Geely Automobile Holdings Limited (Group) report half-year revenue of RMB 47.56 billion and profit of RMB 4.01 billion. Average selling price increase with higher ratio of high-end models sold Future focus on high-quality development, enhancing core technological capabilities, and accelerating brand building. Retail market share up from 6.3% to 6.5%. Exports surged 334% to 38,619… Continue reading Geely Automobile Holdings Announced lnterim Results for the First Half of 2019

Tag: Strategy

Uber-rival Bolt enters European food delivery business

TALLINN (Reuters) – Estonia’s Bolt, a popular ride-sharing service in Eastern Europe and Africa, on Wednesday launched food delivery service in its home town of Tallinn, the nation’s capital, and said it plans to roll out Bolt Food this year in South Africa, Latvia and Lithuania as well. FILE PHOTO: A Bolt (formerly known as… Continue reading Uber-rival Bolt enters European food delivery business

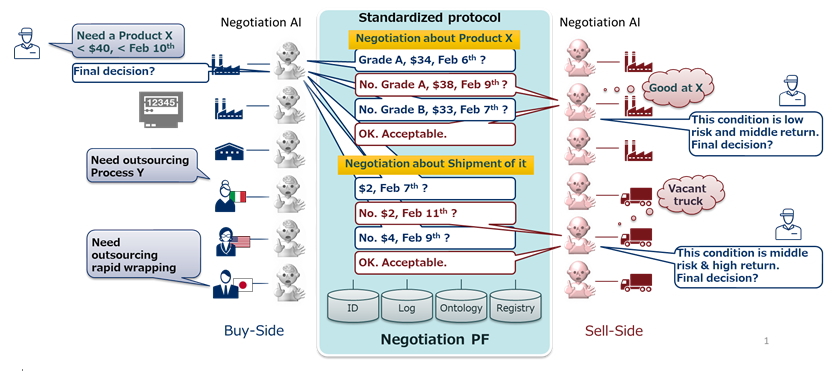

Industrial Internet Consortium approves Testbed of Negotiation Automation Platform for coordinating interests among AI systems- Promoting implementation through expansion of participants –

2019-08-21 Tokyo, August 21, 2019 – NEC Corporation (NEC; TSE: 6701), Fraunhofer IOSB, Kabuku Inc., the Korea Electronics Technology Institute (KETI) , Oki Electric Industry Co., Ltd., and Toyota Tsusho Corporation announced today the approval by the Industrial Internet Consortium® (IIC™,*1) of a Negotiation Automation Platform Testbed in cooperation with Japan’s National Institute of Advanced… Continue reading Industrial Internet Consortium approves Testbed of Negotiation Automation Platform for coordinating interests among AI systems- Promoting implementation through expansion of participants –

Porsche Consulting: Weber’s aftersales service pleases customers

08/20/2019 Small parts—big results: The grill maker delights its customers with premium service. Hans-Jürgen Herr selects his company’s own “grill oasis” for the photo. It might also be called the company’s test lab. This terrace on the eighth floor of a building in the center of Berlin has a number of smoking charcoal grills. It… Continue reading Porsche Consulting: Weber’s aftersales service pleases customers

Reality check: CHAdeMO fast-charging stations still outnumber CCS ones

Five years ago, a frequent matter of debate here at Green Car Reports was whether CCS or ChAdeMO would become the electric-car DC fast-charging standard of choice in the U.S.

Soon after that it became quite clear that CCS, with the weight of the European and U.S. auto industry behind it—and then the Korean industry joining later—was going to win.

And yet today, when you look at the actual numbers, as tallied by the U.S. government’s Alternative Fuels Data Center, you’ll find that even now, in the second half of 2019, there are still more places to fast-charge CHAdeMO vehicles than those with CCS.

CHAdeMO, CCS, and Supercharger – Alternative Fuels Data Center, Aug. 20, 2019

As of August 20, 2019, there are 2,140 charging stations and 3,010 connectors with CHAdeMO fast charging. CCS still lags behind CHAdeMO in the number of stations by more than 250, while it has about 500 more connectors. And Tesla has 678 Supercharger locations with 6,340 connectors. The Nissan Leaf lineup is the only one still on the market to primarily use the CHAdeMO standard.

When the first Combined Charging System (CCS) fast charging station finally arrived in the U.S. in October 2013, it was a couple of years behind the rollout of stations using the CHAdeMO standard championed by Japanese automakers and more than a year behind the first Tesla Superchargers.

In 2014 and 2015, Europe stormed ahead with CCS fast-charging infrastructure, and essentially moved to make it the dominant standard, while the U.S. lagged behind in deploying the hardware.

Chevrolet Spark EV at CCS fast charging station in San Diego.

Although the 2014 Chevrolet Spark EV was the first model available in the U.S. with CCS, GM stubbornly maintained that it wouldn’t fund CCS fast-charging sites for its Chevrolet Bolt. Meanwhile, Nissan helped subsidize the growth of a CHAdeMO network. So had early federal and state funding to build “electric highways” with carefully spaced fast chargers, that had been approved (and in some cases completed) before CCS even existed.

Part of the reason why CCS hasn’t gained ground is that, as called out in the Partial Consent Decree of the Volkswagen diesel settlement, Electrify America has to future-proof its stations by operating across different charging standards. Therefore, all public-facing fast chargers will include a CHAdeMO connector—just one, in most cases, running at 50 kw instead of the CCS connectors’ 150 kw or 350 kw.

It’s unlikely that CCS will take the lead for stations/locations this decade. Nationally, Electrify America’s Cycle 2 plan anticipates that just 40 to 50 of about 215 new 150-kw and 350-kw DC fast chargers will be operational by the end of 2019. Meanwhile, under an EVgo plan to install more 100-kw CHAdeMO hardware—jointly announced with Nissan earlier this month, will keep nudging both ahead, as that hardware will also be CCS-compatible.

Tesla Model S with CHAdeMO adapter

U.S. Tesla drivers also can opt for a CHAdeMO adapter, for access to those stations, which tend to be better-located for urban and suburban charging—as opposed to Tesla’s chargers, which tend to be at strategic points for road-trip potential.

Tesla drivers are again the winners. If it weren’t for the terms of the diesel settlement, Nissan and others might not have kept expanding the CHAdeMO network. Add the two standards together and Tesla owners have 2,818 charging locations and 9,350 connectors.

The higher-power CCS chargers (350 kw especially) will start influencing the market more eventually. But in this era of accessibility and cross-compatibility, it's now looking like both standards will be around for a long time.

IAA 2019: Shared & Services.

Shared & Services. Shared & Services is the “S” in Daimler’s CASE strategy. We believe that intelligent mobility services and car sharing will play a key role in the reinvention of mobility. Did you know on average most cars are only in use for one hour per day? We believe sharing is better than parking,… Continue reading IAA 2019: Shared & Services.

IAA 2019: Electric.

Electric. Electric mobility is the “E” in Daimler’s CASE strategy. Electric vehicles will play a key role in the reinvention of mobility. We believe that the demand for lower emissions does not need to compete with the ever increasing demand for mobility. As a matter of fact, it should drive it. Our objective is clear:… Continue reading IAA 2019: Electric.

IAA 2019: Connected.

Connected. Connected is the “C” in Daimler’s CASE strategy. Connected vehicles will play a key role in the reinvention of mobility. Already today, all our vehicles are “always on” and intelligently connected. In addition to real-time traffic service and up-to-the-minute information directly on the navigation map (weather, fuel prices, parking spaces), we also already have… Continue reading IAA 2019: Connected.

Exclusive insights at Research & Innovation Centre: BMW Group Pilot Plant builds BMW iNEXT prototypes

Munich. On the occasion of the BMW iNEXT prototype production, the BMW Group is offering an exclusive glimpse behind the scenes of its Pilot Plant in the heart of the Research & Innovation Centre (FIZ). Prototypes of all vehicles are manufactured long before actual market launch, under the strictest secrecy in specially restricted areas of… Continue reading Exclusive insights at Research & Innovation Centre: BMW Group Pilot Plant builds BMW iNEXT prototypes

EU Regulation on monitoring and reporting of HDV CO2 emissions adopted

Skip to main content

Browse section: icon

EU Regulation on monitoring and reporting of HDV CO2 emissions adopted

25/06/2018The CO2 emissions of new heavy-duty vehicles (HDVs) registered in the EU will have to be monitored and reported as of next year, under a new Regulation adopted today.

From 1 January 2019, manufacturers of HDVs (lorries, buses and coaches) and Member States will have to monitor data including CO2 emissions and fuel consumption of new vehicles and report annually to the European Commission.

The Regulation – the first ever EU legislation on HDV CO2 emissions – is part of a series of measures to implement the 2016 European strategy on low-emission mobility. Following adoption by the European Parliament on 12 June, with today’s Council vote the Regulation is now formally adopted.

The monitoring and reporting requirements will be crucial for providing, as of 2020, the necessary data to set and implement new CO2 emission reduction targets for HDV manufacturers, as pr..