As part of a pilot project, Daimler Trucks gives a truck its own digital identity with legal capacities The truck identifies itself to other machines thanks to the newly developed digital Truck-ID Supplementary Truck Wallet platform technology makes it possible to use the Truck-ID for payments and other applications Successful autonomous payment at electric charging… Continue reading Pilot project: Daimler Trucks is teaching trucks how to pay

Tag: Mobility

Mercedes-Benz Cars and Vans at the 2019 International Motor Show: on the way to an emission-free future

08.

August 2019

Stuttgart/Frankfurt am Main

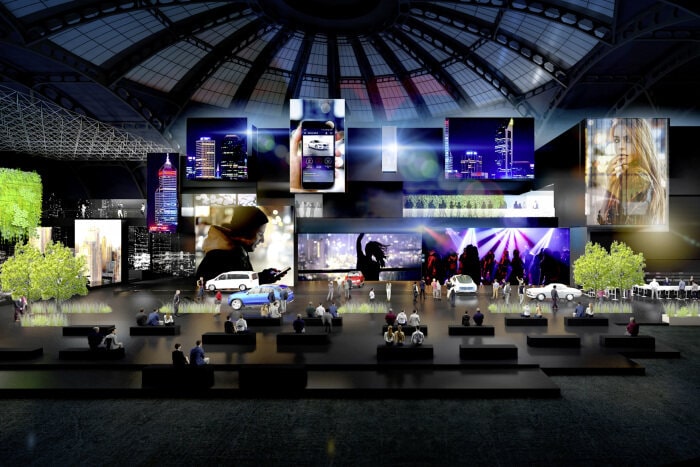

Stuttgart/Frankfurt am Main. Mercedes-Benz's appearance at the International Motor Show (IAA) in Frankfurt from September 10th to 22nd, 2019, will be dominated by sustainable solutions for the future of mobility. Ola Källenius, the new Chairman of the Board of Management of Daimler AG and Head of Mercedes-Benz Cars, will give an outlook on the future of Mercedes-Benz.. Numerous world premieres underscore the claim of the inventor of the automobile to continue designing and offering intelligent mobility solutions. The Mercedes-Benz exhibition stand has been completely redesigned for this purpose and is even more conceptually oriented towards customers. On the evening before the first press day, invited journalists will receive an exclusive look at the innovations during “Meet Mercedes,” which includes an exciting workshop program.

The core topic at the IAA 2019 is the sustainable future of Mercedes-Benz, Ola Källenius will explain what this strategy looks like and what it has to do with universal human needs at the Mercedes-Benz press conference on September 10, starting at 9:20 a.m. The first appearance of the new Chairman of the Board of Management of Daimler AG and Head of Mercedes-Benz Cars at one of the major global motor shows will be accompanied by a large number of new vehicles.

Exclusive preview at “Meet Mercedes”

The focus of the proven “Meet Mercedes” event format is on a tour of the exhibition along with five workshops covering a broad spectrum of topics relating to the product and brand philosophy of Mercedes-Benz Cars and Vans. Among other things, Britta Seeger, Member of the Board of Management, Mercedes-Benz Cars Marketing & Sales, will discuss the sales of the future and the newly developed booth concept. Another workshop will be held by Markus Schäfer, Member of the Board of Management, Group Research & Mercedes-Benz Cars Development, on the goals of the R&D division in a transforming industry. This will be held prior to the session of Sajjad Khan, Member of the Board of Management of Mercedes-Benz Cars, CASE, who will talk about the future of mobility and alignment with the CASE strategy. Renata Jungo Brüngger, Member of the Board of Management, Integrity and Legal Affairs, will then present the principles regarding the use of artificial intelligence at Daimler to the public for the first time. Jörg Burzer, member of the Board of Management of Mercedes-Benz Cars, Production and Supply Chain, will also talk about the future of production at Mercedes-Benz Cars and Vans.

World premieres: Innovative Show Car and new Plug-in Hybrid

A new show car will celebrate the world premiere of a vehicle that embodies the flexible, customer-oriented and sustainable vision of the Mercedes-Benz product and technology brand EQ. Also on show for the first time are new plug-in hybrid derivatives from Mercedes-Benz and the all-electric high-capacity sedan EQV. The GLB will also celebrate its trade fair premiere. smart, the pioneer in urban mobility, will be showing the model upgrades of its electric city cars for the first time in the metropolis on the Main river. As an introduction to the world of driving performance from Mercedes-AMG, the Affalterbach-based brand will present a variant of the compact SUV based on the GLB.

As usual, you will soon find a “media special” with all information and highlights of the 2019 International Motor Show Germany on Mercedes me media: https://media.mercedes-benz.com. You can now also get all the news from Twitter: @mb_press. The new channel supplements the press communication and offers you the opportunity to find out about all current topics and events relating to Mercedes-Benz Cars and Vans.

Press Contact

Willem Spelten

Head of international Brand & smart Product Communications

willem.spelten@daimler.com

Tel: +49 (0)711 17-75847

Fax: +49 (0)711 17-79099473

Katja Bott

Head of Global Communications Mercedes-Benz Cars

katja.bott@daimler.com

Tel: +49 711 17 75841

Fax: –

Press Contact Overview

Media

Download

Pictures (1)

Documents (1)

Media Contact (2)

Filter

Show thumbnails

Show list

Slideshow

Settings

Preview

Do you really want to delete the data record?

Please wait a moment …

Please wait a moment …

Please wait a moment …

Please wait a moment …

19C0624_001

Legend

:

Preview Mercedes-Benz Cars and Vans booth at the IAA 2019 in Frankfurt, Germany.

Release date

:

Aug 8, 2019

Loading

Budgeting for Growth

Newsroom/Stories/Budgeting for Growth

Budgeting for Growth

6 July 2019: From enhancing the ease of doing business, to creating a conducive environment for new-age companies, with a focus on rural growth and infrastructure creation the new Union Budget for 2019-20 ticks several boxes.

Here is a quick recap of the highlights and an analysis from the desk of the Group Chief Economist –

Finance Minister Nirmala Sitharaman, presented a 'mega investment-oriented' budget with a blueprint to transform India's economy by 2025. This will be achieved by setting up a Credit Guarantee Enhancement Corporation, enhancing the source of capital or infrastructure financing and easing the norms for Foreign Direct Investment (FDI).

Anand Mahindra, Chairman, Mahindra Group, said, “Instead of lowering Goods and Services Tax (GST) on all cars, Nirmala Sitaraman aligned with the vision for mobility & incentivized only Evs. In fact, the budget is an accumulation of seemingly unspectacular moves that will nudge the economy onto a trajectory toward USD 5 trillion & an improved ‘ease of living.”

V. S. Parthasarathy, Mahindra Group CFO, said, “Budget 2019 has re-imagined solutions to old chronic problems. This was a 'Governance' focused Budget pivoting around technology, digital and enhancing the ease of doing business in India. It can prove to be a powerful catalyst for economic prosperity if the implementation is flawless and executed in near ‘crisis mode'.

Enhancing the ease of direct and indirect taxation the government has increased the threshold turnover for a lower rate of corporate tax. Currently, the lower tax rate of 25% is only applicable to companies having an annual turnover of up to Rs 250 crore. This has now been expanded to include all companies with an annual turnover of up to Rs 400 crore.

Aadhar card and PAN will be interchangeable and a scheme of faceless assessment in electronic mode involving no human interface will also be launched this year.

In order to incentivize and give thrust to the Electric Vehicles (EVs) sector, customs duty on specified parts required for the manufacture of EVs has been brought down to nil. In addition, there is already a proposal before the GST Council to reduce the GST on e-vehicles from the present 12% to 5%

The Budget also focusses on transforming rural lives by setting up 100 new clusters for traditional industries, 80 Livelihood Business Incubators to develop agro-rural industry sectors, the formation of 10,000 new Farmer Producer Organizations to ensure economies of scale, and expansion of Swachh Bharat Mission to reach every village in India.

Mahindra's Group Chief Economist desk reviewed the Budget saying, “The Budget eschewed the temptation of a big spending splurge because it lacked the room to do so. The government has imparted an Infra thrust by significantly focussing on national grids for water, power, gas, internet, and aviation apart from transportation. Financing the fiscal deficit from abroad, however, can be a double-edged sword especially for countries running twin deficits.

V. Ravi, Executive Director and Chief Financial Officer, Mahindra Finance, said, “The positive reference made by the Finance Minister about NBFCs as an important growth lever by contributing to improved consumption and capital formation, will go a long way in reinvigorating the SME sector. The NBFC industry would have been glad to see the formation of a refinancing body which would address the liquidity stress created by certain entity-specific events that tend to affect the sector as a whole.”

Lyft’s scooters steering new customers to ride-hailing, but winter is coming

FILE PHOTO: A man rides a Lyft scooter near the White House in Washington, U.S., March 29, 2019. REUTERS/Brendan McDermid/File Photo (Reuters) – A quarter of Lyft Inc LYFT.N customers who use its bikes and scooters are new to the company, executives said on Wednesday, outlining how investments in the expensive growth area may eventually… Continue reading Lyft’s scooters steering new customers to ride-hailing, but winter is coming

Postmates lands first-ever permit to test sidewalk delivery robots in San Francisco

On-demand delivery business Postmates says it’s been granted the first-ever permit for sidewalk robotics operations in the city of San Francisco. According to San Francisco Public Works, the permits are active for 180 days and authorize the testing of up to three autonomous delivery devices. We’ve reached out to the Public Works department for comment.… Continue reading Postmates lands first-ever permit to test sidewalk delivery robots in San Francisco

Osram invests in driverless car AI company – LEDs Magazine

Osram might be in the midst of an uncertain ownership change, but it’s conducting business as usual in that it continues to recast itself as a high-tech outfit. In its most recent example, it has invested in a Silicon Valley firm specializing in artificial intelligence (AI) for driverless cars. The company’s Fluxunit venture capital arm… Continue reading Osram invests in driverless car AI company – LEDs Magazine

Lyft’s second quarter was way better than Wall Street expected (LYFT)

Lyft on Wednesday reported second-quarter earnings that topped Wall Street’s expectations, while boosting its guidance for the full year. Here are the important numbers: Revenue: $867 million ($809 million expected) Losses per share: $0.68 (adjusted) vs. $1.74 expected Active riders: 21.8 million Markets Insider Shares of Lyft, which went public in March, rose as much… Continue reading Lyft’s second quarter was way better than Wall Street expected (LYFT)

Mahindra and Mahindra Limited financial result

Newsroom/Press Releases/Mahindra and Mahindra Limited financia…

Mahindra and Mahindra Limited financial result

Q1* Revenue at Rs. 12,997crores

Q1* PAT (before EI) at Rs. 918 crore

Q1* PAT (after EI) at Rs. 2,260 crore

Mumbai, 7th August 2019: The Board of Directors of Mahindra & Mahindra Limited today announced the financial results of the Company for the quarter ended 30th June 2019 and for the consolidated Mahindra Group.

Q1 F2020 – M&M + MVML Results

Rs. crores

Q1 F2020

Q1 F2019

Growth % YoY

Revenues and Other Income

12,997

13,551

-4%

Profit from ordinary activities Before Tax (before EI)

918

1,238

-26%

Profit from ordinary activities After Tax (before EI)

2,260

1,257

80%

Operating margin (OPM)

14.0%

15.8%

Vehicles sold (Nos)

1,23,690

1,30,484

-5%

Tractors sold (Nos)

82,013

96,527

-15%

Exports (vehicles and tractors) (Nos)

10,923

12,730

-14%

For Q1 F2020, the Indian auto industry de-grew 12.3%, with all segments of the industry reporting a decline. It is after six years, that all segments of the industry have posted a reduction in the same quarter. The auto industry excluding 2W fell 15.4% driven by drop of 18.4% in the Passenger Vehicle (PV) industry and the MHCV goods industry falling by 18.6%.

For the PV segment, Q1 F2020 is the fourth consecutive quarter of reduction, the worst ever de-growth since Q3 F2001. PV demand continues to be impacted by the slowing down of the overall economy, which along with tight credit conditions and delayed monsoon has impacted consumer sentiment in both urban and rural India. The stress in the agri sector and finance availability has impacted the demand for LCV 2-3.5T (Pik-UP segment). The HCV goods segment has posted a de-growth of 32.0%, the worst reduction in 23 quarters. The slowing down of economic activity coupled with the increase in freight capacity of existing fleet due to implementation of new axle loading norms has resulted in many transporters either reducing or temporarily suspending their fleet purchase plans.

Tractor demand in Q1 F2020 remained sluggish and was adversely impacted due to a weak sentiment in the agri economy resulting from the delay in SW monsoon, poor spatial distribution in June and weak agricultural incomes impacted by poor price realization. In Q1 F2020, the domestic tractor industry declined by 14.6% with sales of 1,91,305 tractors, against 2,23,937 tractors sold during Q1 F2019. In this period, in the domestic market, the Company sold 82,013 with a market share of 42.9%.

Q1 F2020 – M&M Standalone Results

Rs. crores

Q1 F2020

Q1 F2019

Revenues and Other Income

13,242

13,785

Profit from ordinary activities After Tax (before EI)

973

1200

Profit from ordinary activities After Tax (after EI)

2,314

1,221

Q1 F2020 – Group Consolidated Results

Rs. crores

Q1 F2020

Q1 F2019

Growth % YoY

Revenues and Other Income

26,289

26,261

0.1%

Profit after tax after Non-Controlling Interest (before EI)

777

1,358

-42.8%

Profit after tax after Non-Controlling Interest (after EI)

914

1,707

-46.5%

A full summation of Gross Revenue and other income of all the group companies taken together for the quarter ended 30th June 2019 is Rs. 35,970 crores (USD 5.1 billion).

Outlook:

The IMF has pared down its projections yet again for global as well India’s growth in its latest July 2019 outlook. Domestically, data broadly paints a picture of subdued demand, notably in private consumption with firms and households continuing to hold back spending. The RBI has also scaled down the projection of GDP growth for 2019-20 to 7.0% from 7.2% earlier.

Monsoon, which is crucial for farm output and growth, has played catch up lately, thanks to copious July rainfall, after a delayed and patchy start. The India Meteorological Department (IMD) has forecast a zero-deficit monsoon in the second half of season, which bodes well for cumulative rainfall as well as Kharif acreage. The resultant precipitation and soil moisture could also turn out to be positive for Rabi crops.

The RBI has cut policy rates by 75bps thus far and is likely to remain accommodative. The lagged effect of interest rate cuts, liquidity infusion and targeted fiscal spending post budget, especially government actions on improving incomes for farmers, cash transfers and sops for affordable housing, could provide support to growth going forward. However, given the current challenging global and domestic growth environment, a concerted policy effort will be required to prop sentiment, put a floor under consumption and revive growth.

Note: Translation of rupee to dollar is a convenience translation at the average exchange rate for the twelve month period ended 30th June 2019.

About Mahindra

The Mahindra Group is a USD 20.7 billion federation of companies that enables people to rise through innovative mobility solutions, driving rural prosperity, enhancing urban living, nurturing new businesses and fostering communities. It enjoys a leadership position in utility vehicles, information technology, financial services and vacation ownership in India and is the world’s largest tractor company, by volume. It also enjoys a strong presence in agribusiness, aerospace, commercial vehicles, components, defense, logistics, real estate, renewable energy, speedboats and steel, amongst other businesses. Headquartered in India, Mahindra employs over 2,40,000 people across 100 countries.

Learn more about Mahindra on www.mahindra.com / Twitter and Facebook: @MahindraRise

Media contact information:

Mohan Nair

Vice President (Communications)

Mahindra & Mahindra Ltd.

Office Direct Line – + 91 22 28468510

Office Email Address – nair.mohan@mahindra.com

Lyft’s stock is a roller coaster after its Q2 earnings release

In its second quarterly earnings release as a public company, Lyft showed it still isn’t afraid to lose money as long as that means surging revenues. Update: The company’s stock price jumped as high as 12% after-hours following the Q2 earnings release, but by 1:30pm PT the stock had sunk below the day’s close (following… Continue reading Lyft’s stock is a roller coaster after its Q2 earnings release

The future of mobility lies close to home!

Electric mobility goes well beyond the vehicle by Valérie Calloch Electric mobility goes far beyond the vehicle. It is designed to adapt to our home. As was demonstrated by the SYMBIOZ, the concept car that we presented at the 2017 Frankfurt Motor Show. Remember, this car of the future slotted harmoniously into, and interacted continuously… Continue reading The future of mobility lies close to home!