Sergio Marchionne, one of the longest-serving CEOs in the automotive industry, has a blunt warning: Carmakers have less than a decade to reinvent themselves or risk being commoditized amid a seismic shift in how vehicles are powered, driven and purchased.

Developing technologies like electrification, self-driving software and ride-sharing will alter consumers’ car-buying decisions within six or seven years, the Fiat Chrysler Automobiles NV chief executive officer said in an interview in Detroit, ahead of this week’s North American International Auto Show. The industry will divide into segments, with premium brands managing to hold onto their cachet while mere people-transporters struggle to cope with the onslaught from disruptors like Tesla Inc. and Google’s Waymo.

Sergio Marchionne

Photographer: Chris Ratcliffe/Bloomberg

“Auto companies need to quickly separate the stuff that will be swallowed by commodity from the brand stuff,” Marchionne said.

Marchionne has witnessed major changes already leading Fiat for almost 14 years, overseeing the combination with Chrysler in 2014 and the 2016 spinoff of Ferrari NV. The 65-year-old executive, who studied philosophy and law before finding his way into the auto business, is known as an iconoclast, trying to force mergers and backing away from mass-market sedans to focus on SUVs — a shift others are now emulating. In a two-hour interview, the dual Italian-Canadian citizen discussed his vision for the industry and confirmed plans to step down next year.

For Marchionne’s plan to double profit by selling more Jeeps, click here

While the car industry has always been tough — Chrysler and GM both went bankrupt during the financial crisis — in the past the mistakes were self-induced, Marchionne said. Now the tumult is being driven by outside forces, and it’s coming faster than people expect, he said — a surprising view, given that Fiat is perceived to be behind some competitors in adapting. He said the company is positioned well, and rather than pour money into competing with Silicon Valley, the industry should try to identify the best solutions coming from tech companies and reduce its exposure to products that aren’t going to be easily defended.

“This business has never been for the fainthearted,” Marchionne said. “The technology changes that are coming are going to make it probably more challenging than it’s ever been.”

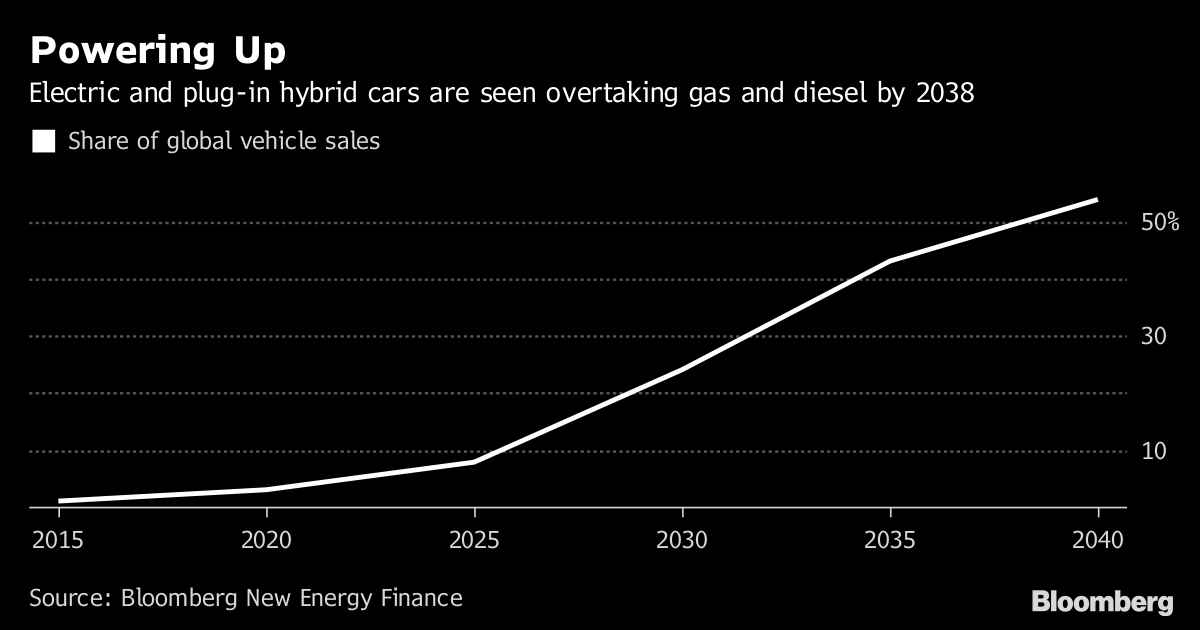

Marchionne reckons, for example, that by 2025, fewer than half the cars sold will be be fully combustion-powered, as gas and diesel give way to hybrid, electric and fuel cell drivetrains.

Powering Up

Electric and plug-in hybrid cars are seen overtaking gas and diesel by 2038

Source: Bloomberg New Energy Finance

By comparison, Bloomberg New Energy Finance has projected battery-electric cars like Tesla’s and plug-in hybrids won’t combine to overtake more conventional engines until 2038. That prediction wouldn’t include hybrids that don’t plug in, such as the gasoline-electric Toyota Prius.

The pace of innovation was evident at last week’s CES trade show in Las Vegas, where dozens of technology companies were gunning for pieces of the electrified, self-driving future. General Motors Co. said on Friday that it will begin testing a Chevrolet Bolt without steering wheel or pedals next year, putting it in position to be the first production-ready car on the roads without the tools for human control.

Indeed, automakers have been reallocating their massive research and development budgets to steer more money toward projects such as improving batteries or starting ride-sharing services — an area where Marchionne says automakers can compete with the likes of Uber. They’re also seeking new partnerships, or engineering major reorganizations. There are opportunities to be had. Fiat, for example, could eventually operate a ride-sharing service that makes use of its dealer network, he said.

Before he leaves, Marchionne said he’ll continue the brand-building push at Jeep, aiming to more than double the number of vehicles produced under the offroad nameplate each year, Bloomberg News reported on Sunday. Fiat is also on track to eliminate its debt this year, he said. At Dodge, the focus has narrowed to muscle cars like the Charger and the Challenger, while more run-of-the-mill models were dropped. He is also expanding Ferrari’s lineup with SUVs to boost profit. (While Ferrari is independent, its biggest owner remains the Agnelli family that founded Fiat and retains the biggest stake.)

The brand he oversees that’s most vulnerable to commoditization is Fiat itself, Marchionne said. He will focus on the sporty 500 family, while bread and butter sedans that compete with PSA Group’s Opel and Peugeot brands face a harder road in the long run.

The Jeep plans in particular have helped to boost investor confidence in Fiat. On top of its 73 percent surge last year in Milan, the stock, including a 0.5 percent gain as of 10:09 a.m. Monday, is up 29 percent so far in 2018, outrunning its competitors by far. Marchionne, whose attempt to merge with GM was rebuffed, said shareholders are better off that the deal didn’t happen.

Marchionne suggested that Fiat has also made more progress toward the new era than the marketplace appreciates. He cited the recent alliance with BMW AG, Intel Corp. and others, which will yield a common platform for self-driving cars. Fiat also plans to offer a hybrid version of the Jeep Wrangler in 2020, which he called part of “normal development” that didn’t require a prominent proclamation.

The next five-year plan, due to be released on June 1, his 14-year anniversary at the Fiat helm, will cover these matters. It will be up to the next CEO to carry out the plan, he said — and it will be one of the top internal candidates who are now working on it. After so long in a job he called “all-consuming,” he said he was ready for a change.

“I am tired,” he said. “I want to do something else.”

— With assistance by Craig Trudell