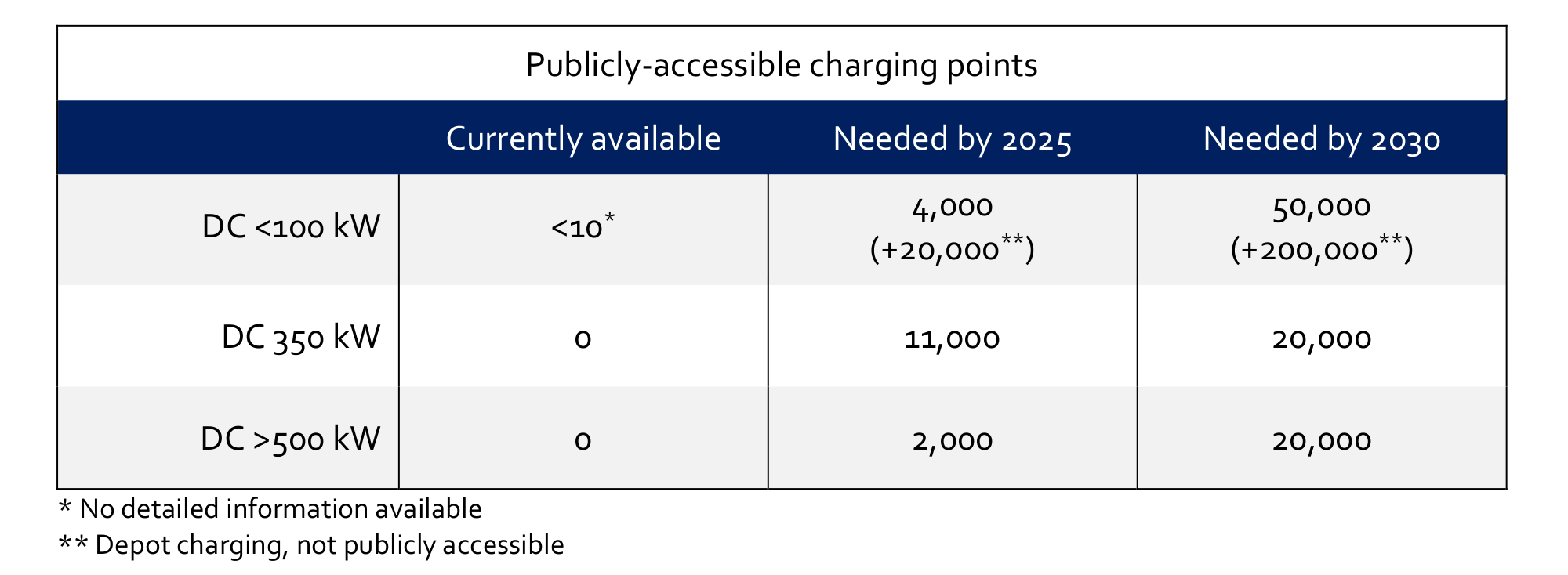

Brussels, 3 April 2020 – The European Automobile Manufacturers’ Association (ACEA) has released new data on the number of charging points and re-fuelling stations required for zero- and low- emission trucks to meet the 2025 and 2030 CO2 targets. In terms of charging points for electric trucks, this means going from close to zero today to some 90,000 public points over the next decade in order to enable the transition to carbon-neutral road transport.

“Obviously our industry is currently grappling with immediate issues related to the COVID-19 crisis,” stated Henrik Henriksson, Chairman of ACEA’s Commercial Vehicle Board and CEO of Scania. “Despite this, we are keeping the long-term climate objectives in sight. Neither the truck industry nor policy makers can afford to drop the ball on this right now.”

Last year, the EU adopted its first-ever CO2 standards for heavy-duty vehicles, which will apply in 2025 (-15%) and 2030 (-30%). Henriksson: “These CO2 targets for trucks set extremely challenging milestones on the road towards carbon neutrality. To deliver these steep reductions, we are committed and ready to bring a growing number of zero-emission trucks to the market.”

However, the overwhelming majority of trucks sold in Europe today still runs on diesel, as it is the most convenient and cost-efficient energy carrier available to transport operators. For the first time, statistics now reveal the exact composition of the EU market for new trucks by fuel type. These new ACEA numbers show that 97.9% of all medium and heavy trucks sold in 2019 ran on diesel, 0.1% ran on petrol, 1.7% ran on natural gas, 0.2% were electrically-chargeable and 0.1% were hybrid electric.

If we fast-forward to 2030, a fleet of approximately 200,000 battery-electric trucks should be in operation in the EU to meet the CO2 target set for that year, according to ACEA estimates. With some 700 medium and heavy battery-electric trucks (over 3.5 tonnes) sold last year, this means that sales of electric trucks will have to grow 28-fold over the next 10 years.

Henriksson: “The rollout of a dense network of infrastructure for alternatively-powered trucks is one of the key prerequisites for achieving carbon-neutral road freight transport. We urgently need Europe to introduce binding commitments for the deployment of at least 37,000 charging points, 50 hydrogen filling stations and 750 LNG-stations suitable for heavy-duty vehicles already by 2025.”

Heavy-duty vehicles simply cannot use passenger car infrastructure because of their much higher power and energy demand, as well as specific space, parking and access requirements. If Europe is to achieve these minimum levels of deployment, binding truck infrastructure targets for member states must be set now by the Alternative Fuels Infrastructure Directive, ACEA urges.

Missing technical standards should also be defined, and the necessary standardisation processes must start immediately. Finally, investments in charging and re-fuelling infrastructure will require significant financial and administrative support from the EU and national governments. Transport operators in particular should be incentivised to invest early in private and semi-publicly accessible depot charging stations.

***

Notes for editors

About ACEA

- The European Automobile Manufacturers’ Association (ACEA) is the Brussels-based trade association of the 16 major car, van, truck and bus producers in Europe.

- The ACEA commercial vehicle members are DAF Trucks, Daimler Trucks, Ford Trucks, IVECO, MAN Truck & Bus, Scania, Volkswagen Commercial Vehicles, and Volvo Group.

- More information about ACEA can be found on www.acea.be or www.twitter.com/ACEA_eu.

- Contact: Cara McLaughlin, Communications Director, [email protected], +32 485 88 66 47.

About the EU automobile industry

- 13.8 million Europeans work in the auto industry (directly and indirectly), accounting for 6.1% of all EU jobs.

- 11.4% of EU manufacturing jobs – some 3.5 million – are in the automotive sector.

- Motor vehicles account for €428 billion in taxes in the EU15 countries alone.

- The automobile industry generates a trade surplus of €84.4 billion for the EU.

- The turnover generated by the auto industry represents over 7% of EU GDP.

- Investing €57.4 billion in R&D annually, the automotive sector is Europe’s largest private contributor to innovation, accounting for 28% of total EU spending.