The ministry also asked the firms to improve logistics efficiency and supply chain coordination to support the industry’s development, according to the statement. BEIJING: China’s industry ministry said on Tuesday it met with automotive and chip companies and asked them to help ease a supply shortage that has forced many automakers across the world to… Continue reading China urges chipmakers to allocate more capacity to China auto market

Tag: GM

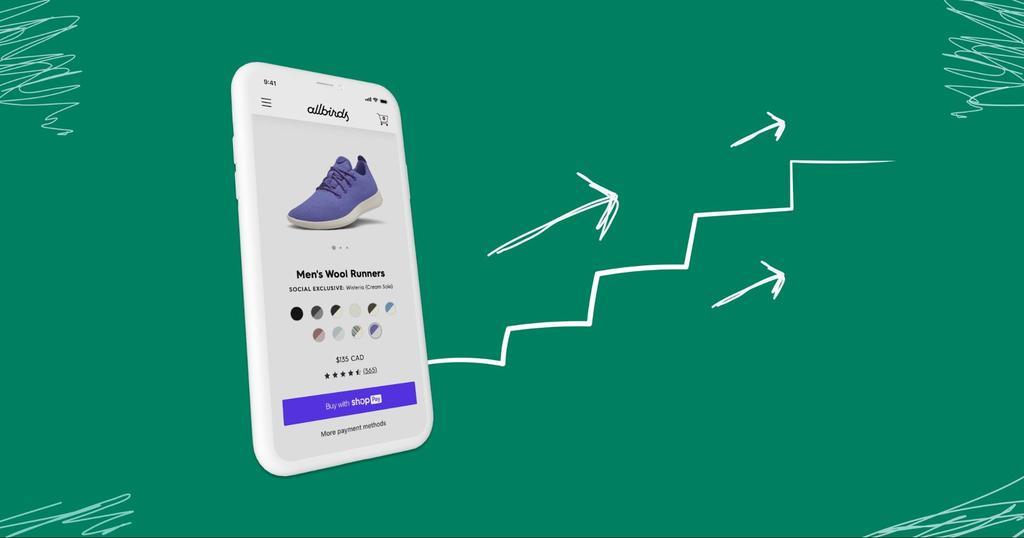

Shopify’s online checkout service Shop Pay to integrate with Facebook, Instagram

Shopify announced Tuesday that it’s expanding its online checkout service Shop Pay to merchants selling on Facebook and Instagram. The e-commerce platform provider said the move marks the first time Shop Pay will expand beyond Shopify merchant stores. Shopify released its one-tap checkout system under the name Shopify Pay in 2017 with an aim to… Continue reading Shopify’s online checkout service Shop Pay to integrate with Facebook, Instagram

Future Jeep compact SUV could use Citroen platform, powertrains

Top: With the Renegade difficult to bring in, Jeep will base its upcoming compact SUV on the PSA CMP platform (above).. Fiat Chrysler Automobiles (FCA) and PSA Group officially merged last month to create Stellantis, the fourth largest automotive group in the world with 14 car brands (including Abarth, Alfa Romeo, Citroën, DS, Fiat, Jeep, Peugeot and Opel/Vauxhall), under its umbrella. Three of… Continue reading Future Jeep compact SUV could use Citroen platform, powertrains

Exclusive: GM extends vehicle production cuts, begins parking incomplete cars due to global chip shortage

By Ben Klayman 3 Min Read FILE PHOTO: The GM logo is seen in Warren, Michigan, U.S. on October 26, 2015. REUTERS/Rebecca Cook/File Photo DETROIT (Reuters) – General Motors Co said on Tuesday it was extending production cuts at three global plants through at least mid-March and building but leaving incomplete vehicles at two other… Continue reading Exclusive: GM extends vehicle production cuts, begins parking incomplete cars due to global chip shortage

Tencent hit with fresh anti-monolopy complaint, this time from GM China venture

PATEO offers voice recognition features and other mobile applications that rely on Tencent’s all-in-one WeChat app. Chinese tech giant Tencent Holdings Ltd has become the target of a fresh anti-monopoly complaint to regulators, this time from a supplier of smart vehicle technology and a General Motors Co China venture. The supplier, Shanghai PATEO, in a… Continue reading Tencent hit with fresh anti-monolopy complaint, this time from GM China venture

AEye Insights: The Road to Electrification

In this installment of the AEye Insights series, AEye Founder and VP of Corporate Development, Jordan Greene sits down with Ryan Popple, AEye Advisor, General Partner at R7 and Executive Director at Proterra to discuss current trends in electrification and urban transportation, the importance of smart sensors, and the implementation of fully autonomous charging stations.

JG: Hello, everybody. Welcome to AEye Insights, where we talk industry trends with proven business leaders. Our guest today is Ryan Popple, AEye Advisor, General Partner at R7 and Executive Director at Proterra, a company that designs and manufactures zero emission buses. Ryan, welcome and thank you for joining us.RP: Thanks for having me, Jordan.

JG: Ryan, we’ll just dive right into it. You have been involved in a number of really interesting things in next generation mobility, both on the corporate and the investment side. Can you tell us a little bit about your experience in this sector?RP: Sure. I’ve been working on mobility technology, specifically with a sustainability aspect to it, for about the last 15 years. I worked on biofuels, and was an early employee at Tesla Motors. I saw Tesla through the early development of its technology and the launch of its first car, the Tesla Roadster, and also worked on the origin of the Model S program, when EV was the focus and AV was just getting started. Also, as you mentioned, I worked on the investment side in venture capital, again, focused on mobility technologies, including EV charging, telemetry, fleet management and EV fleet vehicles like Proterra. And then for five-and-a-half years, I was the CEO of Proterra. I saw the company through early commercialization, past its first hundred million dollars of revenue, and, as mentioned, I’m currently on the board of Proterra and also general partner with R7.

JG: You’ve had a lot of experiences within the electric vehicle domain and urban transportation. Where do you think we are today as far as the development cycle? And what trends are you seeing in the market?RP: I think autonomy and sensor technology is very much following a similar curve to electric vehicle technology, and it’s probably lagged by a few years, but it is helpful for us to look at the EV sector as kind of an example of how things start, how they initially ramp up and then how they reach real market impact. On the EV side, where we are today, I think for the first time in a long time, the market – as well as customers – generally accept zero emission and EV in particular for urban markets is the future of the transportation market from a propulsion perspective. If you think about it, EV in the modern era probably really got started with GM’s EV1. It’s great that you’ve got the Bolt EV behind you because it’s kind of the bookends of very early R&D now to mass market commercialization of a vehicle that is a successful consumer application and in high volume. But it did take a lot of core technology development, and I think that’s where we’ve been the last few years in EV, and then active participation from the major OEMs like GM, Daimler, BMW, Ford, Porsche, really getting into the EV space and utilizing their supply chain to ramp quickly. And again, I think that’s going to be a parallel to what we see in the sensor and AV market, that we’re in the very beginnings of commercialization now with commercial traction starting to appear in a lot of different applications, especially enhanced safety, but because of the fact that the OEMs are really embracing it, like they’ve started to embrace EV, I think the growth from this point on is going to be quite dramatic and step change in nature.

JG: I’m sure that you’ve seen within the technology development several technology hurdles and engineering challenges. Let’s dive into some of those and try and see where we come out, because I’m curious what your thoughts are – we talked in the past about infrastructure challenges, charging challenges and various different challenges that have been hurdles in some sense to try and get through to make this electric vehicle, autonomous vehicle world a reality. What are some of those, and what are you most concerned with, and what are you thinking are addressable problems, and how do we solve them?RP: Sure. Well, in any new technology market, as a good friend of mine has said, every day, there’s a different puzzle to solve and that continues through full commercialization. In the EV market, I think the first challenges were largely technical, and I think you can look at the battery as probably the most essential component of the EV market. So those early technical challenges were things like energy density, which is kind of shorthand for the size and weight of a battery relative to how much range and use you can get out of it. Cycle life, which is probably, again, shorthand for just durability and reliability. How long is the technology going to last in the vehicle application? And then there were also early challenges to overcome in terms of product market fit with charging and charging models, cold weather applicability, and I would say it’s been very important for the industry to solve those challenges first, while also in parallel, keeping a close eye on cost of technology to make sure that the business case really was robust for a consumer or a business or a government fleet to implement EV. That’s both on the vehicle side and on the charging side.

While you have to do those things in parallel, I would say that getting the technology right and working in a really robust manner is probably more important than the cost reduction, that there generally are pockets of the market where a new technology can enter, and then as you grow it, you naturally are able to achieve economies of scale and reduce pricing to enable a larger market.

We’ve seen every few years, as you unlock bigger and bigger portions of the market, there’s a new puzzle to solve and sometimes that’s hill climb capability or extreme cold weather performance. A couple of years ago, the focus was more on hot weather performance. How does the HVAC system work? And again, I think very similar parallels to what’s going on in the sensor software AV/ADAS market that initially the most important element to get right is the technology working really well. You enter the market in some relative niche applications and then you scale from there and naturally cost comes down and you unlock more and more market applications.

JG: I have several follow up questions, but the first would be on the hybridization of those EV and AV models, there seems to be a lot of overlap. There seems to be a lot of interesting interplay between the two. You talked about the emergence of new technology enabling all this. But specifically, if I look at the photo that’s right behind your head, could you tell us a little bit about what’s going on there and what the challenges are or the next gen challenges are for EV and maybe how they fit and interplay with the AV challenge?RP: The graphic behind me is a great representation of how a number of technologies are coming together, both seen and unseen, in this representation of the fleet vehicle yard of the future. The first thing you notice is there are electric buses, so EVs are a critical portion of the future fleet. But you also see solar power generation, so distributed energy generation, in the form of PV panels, and then you see the green boxes behind me, which are bidirectional chargers so the electric vehicles can take power from solar or off the grid and they can resupply with it or refuel with it, but they can also take power or they can provide power back through those boxes or power electronics, and they can supply power back to the grid or to onsite energy storage. You can also see in the photo that there is automated overhead charging. The vision, and we’ve already started to deploy this in places like Edmonton, Canada or Foothill Transit in Southern California, is that the electric vehicle, the electric fleet vehicles of the future are going to have fully autonomous, fully robotic charging. Those charging systems basically prevent or remove the need for human beings to be involved in plugging in all these different vehicles. There are some positive safety elements to that. There’s also just a general quality control aspect of it, because you completely automate it.

In order to accomplish the vision behind me, in addition to needing solar technology, EV stationary storage, you also need sophisticated sensor technology for micro location and vehicle verification, because every one of those buses should be capable of pulling into an automated charging station, positively identifying the fact that the vehicle is ready to charge, and the charger needs to identify that there is the correct type of vehicle behind it and that when the right bus pulls in the right lane, the correct charger deploys to charge it. All of that requires some pretty, pretty sophisticated sensor technology to get right at scale, and I think that’s one of the places where AV technology plays a role in the EV fleet of the future. Initially, it’s for automating and error proofing that charging process. But longer term, it will likely be that once an electric vehicle is behind the fence in a fleet yard, the vehicle should be able to drive itself to perform basic behind the fence operations, like potentially pulling into a wash rack or pulling into a charging depot.

JG: Walk me through the current sensor suite and what’s involved in that. I imagine the operator of the vehicle will likely pull up to this charging depot, and the goal would be to completely automate the process from that handoff onwards to the charging. What is required? What kind of sensors do you need? What kind of precision do you need? What kind of tools do you need to make that a successful option?RP: Well, I’d say the state of the industry today, depending on which deployment you’re ..

Clean Technica: Global Plugin Vehicle Sales Up 43% In 2020, European Sales Up 137%000578

Plugin electric vehicles (fully electric vehicles as well as plugin hybrids) had a sales increase of 43% in 2020 compared to 2019 according to new data from EV Volumes. That meant a rise from 2.5% market share in 2019 to 4.2% share of the global light-duty vehicle market in 2020. In the first half of… Continue reading Clean Technica: Global Plugin Vehicle Sales Up 43% In 2020, European Sales Up 137%000578

Interview: Kevin Magnussen on leaving F1 for Le Mans

Kevin Magnussen says the desire to battle for wins again was key to his decision to sign with Peugeot for the firm’s return to the top class of the Le Mans 24 Hours in 2022. The 28-year-old Dane was ditched by the Haas Formula 1 team at the end of 2020, ending his F1 career after seven… Continue reading Interview: Kevin Magnussen on leaving F1 for Le Mans

@GM: Cruise Supports Vision Zero Network and Commits to National #ZeroTrafficDeaths Campaign

“We’re excited to partner with Cruise to make sure we’re doing all we can to make our streets, sidewalks, and bikeways safe for everyone. “We all need to step up to prioritize safety, including government at all levels and the private sector.” — Leah Shahum, of the Vision Zero Network. San Francisco — like more… Continue reading @GM: Cruise Supports Vision Zero Network and Commits to National #ZeroTrafficDeaths Campaign

Bollinger B1: Costs, Facts, And Figures Of The Electric Truck – HotCars

It’s no secret that the world is going electric. Many states and companies, like GM, are committing to becoming fully electric by as early as 2035. Small companies and manufacturers are jumping on the bandwagon to try to become the next big name in electric vehicles. One company, Bollinger, is aiming its sights on being… Continue reading Bollinger B1: Costs, Facts, And Figures Of The Electric Truck – HotCars