Ventec Life Systems and GM Partner to Mass Produce Critical Care Ventilators in Response to COVID-19 Pandemic GM to also produce surgical masks to support frontline healthcare professionals 2020-03-27 GM CANADA STATEMENT: GM manufacturing, purchasing and logistics are working with Ventec and our supply chain partners to get expanded ventilator production and Level 1 surgical face mask… Continue reading @GM: Ventec Life Systems and GM Partner to Mass Produce Critical Care Ventilators in Response to COVID-19 Pandemic

Tag: People

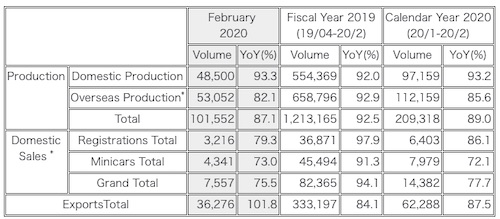

@Mitsubishi: Mitsubishi Motors Announces Production, Sales and Export Figures for February 2020

TOKYO, Mar 30, 2020 – (JCN Newswire) – February 2020 Summary * Beginning fiscal 2012, locally branded models produced in China, which to date had been included in the output figure for China, are now excluded * Includes imports to Japan Domestic Production– Sixth consecutive monthly year-on-year decrease since August, 2019; 93.3% year-on-year Overseas Production–… Continue reading @Mitsubishi: Mitsubishi Motors Announces Production, Sales and Export Figures for February 2020

@McLaren: A consortium of significant UK industrial, technology and engineering businesses from across the aerospace, automotive and medical sectors, has come together to produce medical ventilators for the UK.

A consortium of significant UK industrial, technology and engineering businesses from across the aerospace, automotive and medical sectors, has come together to produce medical ventilators for the UK. The VentilatorChallengeUK Consortium (“the consortium”) is led by Dick Elsy, CEO of High Value Manufacturing Catapult, a group of manufacturing research centres in the UK. Over the… Continue reading @McLaren: A consortium of significant UK industrial, technology and engineering businesses from across the aerospace, automotive and medical sectors, has come together to produce medical ventilators for the UK.

Fiat Chrysler CEO to halve his salary for three months in virus response -letter

FILE PHOTO: CEO of Fiat Chrysler Automobiles (FCA) Mike Manley attends the North American International Auto Show in Detroit, Michigan, U.S., January 14, 2019. REUTERS/Rebecca Cook MILAN (Reuters) – Fiat Chrysler (FCHA.MI) top executives will temporarily cut their salaries to preserve the automaker’s financial soundness during the coronavirus emergency, Chief Executive Mike Manley told employees… Continue reading Fiat Chrysler CEO to halve his salary for three months in virus response -letter

@VW Group: SEAT posts positive financial results and faces a challenging year

Double-digit sales growth drives key financial indicators to record figures Profit after tax goes up by 17.5% and reaches 346 million euros SEAT devoted 1.259 billion euros to investments and R&D expenses (+3%) Carsten Isensee: “The 2019 results provide a solid foundation on which to build the future” Wayne Griffiths: “CUPRA will be key to… Continue reading @VW Group: SEAT posts positive financial results and faces a challenging year

@VW Group: SEAT agrees on a package of measures to help contain COVID-19

Following the decision adopted by the Spanish Government to declare a state of emergency to halt the spread of COVID-19 among the population, and in view of the expected lack of components in the coming days, SEAT’s Executive Committee has agreed to implement a series of responsibility measures to help contain the virus and further… Continue reading @VW Group: SEAT agrees on a package of measures to help contain COVID-19

France’s Renault puts Paris white collar staff on partial unemployment

PARIS, March 30 (Reuters) – French carmaker Renault put most of its white collar staff in the Ile-de-France region around Paris on partial unemployment on Monday as the lockdown imposed due to the coronavirus outbreak lowered activity.

The company will use the scheme that French government has set up to fight the economic crisis caused by the pandemic.

Under the scheme, Paris has pledged to reimburse companies so that workers placed on partial unemployment can still get most of their salary.

“After a two-week stoppage of industrial and commercial activity, it is necessary to adapt the working hours of employees”, a Renault spokeswoman told Reuters.

From Monday and until further notice, Renault white collar staff will work from home in the morning and will be on partial unemployment in the afternoon.

Only a few people will keep their full-time jobs to ensure key activities such as security, maintenance and communication.

The partial unemployment measure in the region of Paris will affec..

@Toyota: Toyota Releases Sales, Production, and Export Results feb 2020

Toyota City, Japan, Mar 30, 2020 – (JCN Newswire) – Toyota Motor Corporation (TMC) announces its sales, production, and export results for February 2020 as well as the cumulative total from January to February 2020, including those for subsidiaries Daihatsu Motor Co., Ltd. and Hino Motors, Ltd. February 2020 Sales Results Toyota– Worldwide sales: Second… Continue reading @Toyota: Toyota Releases Sales, Production, and Export Results feb 2020

News – Interactive map: Employment impact of COVID-19 on the European auto industry

This interactive map shows the employment impact of the coronavirus / COVID-19 crisis on the European auto industry for each of the 27 EU member states plus the United Kingdom. Employment impact, by country Status on: 27/03/2020 The jobs of at least 1,087,293 Europeans working in automotive manufacturing are affected by factory shutdowns as a result of… Continue reading News – Interactive map: Employment impact of COVID-19 on the European auto industry

Free Zoom backgrounds you can use to disguise your messy remote work rooms

Now that people are finding themselves working remotely or setting up virtual parties to chat with friends and family while maintaining social distance, Zoom is quickly becoming the go-to source for those gatherings. But when you spend days quarantining at home, cleaning up for a Zoom call might be the last thing on your mind.… Continue reading Free Zoom backgrounds you can use to disguise your messy remote work rooms