DUBLIN, July 18, 2022 /PRNewswire/ — The “Global and China Flying Car Industry Research Report, 2022” report has been added to ResearchAndMarkets.com’s offering. A flying car is a three-dimensional vehicle. Broadly speaking, it is a low-altitude intelligent autonomous transportation tool carrying cargo or people, namely electric vertical take-off and landing (eVTOL). It features electric vertical take-off… Continue reading Global and China Flying Car Industry Report 2022 Featuring Major Flying Car Suppliers & OEMs Deploying Flying Cars

Tag: Honda

Honda readies new ZR-V for launch in Japan

Honda Motor Co today released initial information on the ZR-V, an all-new SUV scheduled to go on sale in Japan later this year, with pre-orders opening in September 2022. The hybrid model of the all-new ZR-V will be the first Honda SUV to be equipped with the Sports e:HEV that combines a 2.0-litre direct injection… Continue reading Honda readies new ZR-V for launch in Japan

Honda’s Dixon, Herta Finish 1-2 in Toronto

Starting together on the front row, pole qualifier Herta and Dixon led the 26-car field from the green in the return of INDYCAR competition to Exhibition Place in Toronto for the first time in three years, with Herta at the point of those on the primary race strategy, which include the majority of the field. … Continue reading Honda’s Dixon, Herta Finish 1-2 in Toronto

Ioniq 6 efficiency, Honda CR-V hybrid, Canoo lifeline, Tesla Powerwalls backing up the grid: The Week in Reverse

Go to Source

Nissan, Ford among vehicle recalls this week

U.S. National Highway Traffic & Safety Administration The U.S. National Highway Traffic Safety Administration has issued recalls for July 7 through 14, including a Nissan recall involving 180,176 units and a Ford recall involving 100,689 units. See the list of this week’s car recalls involving ten or more units below, or search USA TODAY’s automotive… Continue reading Nissan, Ford among vehicle recalls this week

New Electricity Approach Achieves 90% Coverage of China’s EV Charging Station Market with the Addition of 954 XPeng’s Charging Stations Added into Its Charging Pile Network

In addition, New Electricity Approach also plans to achieve data interoperability with XPeng superchargers by sharing and using each other’s back-end data. By doing so, the charging platform can leverage the combination of data from XPeng and its own algorithms across application scenarios. “The collaboration between the leading aggregation charging platform and the promising Chinese… Continue reading New Electricity Approach Achieves 90% Coverage of China’s EV Charging Station Market with the Addition of 954 XPeng’s Charging Stations Added into Its Charging Pile Network

Can Hyundai’s N division transfer its magic to electric cars?

In recent years, Hyundai has emerged from performance car no-man’s land to be the defender of the hot hatch with its N models. The Hyundai i20 N is a breath of fresh air in a segment with a huge attrition rate, and while the Hyundai Kona N and Hyundai i30 N can be a little… Continue reading Can Hyundai’s N division transfer its magic to electric cars?

La SUV favorita de los Estados Unidos mejora aún más: la nueva Honda CR-V cuenta con un diseño sofisticado y robusto, además de un sistema híbrido más avanzado y deportivo

Perfecto para escapadas diarias o de fin de semana, el nuevo CR-V es más largo y ancho, con proporciones prémium y una postura significativamente más amplia, lo que impulsa aún más la dirección de diseño de Honda con una línea de cintura horizontal baja y una zona frontal larga y poderosa. El SUV más popular… Continue reading La SUV favorita de los Estados Unidos mejora aún más: la nueva Honda CR-V cuenta con un diseño sofisticado y robusto, además de un sistema híbrido más avanzado y deportivo

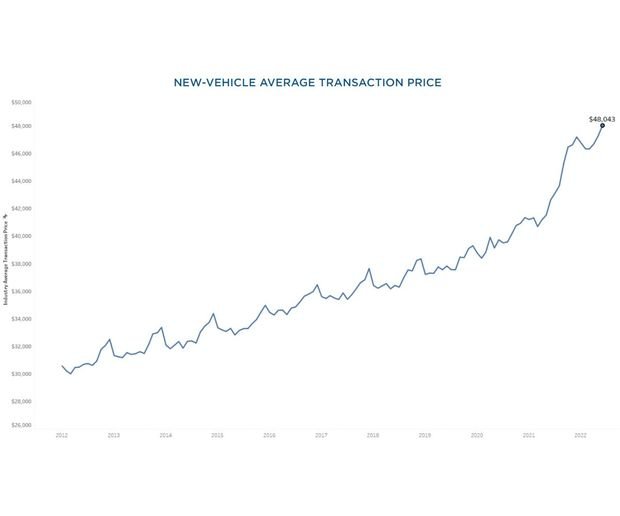

New-Vehicle Prices Set Record in June

According to data from Kelley Blue Book, the average transaction price (ATP) for a new vehicle surpassed the $48,000 mark in June, the highest ATP on record. Chart: Cox Automotive In June, the average price paid for a new vehicle was the highest on record and marked the first time that the average transaction price… Continue reading New-Vehicle Prices Set Record in June

Piaggio plans flex fuel engines for India 3-wheelers by 2025

Piaggio is at an advanced stage of developing India-specific flex fuel engines for its three-wheeler range. Work is underway at its R&D centres across Pontadera headquarters in Italy and will be ready for India by 2025. Diego Graffi, Chairman and MD, Piaggio India, told Autocar Professional, “We already have global Piaggio R&D teams on standby for development… Continue reading Piaggio plans flex fuel engines for India 3-wheelers by 2025