New Delhi: Growth in the electric vehicle (EV) market worldwide has been particularly impressive over the last three years. Sales of electric cars hit 6.6 million in 2021, more than tripling their market share from two years earlier. Based on updated electric product lineup plans announced recently by automakers, the complete transition to EV production for many OEMs could come as soon as 2030, a research report said.

According to global technology intelligence firm ABI Research, auto OEMs will invest an estimated USD 515 billion in EV-related technologies and manufacturing plant upgrades over the next 5 to 10 years.

“Battery technology and capacity are front and center, and automotive and battery OEMs are investing heavily in battery technology research and production volume capacity to ensure adequate supplies. OEMs have announced an estimated USD515 billion in investments in EV-related technologies and manufacturing plant upgrades over the next 5 to 10 years,” ABI Research said in its whitepaper on ‘The Electrification Wave and its impact on the automotive supply chain‘.

However, ABI research argues that automakers have not adequately recognized other impacts that the EV transition will have on the supply chain and, consequently, the impact on the ability to achieve their new vehicular model rollout plans.”

According to Ryan Martin, Industrial and Manufacturing Research Director at ABI Research, specifically, automakers, from GM and Ford to VW and Mercedes, will need to maintain the simultaneous development of new or updated Internal Combustion Engine (ICE) models and the introduction of differentiated EV models (models that are not powertrain variants of existing ICE models).

“Incumbent automakers also need to contend with an influx of new OEM entrants beyond Tesla, including Lucid Motors, Rivian, and Fisker. These market pressures will require an elevated level of new model “programs” that will address operational capacity constraints, which have been largely overlooked,” he added.

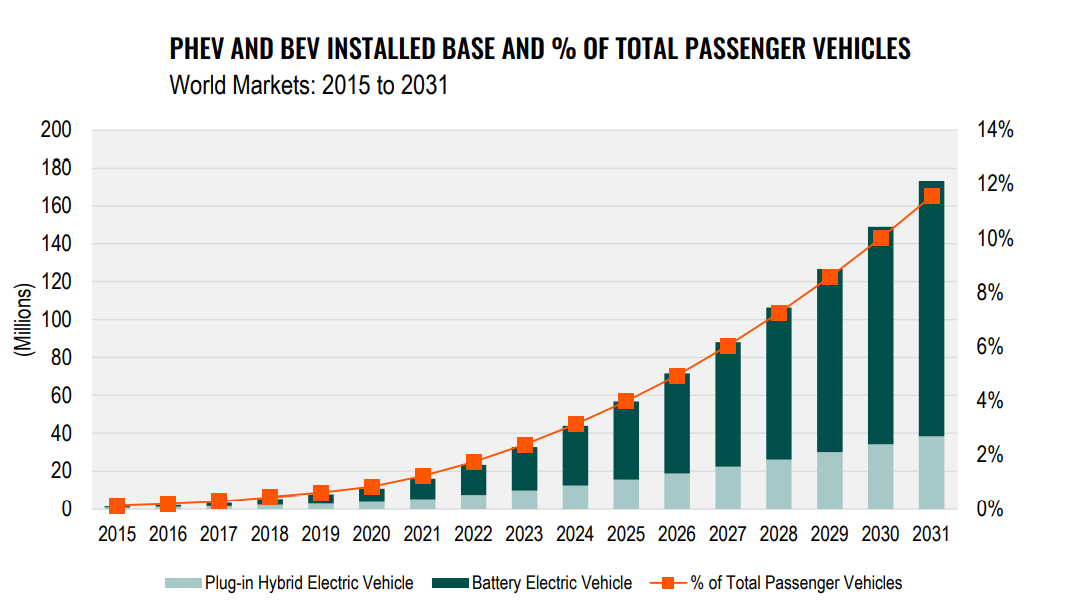

ABI Research noted that the installed base of PHEVs and BEVs grows exponentially from 16 million in 2021 to 173 million in 2031, at a Compound Annual Growth Rate (CAGR) of 26.9%. By the end of the forecast, it estimates that 4% of the installed base of passenger vehicles will be electric by 2025 and 12% by 2031.

“It should be noted that if the major OEMs unilaterally take an even more EV-centric posture, it is likely that other OEMs will move in lock step and further accelerate the forecast. If automakers’ plans are realized over the next few years, it could presage one of the largest industrial revolutions in history,” the research firm added.

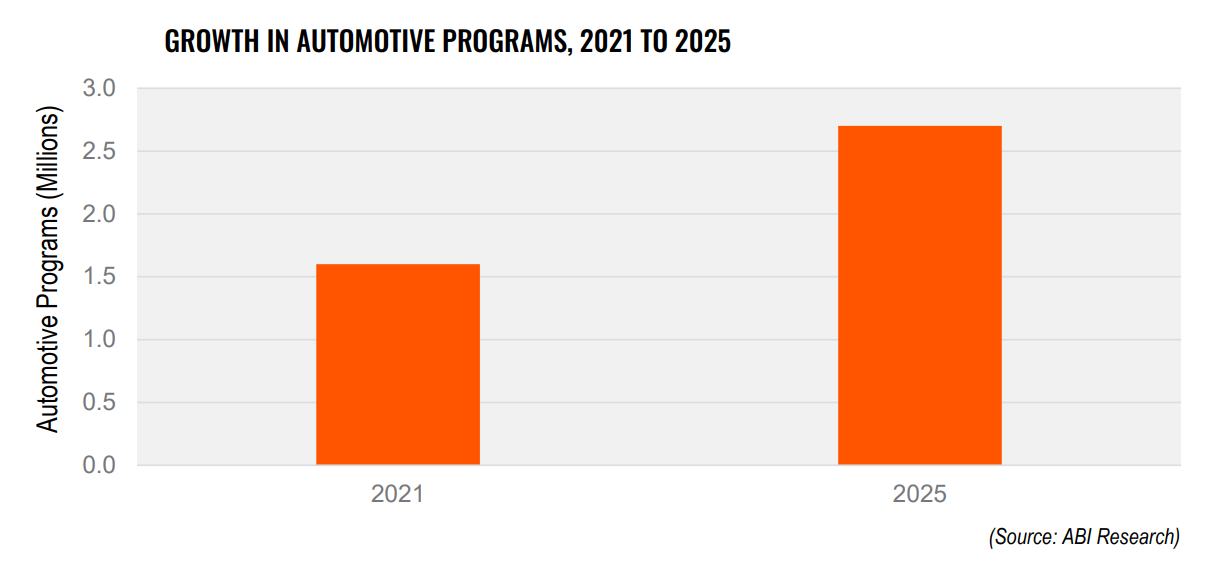

Between 2021 and 2025, the technology research firm estimates that the automotive industry is planning to increase the total volume of automotive and parts programs by roughly 66%. In 2021, ABI Research estimates a total of 1.66 million new supplier component programs. By 2025, it forecast that number to grow to 2.75 million.

“With many suppliers already operating at maximum capacity, achieving this forecast will be extremely challenging. As the chip shortage has shown, if only a few key components are constrained, the result can have a dramatic impact on overall vehicle production,” the report said.

A modern automobile is assembled from tens of thousands of parts, most of which are sourced from a global supplier network and many of which are custom components designed for a specific OEM vehicle model or platform program. “From ABI Research’s ongoing research, automotive program management has not received the same managerial attention or level of investment as the supply chain that it supports,” adds Jake Saunders, Vice President at ABI Research.

Supplier’s resources to manage new model launches are finite and are already stretched thin. “Unless automakers and suppliers take the initiatives needed to expand overall program launch capacity, their electrification goals are under threat,” Martin concludes.