Mumbai: The central bank’s Monetary Policy Committee (MPC) voted unanimously to raise rates by half a percentage point early June to prevent inflation from corroding the economic recovery even as some members favoured quickening the pace of increases to ensure the price spiral wouldn’t worsen further, the minutes of the meeting published Wednesday showed.

The Reserve Bank of India (RBI) raised the benchmark policy repo rate, or the rate at which it lends short-term funds to banks, by 50 basis points to 4.9% in its June policy statement as consumer inflation has been consistently above the upper band of 2-6%target.

One basis point is 0.01%.

“If this inflation is allowed to go out of hand, it could corrode the foundations of the recovery that is gradually gaining traction — empirical evidence shows that inflation above 6% in India is unambiguously harmful for growth,” MPC’s internal member and RBI deputy governor Michael Patra was cited as saying in the minutes.

The RBI move was aimed at ensuring price stability even while recognising that growth initiatives still deserved a helping hand from the Mint Road.

Tracking Global Developments

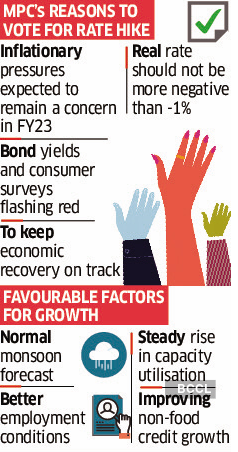

Factors giving MPC members comfort on the growth outlook include forecast of a normal southwest monsoon, the improvement in employment conditions, steady rise in capacity utilisation and improving non-food credit growth.

“This action will reinforce our commitment to price stability — our primary mandate and a prerequisite for sustainable growth over the medium term,” said RBI governor Shaktikanta Das.

Changing the course of inflation trajectory to reach the targeted level is a priority for the MPC despite modest growth prospects, said external member Shashank Bhide, who is a senior advisor at the NCAER.

Between April and June, the MPC raised the policy rate by 90 basis points, but during the same period the RBI’s projection of inflation for FY23 has risen 100 basis points — from 5.7% to 6.7%. The real policy rate, therefore, remains more or less where it was in April, implying that further rate increases are needed to get the real policy rate in the positive zone.

“This reminds me of Lewis Carroll’s adage that we must run as fast as we can, just to stay in place, and to go anywhere we must run even faster,” said external member Jayant Varma, a professor at IIM Ahmedabad. “Clearly, more needs to be done in future meetings to bring the real policy rate to a modestly positive level consistent with the emerging inflation and growth dynamics.”

The one-year ahead real rate must not be more negative than -1%, said external member Ashima Goyal, a professor at the Indira Gandhi Institute of Development Research. “A 50- or 60-basis-point hike would achieve this,” Goyal said, although “further supply-side movement and clarity on global developments are awaited.”

Varma made the case for starting to move toward providing projections of the future path of the policy rate. “This would help stabilise long-term bond markets and also anchor inflation expectations.” As for the policy stance, the withdrawal of accommodation would be non-disruptive to the process of recovery and would strengthen the ongoing efforts to combat inflation and anchor inflation expectations, Das said.