Cynbiose, a Marcy l’Etoile, France-based service company specializing in the development and commercialization of innovative preclinical models, procured financing of €1.9m ($2.1M) under the third phase of the French Program ‘Investment for the Future’ (PiA3). These funds will make it possible to launch CYNBIOME, a network on microbiota and infectious diseases based on the Non-Human… Continue reading Cynbiose Receives €1.9m in Funding

Author: FINSMES Online News

Mammoth Biosciences Raises $45M in Series B Funding Round

Mammoth Biosciences, a South San Francisco, CA-based developer of a CRISPR-based disease detection platform, raised $45m in Series B funding. The round was led by Decheng Capital with participation from Mayfield, NFX, Verily, Brook Byers, Plum Alley, Pacific 8, aMoon, and others. The company will use the funds to accelerate development of CRISPR diagnostics and… Continue reading Mammoth Biosciences Raises $45M in Series B Funding Round

Neighbor.com Raises $10M in Series A Funding

Neighbor.com, a Lehi, Utah-based self-storage marketplace, closed a $10m Series A funding. The round was led by Andreessen Horowitz, with participation from Nate Bosshard, former partner at Khosla Ventures and co-founder of Tonal, as well as Ryan Graves, Uber’s first CEO. In conjunction with the funding, Jeff Jordan, managing partner at Andreessen Horowitz, will join… Continue reading Neighbor.com Raises $10M in Series A Funding

Sendy Raises $20M in Series B Funding

Sendy, a Nairobi, Kenya logistics startup providing a delivery solution for business, raised $20m in Series B funding. The round was led by Atlantica Ventures, with participation from Toyota Tsusho Corporation, Asia Africa Investment, Sunu Capital, Enza Capital, Vested World and Kepple Capital. The company intends to use the funds to continue to grow operations,… Continue reading Sendy Raises $20M in Series B Funding

Axle Raises $1.4M in Pre Seed Funding

Axle, a NYC-based financial partner for modern freight brokers, raised $1.4m in pre-seed funding. The round was led by Trucks Venture Capital, with participation from Plug and Play Ventures, 37 Angels, Fontinalis Partners, and Techstars. The company intends to use the funds to grow the team of transportation and finance experts and to reach more… Continue reading Axle Raises $1.4M in Pre Seed Funding

Busuu Acquires Verbling

Busuu, a London, UK-based language-learning platform, acquired Verbling, a San Francisco, CA-based live video tutoring company, for a double-digit million amount. With the acquisition, Busuu will expand into the live video tutoring space for its consumer users and corporate clients. Following the acquisition, Verbling’s team members, including co-founders Mikael Bernstein (CEO) and Gustav Rydstedt (CTO)… Continue reading Busuu Acquires Verbling

Moody’s Buys Risk Intelligence Technology Company RDC

RDC, a provider of risk intelligence compliance screening solutions located in the greater Philadelphia area, is to be acquired by Moody’s Corporation (NYSE:MCO). The amount of the deal was not disclosed. Moody’s will be acquiring RDC from Vista Equity Partners. Led by CEO Tom Walsh, RDC is a compliance screening company that provides anti-money laundering… Continue reading Moody’s Buys Risk Intelligence Technology Company RDC

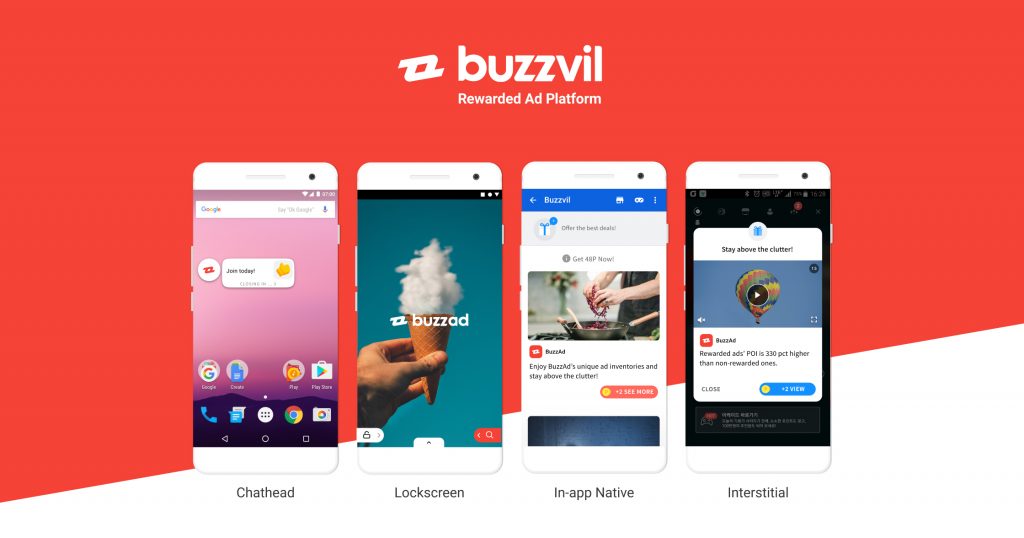

AdTech Company Buzzvil Raises $17M Series C Funding

Buzzvil, a Seoul, South Korea-based provider of rewarded ad platform, raised a total of USD17m in series C funding from the Mega-7 Club. The Mega-7 Club, dubbed as South Korea’s version of Softbank Vision Fund, is consisted of returning investors LB Investments, Company K Partners and new investors SBI Investments, Korea Development Bank and Shinhan… Continue reading AdTech Company Buzzvil Raises $17M Series C Funding

VMware to Acquire AI-Based Network Analytics Platform Nyansa

VMware, Inc. (NYSE: VMW), is to acquire Nyansa, Inc., an AI-based network analytics platform provider. The amount of the deal – expected to close in VMware’s fiscal Q1 FY2021, subject to customary closing conditions – was not disclosed. Nyansa will enable VMware to deliver an end-to-end network visibility, monitoring and remediation solution within VMware SD-WAN… Continue reading VMware to Acquire AI-Based Network Analytics Platform Nyansa

TriggerMesh Raises $3M in Seed Funding

TriggerMesh, a Raleigh, NC and Geneva, Switzerland-based Kubernetes based cloud native integration platform provider, raised $3m in seed funding. The round was led by Index Ventures and Crane Venture Partners. The company will use the funds to scale operationd and grow the development team. TriggerMesh has developed a cloud native integration platform that provides complete… Continue reading TriggerMesh Raises $3M in Seed Funding