UK firm, which provides electric commercial vehicles, claims to be enjoying significant success

Arrival already has more than 600 staff globally, with about 250 in the UK.

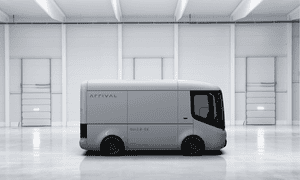

Photograph: Arrival

As the British automotive industry endures its worst period in almost two decades, it might not seem like a good time to open a new van factory. Investment has come to a virtual standstill as the prospect of a no-deal Brexit looms and commercial vehicle production has plunged by a third in response to waning demand.

But Arrival begs to differ and has put its money where its mouth is with a new factory in Banbury, Oxfordshire. So far it appears to be paying off, with delivery firms Royal Mail, DHL and DPD, as well as telecoms company BT, among those to have trialled the technology. It plans to launch prototypes of the van’s first full version, using full robotic assembly in Banbury, with UPS in December.

While vanmakers have been slower to electrify than carmakers, Arrival is one of a clutch of companies betting that the time and technology have come for smaller commercial vehicles to make the electric transition.

Commercial vehicles certainly offer a compelling rationale for electrification, often with predictable routes and mileage, charging that could be installed in depots, and tightening emissions regulations, meaning that diesel vans are becoming unviable in cities such as London. Manufacturers are finally starting to catch on. The white van is going green.

Built from the ground up, Arrival’s prototypes look very different to vans on the market today, with all of the battery and motor technology in the “skateboard” wheeled base. This removes the need for a bonnet containing an internal combustion engine (ICE). Arrival says the vehicle will be about the same price as comparable ICE vans on the market, which cost about £35,000.

Headquartered in west London, the company is backed and led by Russian entrepreneur Denis Sverdlov, who sold telecoms firm and phonemaker Yota in 2013.

Avinash Rugoobur, Arrival’s chief strategy officer, says the company has already achieved “significant sales interest without really much effort”, and has memoranda of understanding with multiple customers covering potential orders for thousands of vehicles, ahead of a production ramp up over the next two years. If that goes to plan, passenger cars could be the next target.

Arrival is still little known – although it has been around since 2014 in stealth mode, previously as Charge Automotive – and some auto industry insiders raise their eyebrows at claims made by the fledgling company. A carmaker such as Jaguar Land Rover says it costs about £1bn to create a new vehicle platform; Arrival said it can manage it for £100m.

But Arrival claims to be doing things differently, by upending auto manufacturing orthodoxy. Volume manufacturers typically have an assembly line down which vehicles run, an efficient technique pioneered by Henry Ford himself. Arrival, however, does not move the vehicle from a single “cell”, with robots bringing and fitting all the components.

“It’s doesn’t have much to do with the way things are done today,” Rugoobur said of Arrival’s production methods. “It’s a ground-up blank sheet approach.”

Arrival says this system allows a factory to be profitable with far fewer vehicles – fewer than 10,000 a year – and the eventual goal is to offer same-day delivery from microfactories in close proximity to their main, urban markets. That ambition is still far off (and the company has already missed a previous deadline of 2017) but Los Angeles and New York are among 10 cities Arrival is considering for production facilities.

Arrival already has more than 600 staff globally, with about 250 in the UK and the rest spread across the US, Germany, Russia and Israel – giving some protection against Brexit. But Rugoobur said being in the UK gives access to good-quality designers and engineers, both of metal and software, but not at Silicon Valley prices.

Arrival is not the only company to notice the opportunity in the urban van market. UPS is working with Tevva, a Chelmsford-based company that specialises in converting existing trucks to hybrids or full battery power. Volta Trucks is another early-stage startup working on trucks.

Traditional automakers are taking a more cautious approach, in part because of large sunk costs in plants making vehicles with internal combustion engines but also because they are targeting a broader market than just urban deliveries. The limits on battery range mean that vans and lorries regularly covering long distances will still rely on hybrid technology for some time yet.

At the end of the year, Ford will launch its plug-in hybrid electric Transit Custom, adding the possibility of zero tailpipe emissions (albeit only for the first 50km) to Britain’s most popular van.

The van is being made in Turkey, using the same production line as diesel Transits but the UK will again be closely involved: Ford’s facility in Dunton, Essex, acts as a global centre for commercial vehicle research and development.

Many in the industry believe the tipping point for electric vehicles is when the cost savings from going green give a financial, as well as an ethical advantage.

“There will be a commercial reason to buy the product – not just a green reason,” said Glenn Saint, Arrival’s director of commercial vehicles. “When you give them a commercial reason to buy EV then they can replace their fleet with EV much faster.”