Sales revenue and deliveries above prior-year level As expected, operating profit for the third quarter affected by WLTP changeover Forecasts for sales revenue and operating profit for 2018 confirmed COO Ralf Brandstätter: “The development in sales and growth over the first nine months has been gratifying. We still need to improve our operating return.” In… Continue reading Volkswagen remains on track for growth despite a challenging environment

Tag: Financial Results

Ford shares jump more than 8 percent on strong earnings and more details of its turnaround plans

Jeff Kowalsky | AFP | Getty Images

Jim Hackett, president and chief executive officer, Ford Motor stands outside the headquarters as they celebrate the production of the 10,000,000 Mustang on August 8, 2018 in Dearborn, Michigan.

Ford shares were up more than 8 percent Thursday after the company delivered better-than-expected earnings Wednesday night.

Investors seemed encouraged by CEO Jim Hackett's pledge to share more details of his plans to restructure the company and improve efficiency.

Ford is going to host several events in the “coming weeks and months” where it will share more information about Hackett's $11 billion turnaround plans. Hackett has spoken extensively of the need to improve the company's “fitness,” or efficiency, but investors have at times expressed frustration at what they say is a lack of clarity and transparency on Ford's part.

The automaker's shares have fallen roughly 30 percent since the beginning of the year.

“It seems that Mr. Hackett understands that the Street needs more information to gain comfort with his plan, and as such he hinted that there are a number of investor events planned for the near future,” said RBC analyst Joseph Spak in a note published Thursday.

Ford's third-quarter results were solid, despite the fact that some key metrics were down from the same quarter last year, analysts said. Strong sales of trucks in North America helped offset declining sales of passenger cars, higher materials costs and difficulties in China.

“The results really show an enhanced focus on North America, and a focus on trucks and SUVs,” CFRA analyst Garrett Nelson told CNBC. Nelson was surprised the automaker maintained its full-year earnings guidance of $1.30 to $1.50 per share, and said he expects earnings to come in at the low end of that range.

Ford still faces challenges on numerous fronts, including risks from rising materials costs, threats to both supplies and sales from new tariffs, and struggling international businesses.

WATCH:Ford is using bionic suits to help employees work safer

Ford is using bionic suits to help employees work safer

6:24 PM ET Fri, 20 April 2018 | 02:20

Avis Grows Q3 Revenue to $2.8B

The company’s corporate debt was approximately $3.6 billion at the end of the third quarter. Photo via Atomic Taco/Flickr. Avis Budget Group released its Q3 results today, reporting a revenue of $2.8 billion, a new record for the company. “Our Americas segment delivered record profits and a 50 basis point margin improvement in the third quarter… Continue reading Avis Grows Q3 Revenue to $2.8B

Panasonic Says Gigafactory Profit in Sight as Tesla Ramps Output

Panasonic Says Gigafactory Profit in Sight as Tesla Ramps Output BloombergTesla Investors Urge Board to Go Beyond SEC-Ordered Overhaul BloombergQuintTesla Says DOJ Sought Documents on Model 3 Production Guidance Bloomberg Big Law BusinessTesla Faces Deepening Criminal Probe Over Whether It Misstated Production Figures Wall Street JournalFull coverage Go to Source

General Motors’ shares soar as strong truck sales, higher prices boost third-quarter profit

General Motors posts strong beats on top and bottom lines

8:37 AM ET Wed, 31 Oct 2018 | 01:42

General Motors said Wednesday it sold fewer vehicles during the third quarter — but at higher prices — helping the Detroit automaker deliver a better-than-expected earnings report that sent its shares soaring.

Here's what the company reported compared with what Wall Street was expecting, based on a survey of analysts by Refinitiv:

Earnings per share: $1.87, adjusted, vs. $1.25 expected

Revenue: $35.79 billion vs. $34.85 billion expected

The carmaker's shares jumped by 6.3 percent in morning trading. During the premarket, it had gained 10 percent.

GM swung to a profit during the quarter from last year's loss, which stemmed from the company's sale of its European business to Groupe PSA. GM's net income was $2.5 billion, or $1.75 a share, compared with a loss of $2.98 billion, or $2.03 a share, a year ago. It generated $35.79 billion in revenue, up 6 percent from $33.62 billion during the same quarter last year. Analysts had expected the company to generate $34.85 billion during the third quarter.

“Our disciplined approach to the U.S. market, combined with strength in China and further growth of GM Financial, drove a very strong quarter,” said GM CFO Dhivya Suryadevara. “We will continue to take actions to mitigate headwinds including foreign currency volatility and commodity costs.”

Here's what's driving the growth in GM's North America sales: Analyst

2:54 PM ET Wed, 31 Oct 2018 | 03:37

Suryadevara said on a conference call that GM expects fourth quarter performance to be strong, with solid sales of highly profitable crew-cab trucks.

The company said it sold fewer cars but was able to raise its prices in the U.S. by an average of about $800 per vehicle to more than $36,000, setting a record for transaction prices and about $4,000 over the industry average. It also said Cadillac sales in China broke a record, up 4 percent over the previous year and 20 percent year to date.

GM's third-quarter vehicle sales volume dropped by 14.7 percent from the previous year, the company said. Sales fell across every region and every brand, with Cadillac seeing the smallest decline in sales among its marquee brands, 3.9 percent, from the previous year.

Sales of several Chevrolet and GMC truck models, including the Silverado LTZ and High Country and the GMC Sierra SLT, Denali and its new off-road AT4 crewcab models exceeded expectations, GM said. The automaker expects to ship about 120,000 of the new trucks in the second half of 2018.

The strength of GM's truck and SUV business in North America is further evidence of how important that market is to all three major U.S. automakers, who have been less successful abroad.

“North America is the best place to do business,” said CFRA analyst Garrett Nelson. “Looking at international operations, it is just a matter of who can tread water the best.”

Major automakers have been reporting higher material costs and other increased expenses stemming from the trade war, particularly between the United States and China.

That's been punctuated by signs of weak demand for new cars overall, particularly in North America. A recent estimate from industry tracker LMC Automotive said North American new vehicle sales are expected to fall in October from last year and face further pressure.

“Affordability may be the canary in the coal mine for the level of auto sales as we close out 2018 and begin to look at 2019. Transaction prices are still edging higher,” said Jeff Schuster, president, Americas operations and global vehicle forecasts at LMC Automotive.

The Federal Reserve is expected to raise interest rates again in December, followed by three more rate hikes in 2019, he said. Drivers are buying more used cars, in the meantime.

“This is a combination that could cause consumers to be squeezed out of the new-vehicle market, putting pressure on volume even if other fundamentals are favorable,” Schuster said.

GM's shares have fallen nearly 19 percent since the beginning of the year.

Elon Musk says Tesla ‘probably would not’ take money from Saudi Arabia now

Elon Musk says he probably wouldn't take Saudi money

8:23 AM ET Fri, 2 Nov 2018 | 00:53

Tesla “probably would not” take money from Saudi Arabia in the wake of the death of Saudi journalist Jamal Khashoggi, Chief Executive Elon Musk said.

Musk and his electric car manufacturer hit headlines in August after the billionaire put out a tweet sayingthat he was considering taking the firm private at $420 per share.

Later explaining his tweet in a blog post, Tesla's boss said he had been approached by Saudi Arabia's sovereign wealth fund “multiple times” about the prospect of taking Tesla private, and that it has bought a nearly 5 percent stake in Tesla through the public market. Plans for a take-private deal were subsequently shelved.

In an interview with Recode's Kara Swisher, which was published early Friday morning, Musk was asked directly about his thoughts on the death of Khashoggi, an outspoken critic of the Saudi regime.

“Yeah, I mean, that sounds pretty bad. So … that is not good. That is bad,” he said.

Asked whether he would accept Saudi money now, following Khashoggi's death, Musk said: “I think we probably would not.”

Saudi Arabia's public prosecutor last week acknowledged for the first time that Khashoggi's killing at the Saudi consulate in Istanbul, Turkey was “premeditated,” deviating from previous claims that his death was unintended.

The Arab kingdom initially denied any involvement in his disappearance, saying the Washington Post journalist had left the consulate unharmed. Saudi Crown Prince Mohammed bin Salman has said he is cooperating with Turkey over Khashoggi's killing, and that those found guilty will be brought to justice.

Musk, asked about the influence of the Saudi sovereign wealth fund in Silicon Valley, added that it was important to recognize that not all Saudi cash is the same.

He said: “I think we should just consider that there is a whole country, and there's, you know … There are a lot of good people in Saudi Arabia, and Saudis who are outside of Saudi Arabia. So I think you cannot paint an entire country with one brush.”

Saudi Arabia's Public Investment Fund (PIF) is a major backer of SoftBank's $100 billion Vision Fund, which has been ploughing cash into Silicon Valley's start-up economy. The PIF has already committed $45 billion to the fund, and Saudi Arabia's crown prince said last month the PIF plans to invest another $45 billion into the Japanese firm's second major fund.

The relationship between SoftBank and Saudi Arabia appears to have become increasingly uncertain, however, following the controversy surrounding Khashoggi. Masayoshi Son, the firm's chief executive, reportedly backed out of the country's high-profile Future Investment Initiative business conference last month.

Various other tech executives withdrew from the investment conference, including Uber's Dara Khosrowshahi, Google's Diane Greene and Simon Segars of Arm Holdings — which is fully owned by SoftBank.

Subaru Corporation Announces Consolidated Financial Results for the First Half of FYE2019

Tokyo, November 5, 2018 – Subaru Corporation today announced its consolidated financial results for the first half of fiscal year ending March 31, 2019. < Results for April-September 2018: Consolidated Net Sales >Consolidated global sales of Subaru vehicles decreased 9.3% to 482,000 units. Despite strong sales of the fully-redesigned Forester launched in July 2018, unit… Continue reading Subaru Corporation Announces Consolidated Financial Results for the First Half of FYE2019

Elon Musk ‘probably would not’ take money from Saudis after Khashoggi murder

Breaking News Emails Get breaking news alerts and special reports. The news and stories that matter, delivered weekday mornings. SUBSCRIBE Nov. 2, 2018 / 6:46 PM GMT By Alyssa Newcomb Tesla Chief Executive Officer Elon Musk said his company “probably would not” take money from Saudi Arabia right now amid the fallout of the attempted… Continue reading Elon Musk ‘probably would not’ take money from Saudis after Khashoggi murder

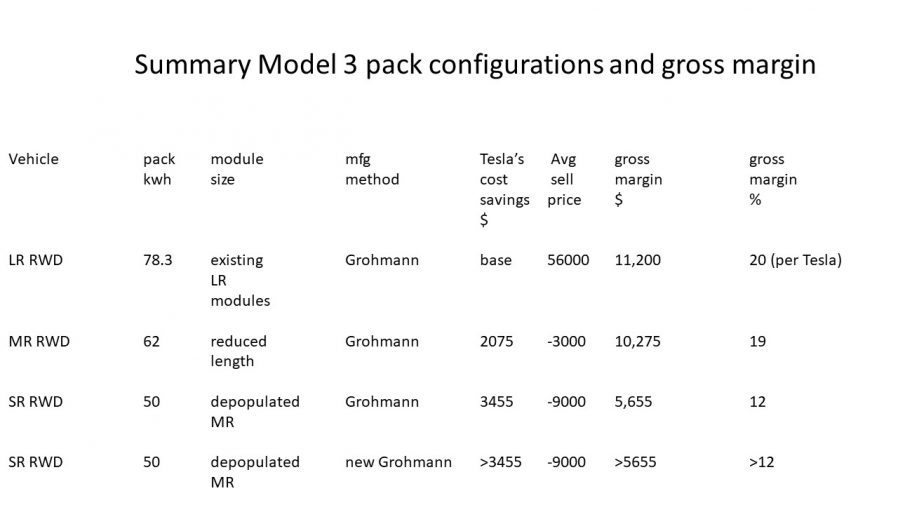

Deep Dive Into Tesla’s Low Cost, Short-Range Model 3 Pack Design

What’s the story here and how much might this new battery pack really save Tesla? We’ve had lots of news in the last week. Tesla told us during their earnings conference call that they maintained 20% gross margins during the 3rd quarter. On the other hand, it also delayed production on the short range version… Continue reading Deep Dive Into Tesla’s Low Cost, Short-Range Model 3 Pack Design

The registrations of cars fall 6.6% in October and accumulate two months to the loss

Updated 02/11/2018 17:12:00 CET 413303.1.500.286.20181102104347 MADRID, Nov. 2 (EUROPA PRESS) – The registrations of cars and SUVs recorded a volume of 88,410 units during the month of October, which represents a decrease of 6.6% compared to the same month of the previous year, according to data from the manufacturers’ associations (Anfac), dealers (Faconauto) and sellers… Continue reading The registrations of cars fall 6.6% in October and accumulate two months to the loss