After two consecutive months of record sales, demand for electric passenger vehicles has felt the heat from the massive consumer demand for internal combustion engine (ICE) PVs as a result of the intensive price cuts enabled by the rationalisation of GST from 28% to 18% as also the withdrawal of the compensation cess.

The 5% GST on EVs remains untouched, which essentially means that the once-substantial price gap between ICE PVs and EVs, particularly entry level models, has reduced sharply. This market dynamic has been reflected in the slowed-down demand for e-PVs in September.

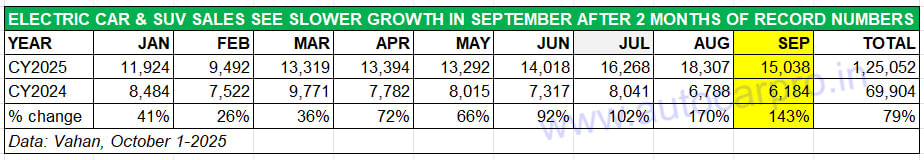

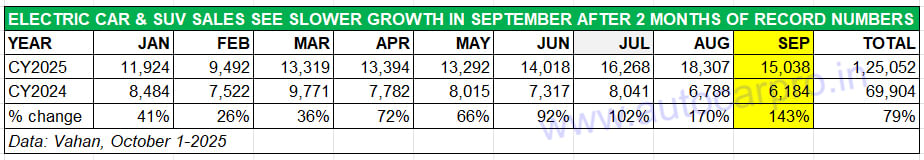

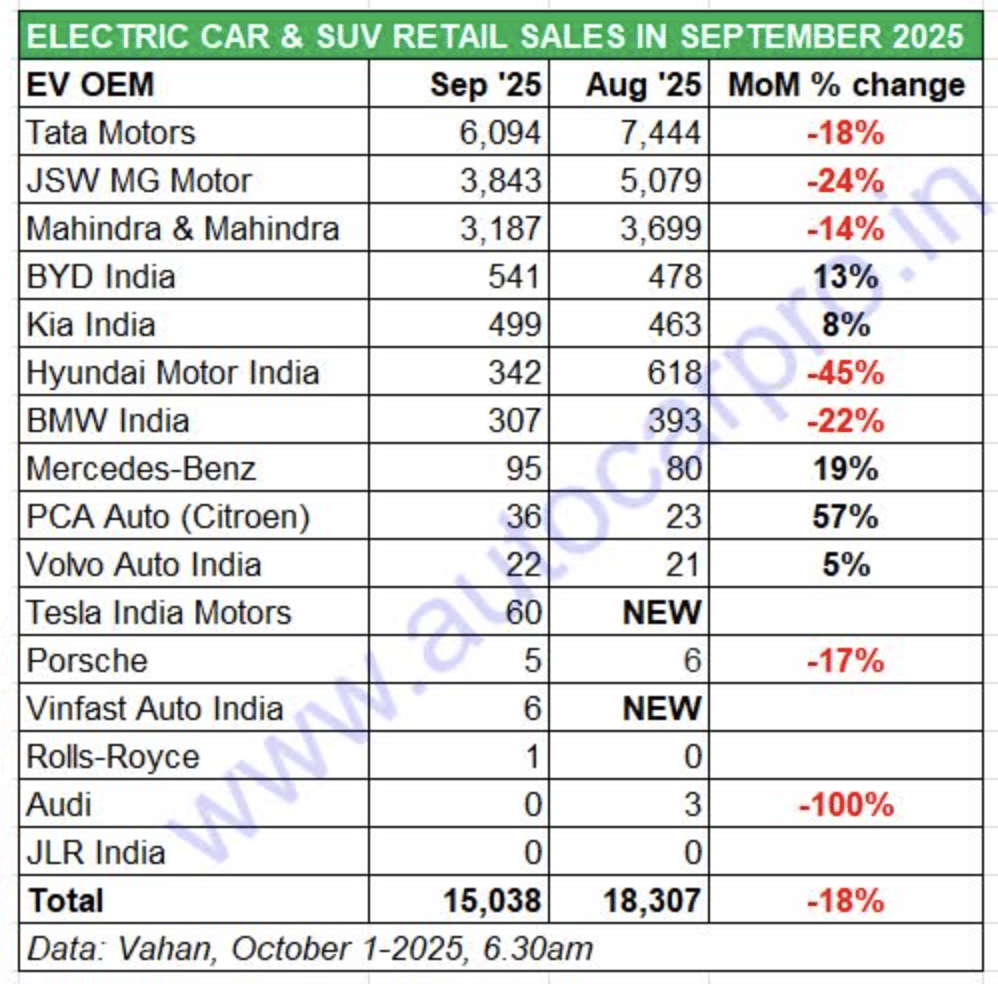

September saw the addition to two new EV makers – Tesla and Vinfast India – who join the existing 14 players in the e-PV market. Between September 1-30, as per Vahan retail sales statistics (October 1, 6.30am), a total of 15,038 units were sold (this number will increase slightly as Vahan factors in additional new EV registrations for the last few days of September). While this constitutes strong 143% YoY growth (September 2024: 6,184 units), the fact is that month on month, September e-PV sales are down 18% on August (18,307 units) and by 8% on July (16,286 units).

While September 2025 sales of 15,038 units constitutes strong 143% YoY growth per se, month on month, they are down 18% on August (18,324 units) and by 8% on July (16,286 units).

As the 16 OEM-wise retail sales data reveals, there’s plenty of red ink when September and August are compared. This is understandable as most of these OEMs have a good number of ICE models across the petrol, diesel and CNG powertrain spectrum and the GST cut, which has made most ICE cars, SUVs and MPVs more affordable has seen buyers flock to showrooms amidst the Navratri festival.

Here’s looking at the electric PV OEM performance in September 2025 and their current market share.

Tata Motors has delivered 6,094 units in September – down 18% MoM (August 2025: 7,444 units). This, nevertheless, gives it a market-leading share of 40% for last month. The recently launched Harrier EV has helped revive demand for the company, which has surpassed sales of 6,000 units for the third month in a row. And the Punch, Nexon and Curvv EVs continue to have a fair share of buyers. Tata Motors, whose EV portfolio also includes the Tiago and Tigor, has been impacted mainly by two OEMs – JSW MG Motor India and Mahindra & Mahindra, both of whom have launched new EVs in the past year.

JSW MG Motor India sold 3,843 EVs in September, down 24% MoM (August 2025: 5,079 units). This is its lowest monthly sales in the past five months but nevertheless gives it a 23% e-PV market share. The company, which has made inroads into Tata Motors’ market share with Windsor EV and its BaaS option, has expanded its portfolio with the M9 MPV, which marks its foray into the premium EV segment, along with the Cyberster electric roadster priced at Rs 72.49 lakh. Both models are retailed through the new MG Select network. JSW MG Motor also sells the ZS EV and Comet EV.

Mahindra & Mahindra, which launched its two new electric origin SUVs – BE 6 and XEV 9e – earlier this year and also sells the XUV400, delivered 3,187 e-SUVs to customers last month, down 14% MoM (August 2025: 3,699 units). This performance gives M&M a 21% market share for last month. Nevertheless, the company is well primed to cater to festive season demand – in August, the Chakan factory manufactured 4,921 units of the BE 6 and XEV 9e, which is the highest monthly factory production yet.

BYD India, the local arm of China’s and the world’s largest electric PV manufacturer ranked fourth on the e-PV OEM sales table, has bucked the overall slow-sales trend in September. The company, which sells the all-electric Atto 3 SUV, Seal sedan, eMax 7 MPV and the Sealion 7 SUV, sold 541 units in September versus 478 units in August 2025, up 13% MoM. This makes September the best month to date after May 2025 (531 units) for the Chinese OEM since it began e-PV sales in India.

It’s the same for Kia India which clocked retail sales of 499 units in September, up 8% MoM, and beating its previous best of 463 units in August. With this, Kia moves up to fifth position among the 16 EV OEMs and is ahead of Hyundai India. Put this down to demand for the recently launched mass-market Carens Clavis EV MPV. Kia’s EV portfolio also contains the EV6 and EV9, which are imported as CBUs into the country and, as a result, are far more expensive than the mass-market Carens Clavis EV-MPV.

Hyundai Motor India sold 342 e-SUVs last month, down 45% MoM (August 2025: 618 units). Following the launch of the Creta Electric in January 2025, monthly sales had risen from 775 in February to 905 in March but since then demand has fallen for the zero-emission avatar of India’s best-selling midsize SUV has been tepid. Hyundai also markets the Ioniq 5 in India.

The eight luxury e-PV makers with 490 units accounted for a 3.25% share of the market in September.

LUXURY CARMAKERS SELL 490 EVs IN SEPTEMBER

As compared to the mainstream e-PV market OEMs, luxury passenger vehicle OEMs have fared better. Cumulative sales of eight OEMs at 490 units are down 2.5% MoM (August 2025: 503 units).

BMW India, the luxury EV market leader, sold 307 units in September – 86 fewer EVs than it did in August (393 units). This performance, nevertheless, helps it retain the No. 7 rank in the 17-OEM listing.

While Mercedes-Benz India sold 95 cars and SUVs last month, up 19% on the 80 e-PVs it sold in August 2025, Volvo Auto India delivered 20 EVs last month, down 19% MoM (August 2025: 21 units). Tesla Auto India, as per Vahan, which has received over 600 bookings for the Model Y, delivered 60 units of the e-SUV to customers in Mumbai, Delhi, Pune, and Gurugram. Imported as a CBU from

Meanwhile, Vinfast India, which has begun sales of the locally assembled VF6 and VF7 e-SUVs, has delivered 6 units to customers last month, as per Vahan statistics.

Cumulative e-PV industry sales in the first nine months of CY2025 at 125,146 units have raced past entire CY2024 sales of 99,625 units. Expect this segment to clock between 150,000-155,000 units this calendar year. With the festive season underway in full swing and Diwali on October 20, this month will be a key month to keep a watch on. Will the robust buying of ICE cars and SUVs continue? Will sales of electric passenger vehicles maintain the same slower growth trend they witnessed in September? Watch this space for the latest updates on the EV world.