BEIJING, 3. April 2023 /PRNewswire/ — Am 31. März fand in Berlin, Deutschland, eine Investitionsförderungsveranstaltung für die 19th International Cultural Industries Fair (ICIF) und die Shenzhen Design Week (SZDW) statt. Neben der Förderung der Kulturindustrie in Shenzhen und dem Angebot von Geschäftsmöglichkeiten im Rahmen der beiden bevorstehenden kulturellen Aktivitäten zielt die Veranstaltung auch auf die… Continue reading Xinhua Silk Road: Investitionsförderungsveranstaltung für 19. ICIF, Shenzhen Design Week in Berlin, Deutschland

Tag: Possible_Terrorism_Warfare

Operation HOPE Announces Tim Crockett as New Chief Risk and Security Officer

ATLANTA, April 3, 2023 /PRNewswire/ — Operation HOPE, Inc., the nation’s largest non-profit dedicated to financial empowerment for underserved communities, today announced that Tim Crockett will join its Senior Leadership team as Chief Risk and Security Officer, effective immediately. Continue Reading With an esteemed career that began in the military, Crockett has provided risk management solutions for… Continue reading Operation HOPE Announces Tim Crockett as New Chief Risk and Security Officer

German Manager Magazin: LME: Scandal for the London Metal Exchange – The Great Nickel Swindle002403

It was shocking news for them commodity industry: The venerable London Metal Exchange (LME) – which has been under criticism since last year’s price turbulence anyway – has fallen victim to nickel fraud. When buyers recently received shipments of the supposedly high-quality metal from one of their warehouses, it turned out to be sacks full… Continue reading German Manager Magazin: LME: Scandal for the London Metal Exchange – The Great Nickel Swindle002403

German Manager Magazin: Tesla with delivery record in the first quarter002403

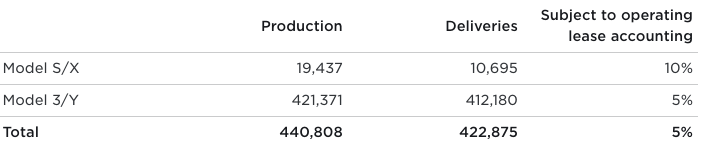

The world’s largest electric car manufacturer Tesla failed to meet analysts’ expectations in the first quarter despite record deliveries. According to its own information on Sunday, the US company handed over 422,875 cars to its customers in the reporting period. According to Refinitiv data, however, experts had expected an average of 430,008 vehicles. Deliveries increased… Continue reading German Manager Magazin: Tesla with delivery record in the first quarter002403

Ammunition Market to Reach $31.7 Billion, Globally, by 2031 at 3.9% CAGR: Allied Market Research

Increase in demand for firearms and ammunition for various purposes, including self-defense, hunting, sports shooting, military and law enforcement operations, and surge in government expenditure on defense operations drive the global ammunition market PORTLAND, Ore., March 30, 2023 /PRNewswire/ — Allied Market Research published a report, titled, “Ammunition Market by Product Type (Centrefire, RimFire), by… Continue reading Ammunition Market to Reach $31.7 Billion, Globally, by 2031 at 3.9% CAGR: Allied Market Research

Australia critical mineral export revenue to match coal by 2028

Annual exports of copper, alumina, lithium and nickel will reach USD 49 billion by 2027-28. The department does not provide a breakdown of other critical minerals such as cobalt and rare earths. Revenue from Australia’s exports of critical minerals like lithium and nickel will nearly equal the current second-biggest export earner coal by 2028 as… Continue reading Australia critical mineral export revenue to match coal by 2028

National Reconnaissance Office Awards Contract Extension to Kleos

SYDNEY, April 2, 2023 /PRNewswire/ — Kleos Space Inc, a subsidiary of Kleos Space S.A (ASX:KSS), a space-powered defence & intelligence technology company, has been awarded the Stage Two option on its current contract with the National Reconnaissance Office (NRO) as part of the Strategic Commercial Enhancements Broad Agency Announcement (SCE BAA) Framework. The NRO is… Continue reading National Reconnaissance Office Awards Contract Extension to Kleos

Tesla Q1 deliveries beat expectations as China helps boost sales

Tesla said Sunday it delivered 422,875 electric vehicles in the first quarter of 2023, just beating Wall Street estimates of around 420,000 units. The company produced 440,808 vehicles in the same period. The delivery and production numbers are record results for the EV maker. In the fourth quarter of 2022, Tesla delivered 405,278 and produced… Continue reading Tesla Q1 deliveries beat expectations as China helps boost sales

Tesla reports 422,875 deliveries for first quarter of 2023

Tesla Superchargers are seen at a charging station on March 17, 2023 in Beijing, China. Vcg | Visual China Group | Getty Images Tesla on Sunday posted its first-quarter vehicle production and delivery report for 2023. Here are the key numbers from the electric vehicle maker: Total deliveries Q1 2023: 422,875 Total production Q1 2023: 440,808… Continue reading Tesla reports 422,875 deliveries for first quarter of 2023

Tesla sales rise 36% in first quarter, following price cuts

Tesla’s first-quarter vehicle sales rose 36% after the company cut prices twice in a bid to stimulate demand. The electric car, SUV and heavy truck maker said it delivered 422,875 vehicles worldwide from January to March, up from just over 310,000 a year ago. But the increase fell short of analyst estimates of 432,000 for… Continue reading Tesla sales rise 36% in first quarter, following price cuts