The interest rate on short-term paper such as treasury bills has risen more sharply than longer-tenor securities as government and monetary policy action provide comfort that inflation could slow and that the interest rate increase cycle may not last long.

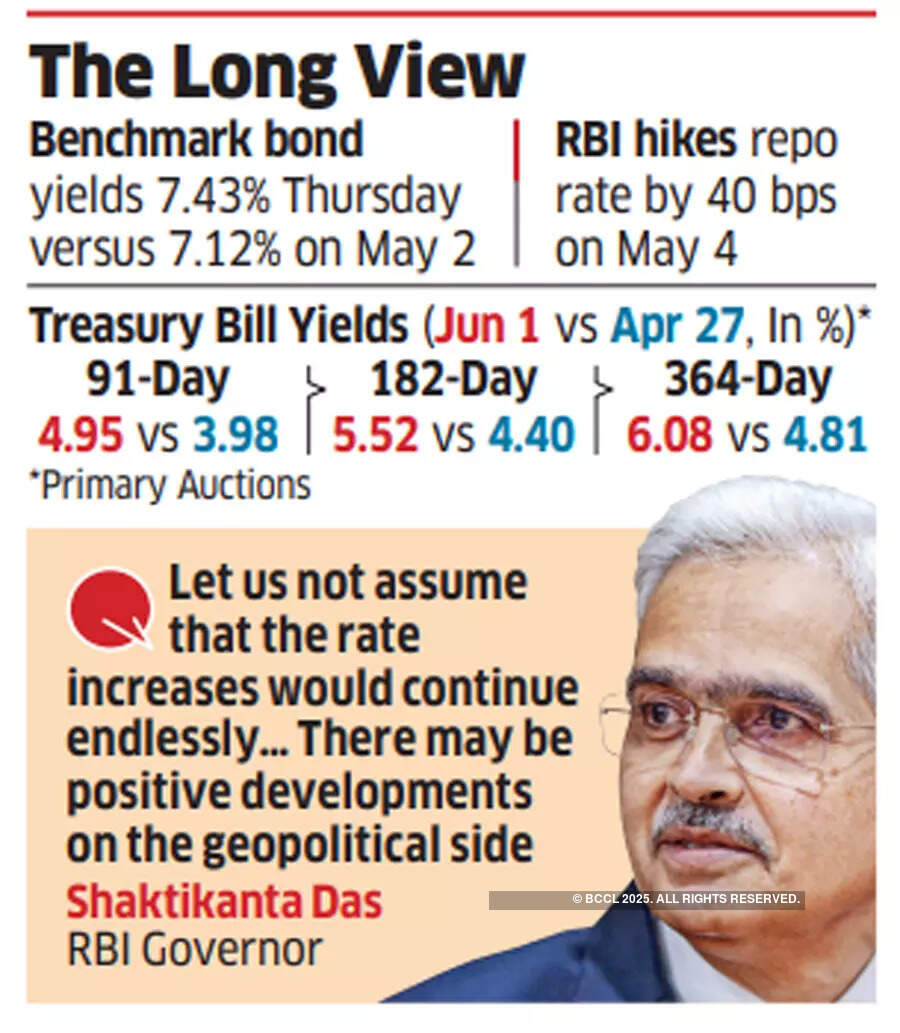

Rates on T-bills have shot up nearly 130 basis points since before the off-cycle rate hike in early May, but benchmark bond yields have risen just over 30 basis points, leading to expectation that corporate capital expenditure may not have to bear the higher cost of funds. A basis point is 0.01 percentage point. The next monetary policy review is scheduled for June 6-8.

“Long-term yields are still at a decent level despite looming inflation worries,” said Parul Mittal, head, financial markets, India, and head, macro trading, South Asia, Standard Chartered Bank. “Companies’ long-term funding cost should rise at a slower pace as they brace up for capex plans at a later stage during the fiscal year. Inflation risk is evolving, depending on geopolitical conditions.”

A Different Scenario

India’s consumer prices rose to an eight-year high of 7.79% in April, well above average market expectations.

In a surprise move on May 4, the Reserve Bank of India (RBI) raised the policy repo rate – at which banks borrow short-term money from the central bank – by 40 basis points to 4.40% to rein in prices. However, it signalled that an end to the Russia-Ukraine war and an easing of the commodity price super cycle, could lead to a different scenario.

“Let us not assume that the rate increases would continue endlessly,” RBI governor Shaktikanta Das told ET on May 26. “There may be positive developments on the geopolitical side, I don’t know.”

To be sure, the global crude oil price is hovering at $110-120 per barrel, a level that raises India’s import bills significantly, ratcheting up inflationary pressure. The 364-day treasury bill yielded 6.08% on June 1 versus 4.81% on April 27 in primary auctions.

“The market considers the current situation unusually worrisome,” said Naveen Singh, head of trading at ICICI Securities PD. “Inflation is running way above RBI’s trajectory, policy action has to be frontloaded rather spread over the period.”

The central bank has an inflation target of 4% with a two-percentage point leeway on either side of that. “Sooner RBI takes policy rate closer to neutral real rates, better it will be for debt market in terms of reduced uncertainty,” Singh said.

In the same period, April 27 to June 1, the 182-day and the 91-day T-bills yielded 112-103 basis points higher. “Short-term rates are likely to be more influenced by any policy rate actions alongside a drop in surplus liquidity that continues to normalise the money market curve settings,” said Rajeev Radhakrishnan, CIO-debt, SBI Asset Management.

The benchmark bond yielded 7.44% on June 2 versus 7.12% on May 2, the last trading day before the central bank hiked the rate.

A surge in shorter duration money market rates makes working capital expensive for companies selling commercial paper, a money market debt instrument. At the same time, external developments and domestic demand supply dynamics along with market expectations of the terminal policy rate are likely to influence the longer-end rates, said Radhakrishnan.