The Chairman of the Supervisory Board has complete respect and understanding for his decision Krüger: “I would like to pursue new professional endeavours” Munich. The Chairman of the Board of Management of BMW AG, Harald Krüger, gave notice today that he will not seek a second term of office. The Chairman of the Supervisory Board,… Continue reading Harald Krüger will not seek a second term of office as Chairman of the Board of Management of BMW AG

Tag: BMW

A look of luxury coupled with utility vehicle qualities: One-of-a-kind BMW X7 Pick-up.

Munich/Garmisch-Partenkirchen. Visitors to this year’s BMW Motorrad Days can expect to see, in addition to many bike highlights, a true one-off – the BMW X7 Pick-up. A unique conversion performed by BMW Group vocational trainees in cooperation with the Concept Vehicle Construction and Model Technology divisions at the BMW Munich plant. The vehicle is based on… Continue reading A look of luxury coupled with utility vehicle qualities: One-of-a-kind BMW X7 Pick-up.

CHINA VOICES | Ofo’s final fight

Jul 5, 2019 4 min read An ofo bike lies on the street in Shanghai on April 4, 2019. (Image credit: TechNode/Shi Jiayi) A version of this first article appeared in our members-only newsletter on June 22, 2019. Become a member and read it first. Ofo flew too close to the sun. Their dockless bikeshare model… Continue reading CHINA VOICES | Ofo’s final fight

Ford to find buyers for its capacity in Russia, but price will not be high – experts

MOSCOW, July 4 / TASS/. American automaker Ford continues to search for buyers for its Russian assets; German, South Korean and Chinese companies may become bidders, but the sale price is unlikely to be high, that is what the experts polled by TASS said on Thursday.

Ford is in commercial negotiations to sell its Russian assets and is currently considering proposals for the acquisition of factories from interested companies, the Ford Sollers press service told TASS. Currently, Ford automobile plants in Naberezhnye Chelny and Vsevolozhsk, as well as an engine manufacturing plant in Elabuga, are in the process of being closed. Its production lines have been closed since late June. “The closure of the plant is a complex and time-consuming process, which includes the preservation of the building and equipment, data archiving and other necessary actions,” explained Ford Sollers.

As previously reported by the Minister of Industry and Trade Denis Manturov, Ford will put the closing plants up f..

Ola gets a taxi license in London and plans to launch services in September

London is one of the world’s biggest markets for consumers that travel using ride-hailing services. Is it now also becoming one of the most crowded when it comes to the companies offering the transportation, too? Today, India’s Ola confirmed that it is the latest of the wave of app-based ride-hailing providers to receive a license… Continue reading Ola gets a taxi license in London and plans to launch services in September

BMW and Daimler to team up in push toward self-driving cars

Andrzej Wojcicki | Science Photo Library | Getty ImagesBMW and Mercedes-manufacturer Daimler announced a new partnership on Thursday to develop autonomous driving.

Some 1,200 technicians from the two German auto giants will team up in a bid to develop self-driving technology. The engineers will work toward driver-assistance systems, automated driving on highways as well as parking. The firms say the technology will be specified to what industry insiders call SAE level 4.

“Further talks are planned to extend the cooperation to higher levels of automation in urban areas and city centers,” BMW said in a joint statement.

SAE (Society of Automotive Engineers) levels determine the automation capabilities of vehicles, ranking from zero to five.

Level 4 vehicles can intervene if things go wrong or if there is a system failure. The car can perform all functions itself, although a manual override is available to a driver.

Daimler and BMW said they are targeting 2024 as a key date for installing the technology in cars available to the general public.

The automakers said the cooperation is “non-exclusive” and partner manufacturers and technology firms will take part in the work.

They added that the results won't be kept secret and other firms can see the conclusions “under license.”

Safer than a human?On Tuesday, the two German companies joined with nine other firms to publish a white paper on driverless technology, entitled “Safety First for Automated Driving.”

The report aims to draft worldwide industry standards for tackling the risks of self-driving cars and trucks.

Authors and experts from the firms involved say they aim to present the paper's principles and findings at auto industry and technology conferences over the next few months.

BMW said the main goal of the paper is to create a situation where an autonomously-driven vehicle is proven to be safer than one involving full human control.

Other participants in the document included Audi, Baidu, Continental, Fiat Chrysler, Here Technologies, Infineon, Intel, Volkswagen and Aptiv.

Now watch: Uber unveils its autonomous carVIDEO2:3902:39Uber looks to reduce costs with autonomous vehiclesSquawk Box

BMW Lets Slip That Its Electric Vehicles Can’t Compete With Tesla’s

Invest

Electric Cars

Electric Car Benefits

Electric Car Sales

Solar Energy Rocks

RSS

Advertise

Privacy Policy

Batteries

Published on June 28th, 2019 |

by Dr. Maximilian Holland

BMW Lets Slip That Its Electric Vehicles Can’t Compete With Tesla’s

Twitter

LinkedIn

Facebook

June 28th, 2019 by Dr. Maximilian Holland

Poor BMW. Director of development Klaus Fröhlich has had yet another EV meltdown, brought on by the pressure of not being able to compete with Tesla in the battery electric vehicle (BEV) market. His excuse for BMW’s failure to compete? “Nobody wants them.” Is Fröhlich really this out of touch? Or is he just playing politics?

Photo of Klaus Fröhlich by Matti Blume (CC BY-SA 4.0 license)

Klaus Fröhlich put on an embarrassing public display of whining and moaning about BEVs at the NextGen conference in Munich this past week. Fröhlich has had faux meltdowns about BEVs before. Most notably, back in October 2018, Fröhlich made a laughable claim that BEVs will “never” be able to compete on price with fossil vehicles. His reasoning? That as EVs become more popular and demand for batteries increases, their price is likely to increase. He stated in October, “When everybody wants to have cobalt, the prices of cobalt will not go down, they will go up.” Poor BMW. Their head of development seems to be living under a rock. Likely a fossil.

Fröhlich has rehashed the exact same argument again this week, as reported by Automotive News and Forbes, claiming:

“The shift to electrification is overhyped. Battery-electric vehicles cost more in terms of raw materials for batteries. This will continue and could eventually worsen as demand for these raw materials increases.”

Even at a time of unambiguous climate crisis, Fröhlich’s plan is for BMW to keep making diesel engines for the next 20 years, and gasoline engines for the next 30 years. BMW also aims to stick with a PHEV-heavy strategy to meet emissions regulations, rather than prioritizing BEVs. (PHEV = plug-in hybrid electric vehicle.)

Fröhlich Fails Economics 101

Fröhlich’s claims about the price of battery materials are absolute nonsense, and he knows it. It should go without saying — especially for someone whose job should involve understanding the trajectories of auto technology — that cobalt is being steadily removed from battery cathodes, and makes up just 5% to 10% in the latest generation of chemistries (e.g. Tesla’s NCA and CATL’s NCM 811), down from 33% of the cathode in recent generations. With time, cobalt will be removed almost entirely. Furthermore, it’s Economics 101 that prices only increase with growing demand if supply is fundamentally constrained. (Related: Nope, Cobalt’s Not A Problem For The EV Revolution, Or Tesla — #CleanTechnica Exclusive.)

When an industry is experiencing growth (as the BEV industry has been for a decade already), especially growth driven by technological developments, there is de facto an overall increase in volume at all levels of the supply chain over time. This, combined with production learning, technological learning, and economies of scale, drives gradually lower prices. Whilst there may be bottlenecks (or oversupply) at some points along the supply chain for short periods, only a fundamental fixed limit at some point of the basic material supply (one that cannot be overcome) would lead to increased prices as demand grows. And even then — only if there were no possible substitutes.

To the chagrin of those used to being in oligopoly positions in the oil industry, none of these dynamics apply in any fundamental sense in the battery mineral supply chain. Decent returns on investment can certainly be made, but monopolistic pricing and cornering the market on vital commodities do not apply in the age of BEVs (except perhaps in regard to the talent pool).

Image via Tesla

If you will allow me a side note — it’s worth remembering also that material content of battery cells for 450+ km of range (around 65 kWh) will soon amount to as little as 220–240 kg (@300 Wh/kg), and this amount of “stuff that needs mining” is steadily decreasing as energy density and vehicle efficiency improve. Once mined and refined once, and then in duty for 12–15+ years in a BEV, and another 10+ years as stationary storage, almost all of these materials can be recycled in perpetuity for repeated use in the future. The electrons that “fuel” the battery weigh almost nothing and can come along existing wires, from renewable sources.

Contrast that with the 200 to 300 gallons of gasoline that simply go up in smoke and other emissions each year, when driving 10,000 miles in a combustion vehicle. 200 to 300 gallons at around ~3 kg (6.3 lb) per gallon — that’s 600 to 900 kg of “stuff” that needs mining, shipping, refining, transporting, storing, and delivering each and every year. Over a 15 year lifetime, that’s around 45× more mined material than the BEV requires. Remind folks of that difference if they question the lifetime environmental impact of BEVs vs. fossil powered vehicles.

Getting back to Fröhlich’s FUD on battery mineral prices: There is no fundamental natural supply constraint to battery minerals (lithium is the 25th most abundant element on earth). There is simply an unprecedented growth in demand for some minerals (lithium and, until more recently, cobalt) that have historically had fairly modest supply volumes for other end uses. The supply industry for these minerals is following a normal pattern of the ramp up of mining (and processing) investments sometimes struggling to keep up with rapidly growing ramp in demand. Nevertheless, the price of the key minerals, lithium hydroxide and lithium carbonate, as well as cobalt sulphate, have actually reduced over the past two years, even as demand for them, and manufacturing of batteries, has rapidly increased:

More substantial mineral components of batteries are, in fact, nickel (5th most abundant element), aluminium (3rd most abundant), and graphite (essentially limitless, as it can be synthesized from carbon). The supply chains of all of these minerals are very well established, and the relative proportion of the global supply of these minerals that goes to batteries is still minor.

In short, although some supply chains (e.g., lithium) will need to continue to scale up, there are no fundamental mineral supply constraints that would lead to enduring price increases over time. Remember the concerns about limited silicon wafer supply for the PV industry back in the 2006–2008 timeframe? Well, let’s remind ourselves of the big picture on the price of PV watts over time:

The exact same trend is happening with battery pricing:

Fröhlich is either being ignorant, unintelligent, or dishonest (or all 3) when he claims the price of batteries, and battery electric vehicles, is at any significant risk of rising over time.

Fröhlich projects BMW’s BEV Failures onto Others

Every serious auto industry analyst knows that Tesla’s BEVs already equal or outcompete fossils on sticker price in the mid-sized premium segments (and every segment above), and BEVs in general will reach sticker price parity with fossils in pretty much all remaining segments before 2025. See, for example, our recent comparison on China pricing of premium mid-sized sedans, where the Tesla Model 3 crushes BMW 3 Series and Mercedes C-Class “rivals” on price. And, of course, savvy consumers are catching on to the already superior total cost of ownership of BEVs once wealth-draining gas fill-ups and high maintenance are removed from the ownership equation.

This reality on the already superior economic proposition of BEVs doesn’t stop Fröhlich from overstating their relative cost today:

“All this range discussion is complete bullshit because it’s an economic proposition of how much you can afford. … You have to pay for range, this is what people don’t seem to understand. The difference between 350km and 600km of BEV range will be 10,000 euros. You put them both out there and see how many people will buy the 600km car”

Fröhlich appears to be desperate. Of course, having extra range involves having a larger battery and thus somewhat higher cost, but Fröhlich grossly overstates the actual battery cost figures. Let’s take the current BEV best seller, the Tesla Model 3, as an example. This is a high-performance mid-sized vehicle, well matched in size to BMW’s own high selling 3 Series. The Tesla Model 3 Long Range rear-wheel drive has a European WLTP range rating of 600 km, from a gross battery size of ~80 kWh ( ~74 kWh usable). This suggests that a 350 km version would require a battery size of 47 kWh, at most. That’s a difference of 33 kWh in cells. This equates to the difference in battery size for the additional 250 km, that Fröhlich claims costs €10,000.

Image via Tesla

BWM is indeed in big trouble if it is paying €10,000 ( $11,380) for 33 kWh of cells. That’s $345/kWh at the cell level! According to BNEF, as of late 2018, the average market price of bulk contract automotive cells was $127/kWh. That would put the 350km to 600km battery premium at around just $4,191, or €3,680. Tesla’s cell cost is somewhere in the region of $100/kWh, putting the premium at just $3,300, or €2,900.

Is BMW really paying 3× too much for its cells? No. Fröhlich is instead grossly exaggerating the pricing (either deliberately or from ignorance) as part of his off-the-cuff negative spin about the inherent costliness of long-range BEVs. Why is Fröhlich talking such nonsense?

Perhaps what he really means to say is that BMW itself is simply incapable (or unwilling) to make decent-range BEVs that are attractive to consumers. This seems to be the case:

“There are no customer requests for BEVs. None. … There are regulator requests for BEVs, but no customer requests. … If we have a big offer, a big incentive, we could flood Europe and sell a million (BEV) cars, but Europeans won’t buy these things.”

Oh dear, oh dear, what nonsense. Fröhlich is taking B..

Contract signed: BMW Group and Daimler AG launch long-term development cooperation for automated driving

Munich/Stuttgart. The BMW Group and Daimler AG are launching their cooperation on automated driving: representatives from the two companies today signed an agreement for a long-term strategic cooperation, which will focus on joint development of next-generation technologies for driver assistance systems, automated driving on highways and automated parking (all to SAE Level 4). In addition,… Continue reading Contract signed: BMW Group and Daimler AG launch long-term development cooperation for automated driving

Contract signed: Daimler AG and BMW Group launch long-term development cooperation for automated driving

Initial goal: to develop technologies for driver assistance systems, highly automated driving on highways, and automated parking (all up to SAE Level 4) Market launch in series vehicles scheduled for 2024 Partners will implement technologies independently in their respective series vehicles Cooperation involves over 1,200 development specialists in Sindelfingen and Unterschleissheim Stuttgart/ Munich. The Daimler… Continue reading Contract signed: Daimler AG and BMW Group launch long-term development cooperation for automated driving

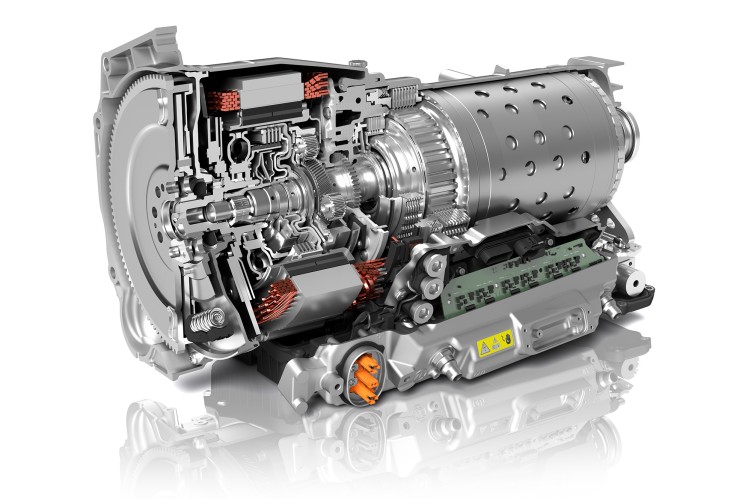

Press: Fiat Chrysler Automobiles Nominates ZF as Supplier for New 8-Speed Automatic Transmission

ZF to deliver 8-speed-transmission for rear-wheel drive and all-wheel drive vehicles with front-longitudinal drive configuration Significant share of hybrid transmissions included Second largest single order for latest generation of ZF’s 8-speed automatic transmission Friedrichshafen / Amsterdam. Fiat Chrysler Automobiles N.V. (FCA) has nominated ZF Friedrichshafen AG as global transmission supplier for rear-wheel drive and all-wheel… Continue reading Press: Fiat Chrysler Automobiles Nominates ZF as Supplier for New 8-Speed Automatic Transmission