June 2, 2020Amsterdam and Tokyo – HERE Technologies today announced that Mitsubishi Corporation (MC) and Nippon Telegraph and Telephone Corporation (NTT) of Japan have completed their joint acquisition of a 30% ownership stake in the company, after receiving regulatory approvals.HERE welcomes MC and NTT as strategic investors. The two companies have co-invested in HERE via… Continue reading Mitsubishi Corporation and NTT complete acquisition of 30% stake in HERE Technologies

Tag: Mitsubishi

Renault cuts 15,000 jobs in major restructuring

Renault is cutting 15,000 jobs worldwide as part of a €2bn (£1.8bn) cost-cutting plan after seeing sales plunge because of the virus pandemic. “This plan is essential,” said interim boss Clotilde Delbos, who announced a bigger focus on electric cars and vans. Some 4,600 jobs will go in France, and Renault has said six plants… Continue reading Renault cuts 15,000 jobs in major restructuring

Alpine A110 sports car plant under review as Renault seeks cost cuts – Motor Authority

Renault and its alliance partners Nissan and Mitsubishi are in crisis mode and looking to scale back operations to help stem losses that were piling up well before the Covid-19 coronavirus pandemic hit. On Friday, Renault announced a major restructuring that has seen six plants placed under review and 14,600 jobs worldwide placed on the… Continue reading Alpine A110 sports car plant under review as Renault seeks cost cuts – Motor Authority

Nissan recovery plan seen as start of long journey by investors

TOKYO — The massive restructuring plans laid out by Nissan Motor that led to its worst loss in 20 years have not dispelled doubts among investors and analysts about whether the Japanese carmaker is now fully on the road to recovery. Nissan is likely to face more restructuring costs, and CEO Makoto Uchida will need… Continue reading Nissan recovery plan seen as start of long journey by investors

Renault plans 17.5% production cut to save £1.8bn by 2024

Renault has laid out plans to implement 14,600 job cuts as it reduces its global vehicle production output by 17.5% in a bid to save £1.8 billion by 2024. A day after Alliance partner Nissan announced the transformation of its global manufacturing operations and an accompanying reduction in its model range, Renault revealed similar steps… Continue reading Renault plans 17.5% production cut to save £1.8bn by 2024

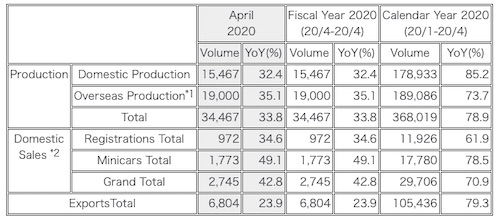

@Mitsubishi: Mitsubishi Motors Announces Production, Sales and Export Figures for April 2020

TOKYO, May 28, 2020 – (JCN Newswire) – Mitsubishi Motors has announced a summary of production, sales, and export figures for April 2020. (1) Beginning fiscal 2012, locally branded models produced in China, which to date had been included in the output figure for China, are now excluded (2) Includes imports to Japan Summary: April… Continue reading @Mitsubishi: Mitsubishi Motors Announces Production, Sales and Export Figures for April 2020

Nissan reports $6.2bn annual net loss, worst in 20 years

TOKYO — Nissan Motor has posted a net loss of 671 billion yen ($6.2 billion) for the year ended in March as the new coronavirus outbreak devastated sales and the carmaker started a big restructuring to cut costs. The annual financial result exceeds the company’s net loss of 233 billion yen for the 12 months… Continue reading Nissan reports $6.2bn annual net loss, worst in 20 years

Nissan sets out survival plan after first loss in 11 years

TOKYO (Reuters) – Nissan Motor Co unveiled a plan to become a smaller, more cost-efficient automaker on Thursday as it looks to recover from four years of tumbling profits that culminated in its first annual loss in 11 years. FILE PHOTO: Nissan Motor’s logo is pictured at its headquarters in Yokohama, Japan February 13, 2020.… Continue reading Nissan sets out survival plan after first loss in 11 years

@Mitsubishi: Alliance New Cooperation Business Model to Support Member-Company Competitiveness and Profitability

TOKYO, May 27, 2020 – (JCN Newswire) – Groupe Renault, Nissan Motor Co., Ltd. and Mitsubishi Motors Corporation, the members of one of the world’s leading automotive alliances, today announced several initiatives as part of a new cooperation business model to enhance the competitiveness and profitability of the three partner companies. The member companies plan… Continue reading @Mitsubishi: Alliance New Cooperation Business Model to Support Member-Company Competitiveness and Profitability

Renault, Nissan abandon race for growth to focus on costs

Renault SA and Japanese partners Nissan Motor Co. and Mitsubishi Motors Corp. unveiled a plan for deeper cooperation in developing and building vehicles as they seek to salvage their strained alliance and weather a collapse in car demand. The measures will help deliver savings of as much as 40% in model investments for jointly developed… Continue reading Renault, Nissan abandon race for growth to focus on costs