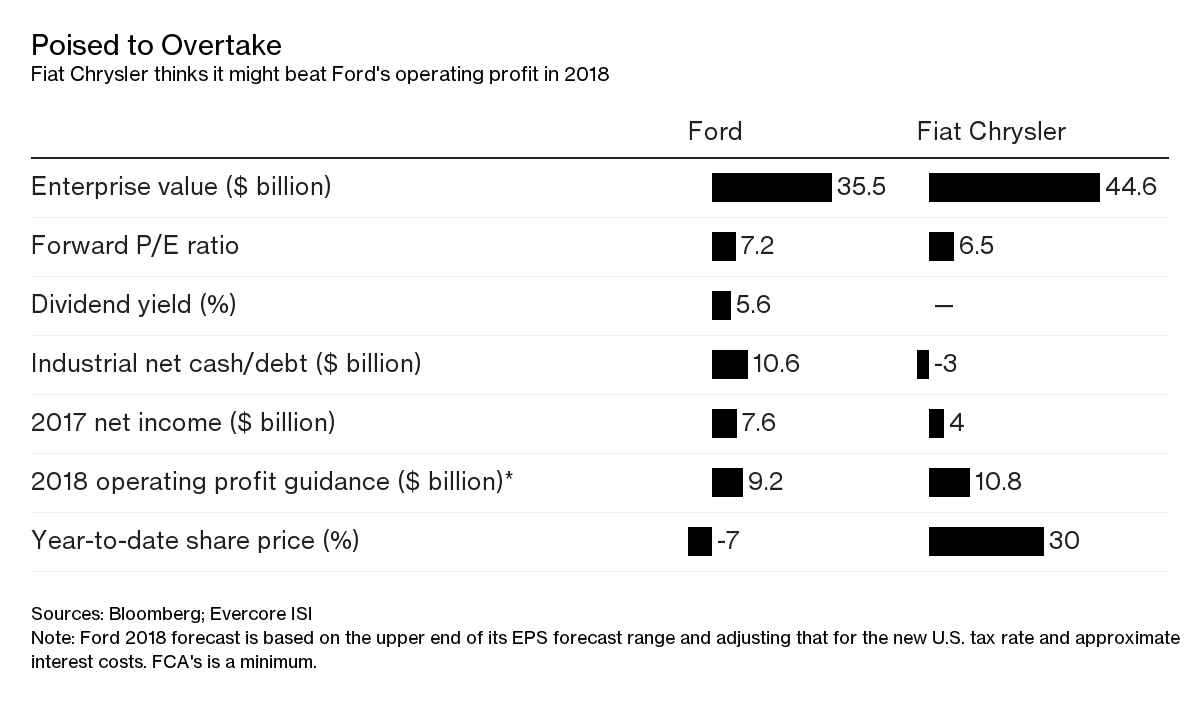

With retirement approaching, Sergio Marchionne seems determined to go out with a bang: the Fiat Chrysler Automobiles NV boss thinks operating profit will surpass that of Ford Motor Co. this year.

On Thursday, Marchionne reminded analysts that’s a surprising turn of events. He’s right. It’s less than a decade since Chrysler filed for bankruptcy protection (Ford didn’t need a bailout) and, in some respects, Fiat Chrysler remains the inferior business. Its automotive unit is still debt-laden and pays no dividend.

Poised to Overtake

Fiat Chrysler thinks it might beat Ford’s operating profit in 2018

Sources: Bloomberg; Evercore ISI

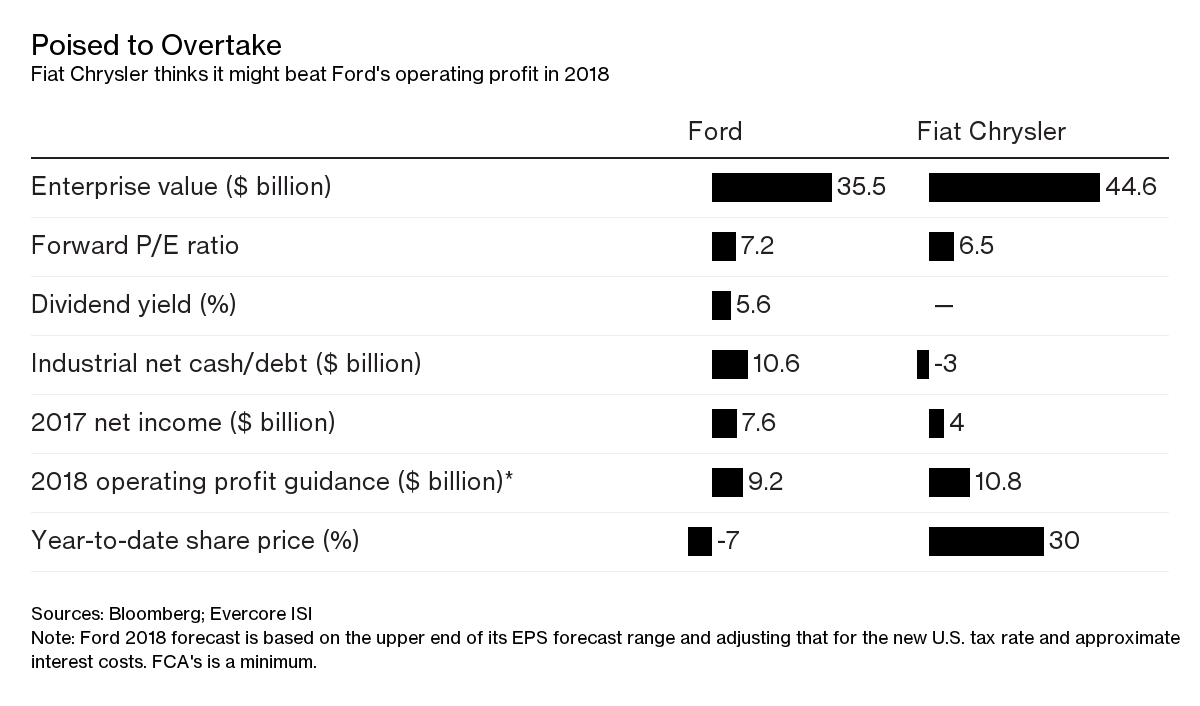

Yet Fiat Chrysler shares have more than quadrupled since 2014, and Ford’s have gone nowhere. One explanation is Marchionne’s more artful capital allocation and communication with investors. After a disappointing earnings update this week, Ford CEO Jim Hackett should ponder whether he could learn from an erstwhile underling.

Poles Apart

Sergio Marchionne’s capital allocation skills have aided Fiat Chrysler’s shares

Source: Bloomberg

Under Marchionne, Fiat Chrysler has made a virtue out of poverty. Instead of empire-building, he unlocked value from the company’s portfolio by spinning off Ferrari NV. He realized quite quickly that there’s little point wasting money or factory space on hatchbacks when sports utility vehicles and trucks sell better and are more profitable. Similarly, Fiat Chrysler doesn’t spend as much on R&D as some peers. Instead, it has pursued partnerships in areas like autonomous driving.

There’s an argument this parsimony is a sign of weakness — but for now it’s working. With new Jeep and Ram models launching, Fiat Chrysler expects to generate at least 6.4 billion euros ($7.8 billion) of cash in 2018. Ford will make less than half that, according to analysts surveyed by Bloomberg.

Importantly, Marchionne is a straight-talker and can craft a message for investors. Shareholders live in perennial fear that car companies will fritter away cash on new factories, technology and models. So the author of an iconoclastic 2015 presentation entitled “Confessions of a Capital Junkie” has continually emphasized Fiat Chrysler’s discipline. On Thursday, Marchionne insisted his successor would be similarly restrained.

For these, and other reasons, analysts love Marchionne. That’s only mild hyperbole. Here’s what Morgan Stanley analyst Adam Jonas gushingly told Marchionne on the earnings call: “There are many hundreds of thousands of families across many nations that are better off because of you and your team. So I had to say, God bless you, Sergio. We’re never going to see anyone like you again.”

In contrast, investors have been less effusive about Ford, which has warned earnings will probably fall in 2018. Hackett’s first big presentation to analysts in October left some observers feeling a little short-changed. He still hasn’t provided much detail on how he will cut costs — “improving fitness,” as he would put it. “I asked you a pretty straightforward question,” Morgan Stanley’s Jonas complained on Ford’s earnings call this week. “That’s a problem, Jim. When are we going to be very clear and transparent about this so that we can — the investors and your associates at Ford — can kind of rally around the mission?”

True, Ford has talked about reducing the number of model variants, investing $11 billion in electric vehicles and redeploying capital away from cars towards SUVs. But unlike General Motors, which sold its loss-making European operations to Peugeot last year, it hasn’t announced the kind of big strategic move that might improve investor sentiment towards the company. Only four analysts rate Ford shares a buy, compared with a dozen for Fiat and GM.

Instead, Hackett, who like Marchionne is a car industry outsider, has spent time espousing on future trends in urban mobility. It’s fine to enthuse about testing driverless pizza delivery, but it’s unlikely to bolster Ford’s cash flow soon. Marchionne told Fiat investors he’d show them the money, and he’s delivering. Hackett needs to do the same.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.