Innovation and Technology in Jaipur and a new R&D unit which opened in January.

Hero has also jumped on the startup bandwagon with HeroHatch, an incubation unit, to foster fresh ideas within the four-decade-old company. “At Hero MotoCorp, we are cognizant of the latest trends and constantly equipping ourselves with new technologies to be able to stay ahead of the curve,” Pawan Munjal, chairman, Hero Motocorp, had said in the company’s latest annual report.

At Ather Energy, for example, CEO Tarun Mehta says that electric vehicles are not just the future of the industry but will also redefine its fundamentals. “We believe product development cycles that old auto is used to — of a new launch every seven or eight years — will be reduced to just two or three,” he says. His company has launched two variants of electric scooters and has an electric motorcycle in the works. As charging infrastructure proliferates, Hero will want to replicate its outsized success with conventional twowheelers in the electric vehicle market, too.

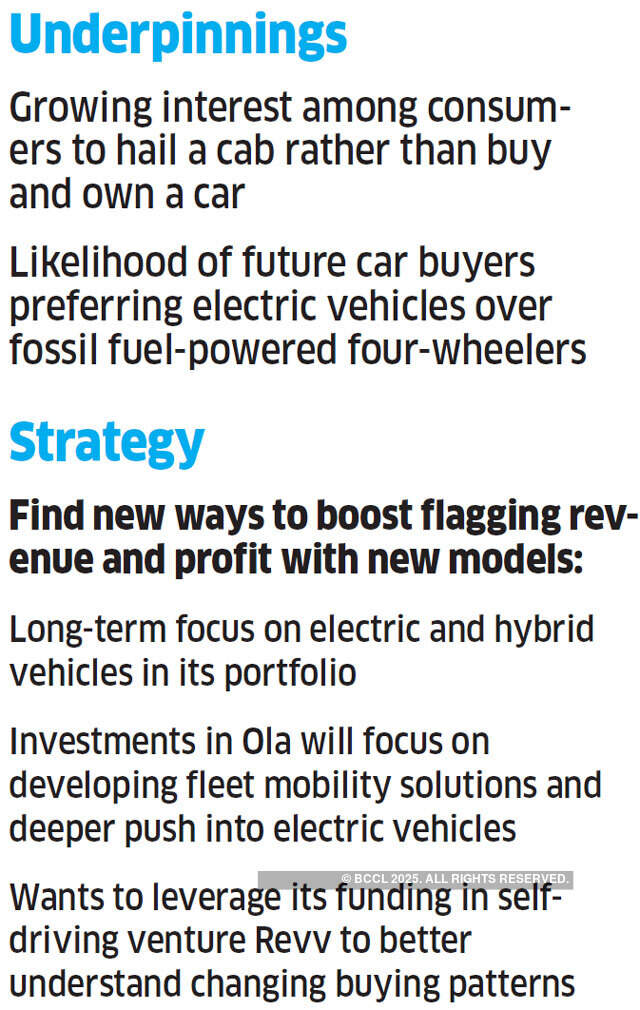

Hyundai’s Growth Hunt

India’s s second largest carmaker is stepping into the future. Over the past 12 months, Hyundai has invested in Ola, the ridesharing unicorn that has ambitious electric vehicle run a car hiring and leasing service.

While the Indian subsidiary of the South Korean carmaker has launched a new SUV, Venue, to increase its share in that segment, top managers of the company are aware that consumer preferences are shifting when it comes to choosing and buying (or not buying) cars. For starters, Hyundai’s first electric vehicle will hit the Indian market later this year, even as the company awaits incentives from the government to quicken electric vehicle adoption.

Then, leaning on its investment in Ola, Hyundai is developing vehicles and charging stations specifically for the ride-sharing market. It is piggybacking on two trends here: a shift in fuel from petrol or diesel to electricity and the fast growing interest in hailing a cab rather than owning and driving one’s own car.

Hyundai’s deal with Revv emphasises this shift. The startup had nearly 1,000 cars in 11 cities when Hyundai signed up as an investor, and this number was projected to increase to 10,000-12,000 cars in 30 cities by end of this year or early 2020.

“India is the centerpiece of Hyundai Motor Group’s strategy to gain leadership in the global mobility market,” says Euisun Chung, executive vice-chairman, Hyundai Motor Group.

“Hyundai will proactively respond to market changes and persistently innovate to deliver greater value to our customers.”

Going gets easy: Startups are making big carmakers change route

Ola

The ride-sharing unicorn has extended its services to electric mobility and started a self-driving initiative too. CEO and cofounder Bhavish Agarwal has roped in a series of new investors even as he tries to keep SoftBank and its billions at bay.

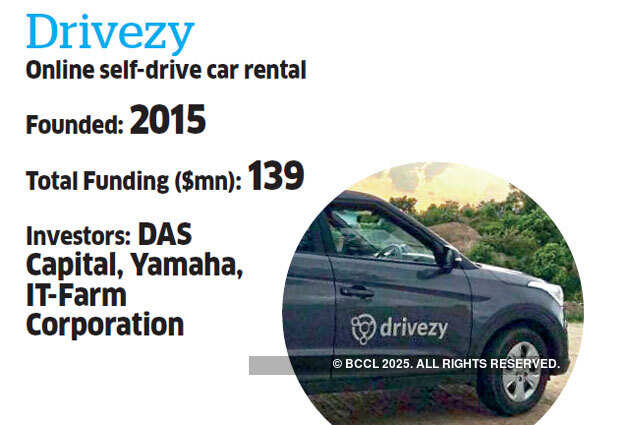

Drivezy

The online two-and fourwheeler self-drive platform is considering raising $100 million in equity funding and $400 million in asset financing to grow its business. The firm expects to grow from 10 cities currently to 21 cities by next year.

Ather Energy

The Bengaluru-based e-mobility startup wants to expand services to threefour more cities, starting with Chennai. The founders want to expand the range of vehicles to motorcycles too, even as they want to use tech to shrink protracted vehicle and development cycles from eight years to just three.

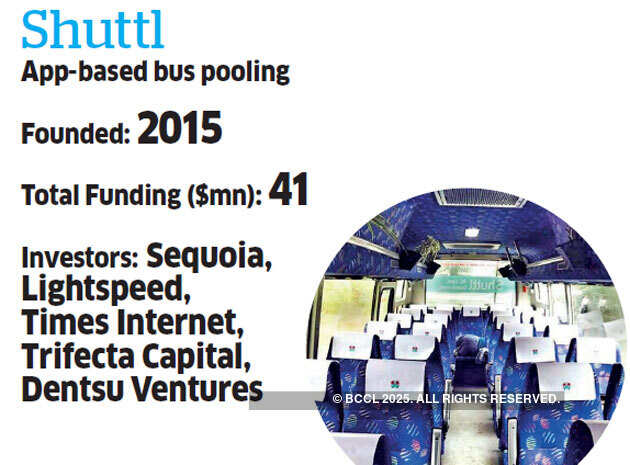

Shuttl

The intra-city bus aggregator has crossed 60,000 daily rides, mainly in the national capital region. It raised funding from marquee names such as Sequoia Capital and is expanding to other cities and adding 300 electric buses to its portfolio.

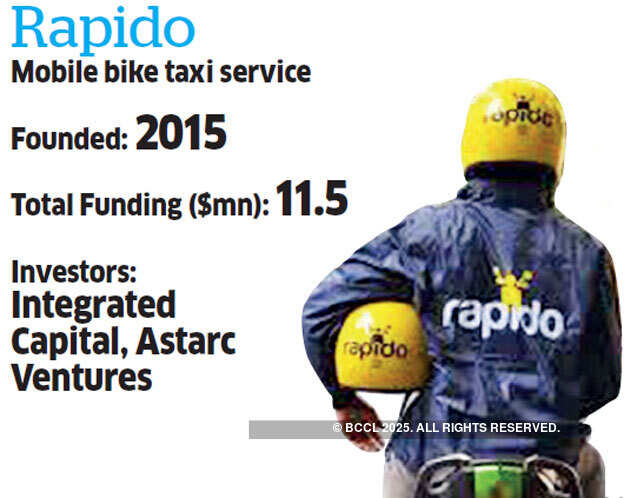

Rapido

Present in Bengaluru, Delhi and Hyderabad, the firm is facing regulatory potholes as it seeks to expand business. Nevertheless, it claims to have 10,000 drivers and wants to grow from 30,000 daily rides as of 2018 to a million by this year.