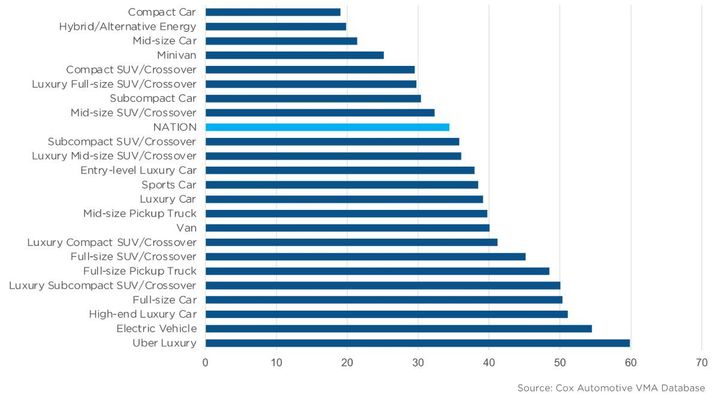

Among vehicle segments, compact cars had the lowest inventory after small volume high-performance cars. Also at the low end were hybrids, midsize cars, minivans and compact SUVs.

Source: Cox Automotive

New-vehicle inventory remained at the same level it has been for months, according to Cox Automotive’s analysis of vAuto Available Inventory data, despite comments from some automotive executives that the global computer chip shortage is easing, and vehicle production is resuming to normal levels.

As gas prices surged to record levels, inventory of imports, especially smaller, fuel-efficient models, including hybrids, was among the lowest in the industry at the end of May. Meanwhile, inventory of full-size pickup trucks and large non-luxury SUVs were building, some to traditional levels. The average new-vehicle listing price rose again to $45,495, with prices expected to remain elevated at least through the fall.

The total U.S. supply of available unsold new vehicles stood at 1.13 million units at the end of May, about the same as the revised end-of-April available supply. Inventory has hovered in that range for months.

Available supply at the end of May was down 25% from the same period in 2021. In raw numbers, as June opened, the supply of unsold new vehicles was about 380,000 vehicles less than the supply a year ago and 1.7 million less than in 2020.

“The percentage and volume gaps are narrowing from a year ago because it was June 2021 when the production cuts caused by the chip shortage began to crimp inventory and hurt sales,” said Charlie Chesbrough, Cox Automotive senior economist, in a news release. But he warned that does not mean the new-vehicle inventory situation has improved. Instead, it has been stuck around the 1.1 to 1.13 million territory for months, far below historical levels, with no end in sight.

The days’ supply of unsold new vehicles was 34 at the start of June, down from the revised 36 days’ supply at the beginning of May. That is the same general range days’ supply has been in since mid-January. Non-luxury inventory totaled 845,738 units entering June for a 34 days’ supply. Luxury supply stood at 138,550 units for a 38 days’ supply.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period, in this case, ended May 30. For the calendar month of May, new-vehicle sales were down 30% from a year ago. By volume, May new-vehicle sales were down 11% from April. The May seasonally adjusted annual rate of sales (SAAR) was 12.7 million, a 25% decline from last year’s 16.9 million and down 13% from April’s 14.5 million pace, which had been the strongest pace since January.

Tight supply and continued production challenges are limiting the growth in new-vehicle sales that would typically happen as the year progresses. The number of vehicles canceled from automaker production schedules worldwide due to the chip shortage has surged past two million, according to the latest estimate by AutoForecast Solutions, a forecasting firm that has been tracking vehicle production since the chip shortage began.

Hopeful predictions and comments by some auto executives about a return to normalcy have not materialized in new-vehicle inventory numbers in the U.S.

Volkswagen Group, noting that parts disruptions are easing, resumed a three-shift operation at its major electric vehicle factory in Germany, which produces Volkswagen and Audi EVs for the U.S. as well as the rest of the world. BMW and Mercedes-Benz claim they have enough chips to produce at full capacity and are now filling a record backlog of orders.

Prices Climb Again; Likely to Stay Elevated

High demand and low inventory are keeping prices high and discounting low. Automakers continue to prioritize available chips for high-end, high-margin models instead of entry-level vehicles. Also, keeping prices high are low incentives. Incentive spending by manufacturers fell to an average of $1,164 in May, down 11.4% from April and down 61.8% from a year ago.

The average listing price – or the asking price – climbed again in May, closing the month at $45,495, up from the revised end-of-April price of $45,137. The asking price began dropping in mid-February but started edging higher in April and continued through May. The listing price is running 12% above May 2021. According to Cox Automotive data, the average listing price for luxury vehicles was $64,282 at the end of May. The non-luxury average list price edged up to $42,240.

The average transaction price – the price people paid – rose again in May. The average transaction price (ATP) increased to $47,138 in May, according to Kelley Blue Book, a Cox Automotive company. That was the second-highest ATP on record, behind December 2021 when it was $47,202. The May ATP rose 1%, or $472, from April and was up 13.5%, or $5,613, from May 2021.

“The growth in new-vehicle asking prices is holding near 12%, with only slight declines in recent weeks. That’s in contrast to used vehicle asking prices that are inching lower,” Chesbrough said. “It may be that new prices are more ‘sticky’ due to limited supplies, and a decline in growth won’t occur for a few more months yet. It may also be the price shift is not over just yet for new vehicles. The focus by automakers on higher-end products, coupled with the introduction of new model-year vehicles in coming months, could keep this price growth higher for longer.”

Small Vehicles Have Low Inventory; Large Vehicle Supply Building

Surging gas prices look to be affecting vehicle inventory as well. Among vehicle segments, compact cars had the lowest inventory after small volume high-performance cars. Also at the low end were hybrids, midsize cars, minivans and compact SUVs. Days’ supply of electric vehicles is well-above average, but low and uneven sales volumes of EVs affects the days’ supply measure, as seen with high-performance cars. Analysts believe demand for EVs remains healthy, and that EVs are not gathering dust on dealer lots.

In contrast, as usual, segments with the highest inventories were luxury and larger cars, but also large non-luxury SUVs and full-size pickup trucks, all of which are gas guzzlers. The Ram full-size pickup truck inventory stood at 70 days’ supply at the end of May, approaching more traditional levels.

Imports dominated brands with the lowest inventories: In the non-luxury category, brands with the lowest supply were Asian imports: Kia, Honda, Toyota, Subaru and Nissan. Luxury brands with the lowest inventories were Land Rover, Porsche, Lexus, BMW and Acura. Brands with the highest inventory were mostly domestic and mostly Stellantis brands. Non-luxury brands with the highest inventory were Ram, Dodge, Jeep and Chrysler. Luxury brands with the highest were Volvo, Audi, Buick, Cadillac and Infiniti.

Of the 30 highest-selling models, which account for the bulk of vehicle sales in the U.S., the 14 models with the lowest inventories were from Asian automakers: Toyota Corolla, Honda Accord, Toyota RAV4, Kia Forte and Toyota Camry. Of the 30 top-selling models, full-size trucks, including Ram 1500, Chevrolet Silverado and Ford F-150, had the highest inventory. Also at the higher end were Ford Escape and Ford Explorer SUVs.

In terms of price categories, the lower the price, generally, the lower the supply. Price categories under $40,000 had less than 30 days’ supply. The other price segments had days’ supply between 36 and 46.

Originally posted on Vehicle Remarketing