UK carmaker turns to former Renault boss to lead group through coronavirus pandemic Go to Source

Tag: Renault

Nissan forecasts record $4.5 billion annual loss as pandemic hinders turnaround efforts

FILE PHOTO: The brand logo of Nissan Motor Corp. is seen at the front nose section of the company’s new Ariya all-battery SUV during a press preview, ahead of the world premiere, at Nissan Pavilion in Yokohama, south of Tokyo, Japan July 14, 2020. REUTERS/Issei Kato/File Photo TOKYO (Reuters) – Nissan Motor Co (7201.T) said… Continue reading Nissan forecasts record $4.5 billion annual loss as pandemic hinders turnaround efforts

@Mitsubishi: MITSUBISHI MOTORS Announces Large-Scale Investment in Mizushima Plant to Manufacture New Electric Kei-cars

TOKYO, July 28, 2020 – (JCN Newswire) – MITSUBISHI MOTORS CORPORATION (MMC) today announced that it will invest for production of new electric Kei-cars at Mizushima Plant in Kurashiki city, Okayama Prefecture starting from August 2020. This investment will be approximately JPY 8 billion. MMC is considering of developing the new electric Kei-car jointly with… Continue reading @Mitsubishi: MITSUBISHI MOTORS Announces Large-Scale Investment in Mizushima Plant to Manufacture New Electric Kei-cars

@Mitsubishi: MITSUBISHI MOTORS Announces Its Mid-Term Business Plan, Small but Beautiful, to Achieve Cost Rationalization and Profitability Enhancement for Sustain…

TOKYO, July 28, 2020 – (JCN Newswire) – MITSUBISHI MOTORS CORPORATION (MMC) today announced its three-year mid-term business plan (from fiscal 2020 to 2022), Small but Beautiful, to concentrate its management resources on its core regions and technologies. This plan focuses on cost rationalization and profitability enhancement to realize solid management foundation aiming at sustainable… Continue reading @Mitsubishi: MITSUBISHI MOTORS Announces Its Mid-Term Business Plan, Small but Beautiful, to Achieve Cost Rationalization and Profitability Enhancement for Sustain…

Nissan sees $4.5 billion annual operating loss as pandemic hinders turnaround efforts

FILE PHOTO: The brand logo of Nissan Motor Corp. is seen at the front nose section of the company’s new Ariya all-battery SUV during a press preview, ahead of the world premiere, at Nissan Pavilion in Yokohama, south of Tokyo, Japan July 14, 2020. REUTERS/Issei Kato/File Photo TOKYO (Reuters) – Nissan Motor Co (7201.T) said… Continue reading Nissan sees $4.5 billion annual operating loss as pandemic hinders turnaround efforts

Peugeot maker PSA says strong rebound underway

PARIS (Reuters) – Peugeot maker PSA Group (PEUP.PA) delivered a profit in the first half of the year even as the COVID-19 pandemic hit revenue and said a strong sales rebound in June had extended into July. FILE PHOTO: An assembly line is seen after PSA Peugeot Citroen shut down last month due to the… Continue reading Peugeot maker PSA says strong rebound underway

Mitsubishi Motors hits all-time low as ASEAN sales slump casts doubt on recovery

TOKYO (Reuters) – Japan’s Mitsubishi Motors (7211.T) faced doubts about a quick recovery after posting dismal quarterly sales in its key Southeast Asia market partly due to the coronavirus outbreak, sending its shares down 13% to a record low on Tuesday. FILE PHOTO: A Mitsubishi Motors signage is pictured next to a Mitsubishi Motors electric… Continue reading Mitsubishi Motors hits all-time low as ASEAN sales slump casts doubt on recovery

The new Mercedes-Benz T-Class: compact city van for families, active leisure enthusiasts and work

28.

July 2020

Stuttgart

Stuttgart. Mercedes-Benz Vans is provider of vehicles in the small-, mid- and large-size van segments, fulfilling all customer requirements for a spacious space. Now, a small van platform will be used to create a new vehicle which is tailored to the needs of families whilst also being a suitable companion for active leisure enthusiasts. Like the V-Class, which is successfully positioned in the midsize segment, Mercedes-Benz Vans will also be offering a small van for private customers from the first half of 2022. The class designation of this new model is “T-Class.”

“With the new Mercedes-Benz T-Class, we will offer a vehicle which makes it possible for families and those with active pastimes to step into the Mercedes-Benz world. These customers seek attractive and practical compact vehicles – and it is precisely these demands which the new T-Class fulfils”, says Marcus Breitschwerdt, Head of Mercedes-Benz Vans.

“With the T-class’s new layout and design we achieve a fusion of functionality and desirability”, says Gorden Wagener, Chief Design Officer Daimler Group. “With our unique design philosophy of Sensual Purity we create an attractive family companion being the T-Class inspiring with its design, proportions and its perceived value.”

Clear membership of the Mercedes-Benz family

As a completely new development, the T-Class will be clearly discernible at first glance as a member of the Mercedes-Benz family and will feature unmistakeably typical characteristics of the brand with the three-pointed star. Especially in terms of design, value, safety and connectivity, the new vehicle will bear the DNA of Mercedes-Benz.

New class, new concept

The private-customer market is the focus of the completely newly developed Mercedes-Benz T-Class. The T-Class will meet the needs of families and leisure-oriented people at an attractive price-value ratio. The letter T stands for efficient room concepts and is thus perfectly suited as a model designation for compact family vans bearing the three-pointed star.

The new Mercedes-Benz T-Class offers a large amount of space and is suited to a range of different uses, including passenger transportation as a reference within sharing services – all while not compromising on comfort. The wide-opening sliding doors on both the left and right-hand sides of the vehicle as an example allow easy and comfortable access to the interior. Alongside conventional drive systems, there will be also a fully electric version.

Mercedes-Benz Vans in the small van segment

In the small van segment, Mercedes-Benz Vans has been represented by the commercially positioned Citan since 2012. In August last year, the Vans division announced a successor to the compact urban delivery van, together with a fully-electric variant. Based on this small van platform, two vehicles will be created: while the Mercedes-Benz Citan is a no-compromise vehicle tailored to the requirements of commercial customers, the Mercedes-Benz T-Class is primarily focused towards private customers.

The T-Class and the Citan will be established in cooperation with Renault-Nissan-Mitsubishi.

Press Contact

Ingeborg Schulenburg-Gärtner

Manager Global Product Communications Mercedes-Benz Vans

ingeborg.gaertner@daimler.com

Tel: +49 160 8670044

Silke Walters

Manager Global Business Communications Mercedes-Benz Vans

silke.walters@daimler.com

Tel: +49 176 30909308

Press Contact Overview

Media

Download

Pictures (1)

Documents (1)

Media Contact (2)

Filter

Show thumbnails

Show list

Slideshow

Settings

Preview

Do you really want to delete the data record?

Please wait a moment …

Please wait a moment …

Please wait a moment …

Please wait a moment …

20A0175

Legend

:

The new Mercedes-Benz T-Class

Release date

:

Jul 28, 2020

Loading

Mitsubishi Motors tumbles to all-time low on ‘shocking’ ASEAN sales plunge

FILE PHOTO: A Mitsubishi Motors signage is pictured next to a Mitsubishi Motors electric car at the Tokyo Motor Show, in Tokyo, Japan October 24, 2019. REUTERS/Edgar Su TOKYO (Reuters) – Shares of Japan’s Mitsubishi Motors Corp (7211.T) plunged more than 10% to an all-time low on Tuesday after the automaker posted dismal sales in… Continue reading Mitsubishi Motors tumbles to all-time low on ‘shocking’ ASEAN sales plunge

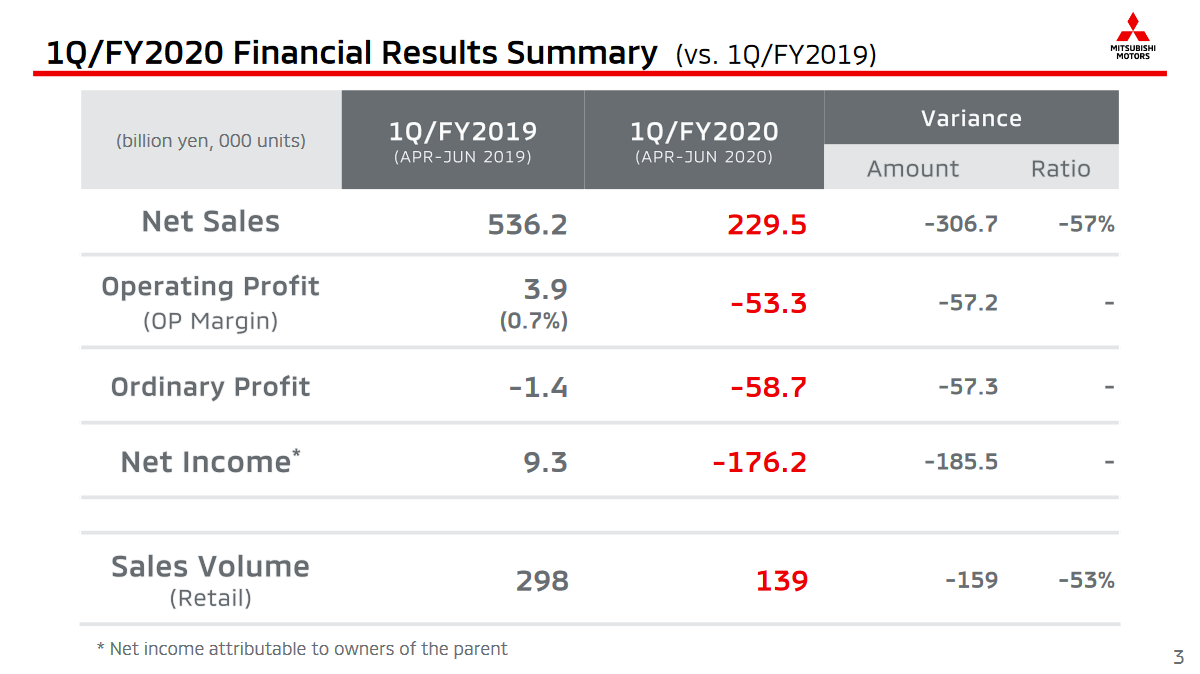

Mitsubishi Is In Trouble, Freezes New Car Launches In Europe

Mitsubishi (part of the Renault-Nissan-Mitsubishi Alliance) announced a bunch of bad news on July 27, 2020 starting with a very poor financial report. For the fiscal year ending March 2021, the Japanese company anticipates an operating loss of 140 billion yen ($1.33 billion). It will be the second year of losses in a row, and… Continue reading Mitsubishi Is In Trouble, Freezes New Car Launches In Europe