BMW Group (BMW and MINI brands), as in previous months, released an interesting set of global electromobility sales charts to show its market position within competition.

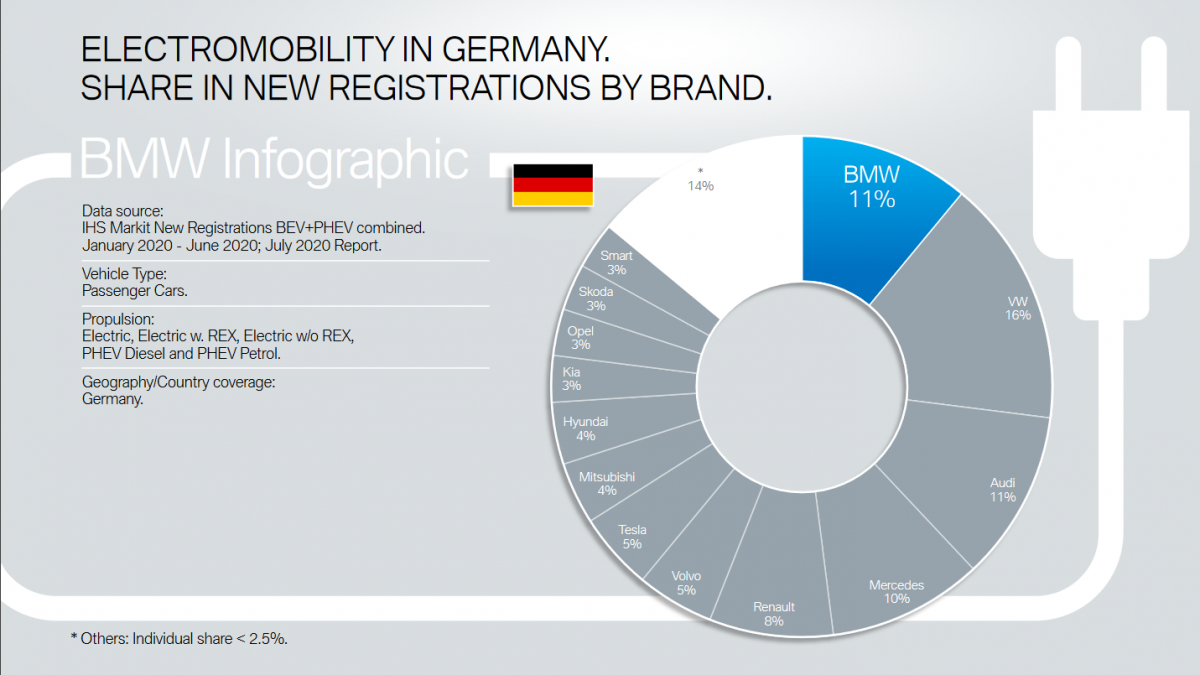

The plug-in car registration data (BEV/PHEV) for the first half of 2020 comes from IHS Markit and concerns only passenger cars.

* As usual, the purpose of the presentation is to show the brand’s position being higher than the industry average, but let’s check what else we can learn from the new set of infographics.

During the period,the position of BMW in Germany has lowered in terms of market share to 11% (from 12% in the first five months), behind Volkswagen (16%) and now on par with Audi (11%). Mercedes-Benz is slightly behind with 10%. The four top brands are at 48% total.

In Europe (most of Europe, to be precise), BMW is on par with Volkswagen and Tesla – all three had 10% share. In the fourth, is Renault with 8%, followed by a relatively strong Volvo (8%).

Globally, BMW’s share remains at 7%. Similar to Volkswagen, both are way behind Tesla – 21% share. All other brands are below 5%.

BMW i3’s share in the compact BEV segment so far this year is at 8% (it was over two times higher last year).

The most popular models are: Renault ZOE (27%), Volkswagen e-Golf (20%) and Nissan LEAF (15%).

Plug-in electric car share for the whole of the BMW Group is significantly higher than the industry average in many markets (no change here compared to previous months).

Globally, it’s 7.6% for BMW Group, compared to 4.0% industry average. However, in the U.S., so far this year, 3.7% of BMW Group cars were plug-ins, which is noticeably below the market average of 5.0%. This is the only major exception, although it should back to norm with the ramp-up of the new wave of BMW plug-ins.

Finally, BMW Group share in the plug-in segment in particular markets is noticeably higher than the company’s share in the ICE segment (globally: 7.9% to 4.0%), which means that the switch to electric brings a general gain of market share for the group (no change here compared to previous months).

The exception among major markets highlighted in the report is only the U.S. market.