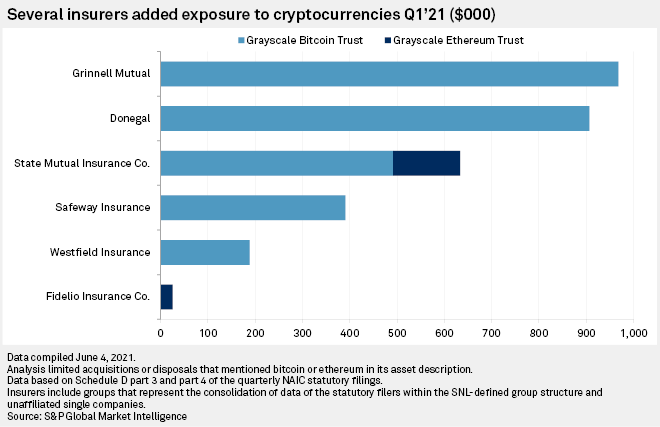

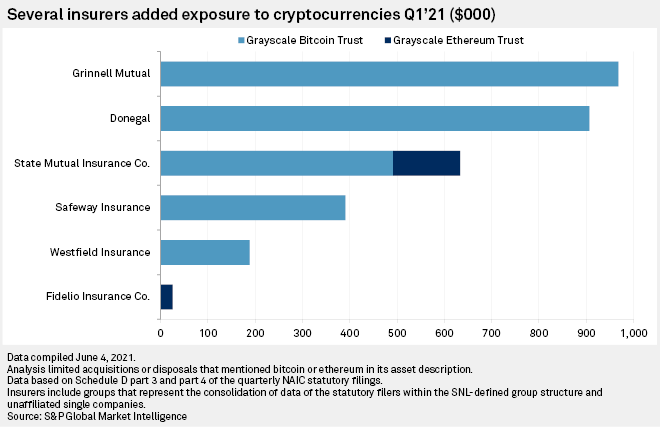

Six insurers in the first quarter picked up shares of digital currency investment vehicles offered by Grayscale Investments, LLC.

While the companies did not directly purchase Bitcoin or Ethereum, they did participate in investment vehicles that derives their value from cryptocurrencies in the form of shares of Grayscale Bitcoin Trust or Grayscale Ethereum Trust.

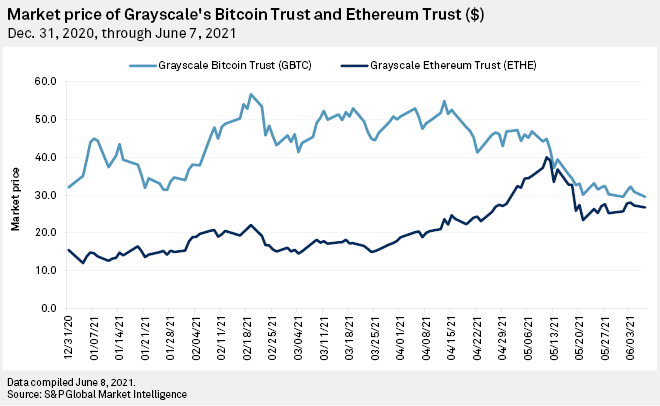

The trusts track the prices of their respective cryptocurrencies using published indexes from CoinDesk LLC, Bitcoin Price Index or Ether Price Index, to calculate net asset values. An accredited investor is able to purchase shares in a private placement transaction, then can sell the investment on the secondary market after a set holding period. Institutional or retail investors can then pick up the shares which trade on the over-the-counter market.

Grinnell Mutual Reinsurance Co. in February took up a position in the Bitcoin Trust with a purchase of 18,000 shares at an actual cost of roughly $968,000. Donegal Mutual Insurance Co. subsidiary Atlantic States Insurance Co. added 20,000 shares of that trust in February as well.

State Mutual Insurance Co. (GA) was the only insurer to initially acquire shares of both the Bitcoin and Ethereum investment vehicles. The Georgia-based mutual insurer acquired 13,000 shares of Bitcoin Trust and 9,000 shares of Ethereum Trust, at respective costs of approximately $491,000 and $141,500.

These quarterly acquisitions where small when compared to Massachusetts Mutual Life Insurance Co.’s investment in Bitcoin at the end of 2020. In December of that year, MassMutual disclosed that it purchased $100 million of Bitcoin within its general account. The mutual insurer recorded the purchase as NYDIG Digital Asset Fund within Schedule BA in its year-end regulatory filing.

MassMutual also made a $5 million equity investment in New York Digital Investment Group LLC around the same time as the Bitcoin purchase. During the first quarter of 2021, the insurer acquired roughly $3.3 million in long-term bonds of the alternative asset manager.

New York Life Insurance Co. reported similar investments, showing an investment of $50 million into a NYDIG Digital Asset Fund, a $5 million investment in New York Digital and a $3.3 million investment in long-term bonds during the same period.

The over-the-counter market share price of Grayscales Bitcoin Trust and Grayscale Ethereum Trust was $30.10 and $24.90, respectively at of close of business on June 9.

This analysis was limited to searching for Bitcoin, Ethereum and New York Digital within the investment description of the NAIC statutory statements.