There were five. And now, there are none. Faraday Future, the once-buzzy Chinese electric vehicle startup that has delivered lots of promises and fanfare, but has struggled to deliver an actual product, suffered back-to-back departures this week of the remaining five founding members of its executive team. Nick Sampson, a co-founder and senior vice president… Continue reading Faraday Future loses the last of its founding executive team as problems deepen

Tag: Tesla

Tesla auto-park upgrade to be ready in six weeks: Musk

Elon Musk speaks at a meeting in Bel Air, Los Angeles, California, U.S. May 17, 2018. REUTERS/Lucy Nicholson (Reuters) – An upgrade to Tesla Inc’s ‘Summon’ auto-parking feature will be ready within six weeks and will allow its vehicles to drive around a parking lot, find an empty spot and read parking signs, Chief Executive… Continue reading Tesla auto-park upgrade to be ready in six weeks: Musk

Elon Musk Says First High-Speed Boring Tunnel Will Open In December

Elon Musk has just revealed that his highly anticipated Boring Company tunnel will be officially open on December 10. The Tesla CEO took to Twitter on Sunday to tell the world that the high-speed subway concept is “almost done.” According to the Los Angeles Times, Musk’s Boring Co. tunnel beneath the city of Hawthorne will be revealed on the evening of December 10 — opening for free rides to the public on December 11.

Elon Musk first revealed his idea for a tunnel underneath the infamous Los Angeles traffic in December of 2016.

“Traffic is driving me nuts. Am going to build a tunnel boring machine and just start digging…” he tweeted. “It shall be called ‘The Boring Company.'”

The internet immediately went into full speculation mode, wondering if Musk was joking — just musing — or whether he really did have a plan to launch a “boring” company.

Shortly after his original tweets, Musk expanded on his idea, giving the new company a motto.

“Boring, it’s what we do,” he announced.

He then tweeted that he was serious about the idea.

“I am actually going to do this,” he said on December 17, 2016.

By February of 2017, the Boring Company had begun digging a trench in the SpaceX property in Hawthorne, California. By March of that year, the company had started using a tunnel boring machine named Godot to dig in earnest. The 2-mile tunnel extends from Hawthorne along the 405 freeway and ends in Westwood, California.

The cities of New York, Philadelphia, Baltimore, Chicago, and Washington D.C. jumped on the tunnel bandwagon — agreeing to issue permits for an underground system within their respective city limits. The company now runs three different boring machines, all working to bring the concept to life.

The Hawthorne tunnel will be the first tunnel to be operational, which the company has dubbed a test tunnel to demonstrate the system. The subway infrastructure shuttles people underground at 150 miles per hour on an electric platform. Riders can either sit in a vehicle carrying up to 16 passengers, or an individual can drive a car onto a platform — which is called a “skate.”

Cars and riders are moved from the surface to the underground tunnel via an elevator, and the company has suggested that cities could either employ a series of shafts into the public transportation infrastructure to move people, or individuals could have access tunnels built into their homes, parking garages or home garages.

Lucky individuals will be able to test out the system in December.

UPDATE 2-Ailing EV maker Faraday Future co-founder Nick Sampson quits

FILE PHOTO: Nick Sampson, senior vice president of product R&D and engineering at Faraday Future, speaks during an unveiling event for the Faraday Future FF 91 electric car in Las Vegas, Nevada January 3, 2017. REUTERS/Steve Marcus (Reuters) – Chinese electric vehicle developer Faraday Future said on Tuesday its co-founder Nick Sampson has resigned, a… Continue reading UPDATE 2-Ailing EV maker Faraday Future co-founder Nick Sampson quits

Auto dealers see slowing sales, sparking fears that a long-expected decline is here

Suzanne Kreiter | The Boston Globe | Getty Images

Keith Monnin, CEO of Bernardi Auto Group, looks over a dealership in Framingham, MA.

A growing number of auto dealers around the country is seeing a noticeable drop in retail sales and customer traffic in showrooms, raising the possibility that a long-anticipated slowdown in auto sales has arrived.

“We are definitely seeing business pull back,” said Scott Adams, the owner of a Toyota dealership in Lee's Summit, Missouri, just outside Kansas City. “September was off some, but this month our car sales are down 12 percent and our truck sales are down 23 percent.”

CNBC breaks down the most recent news in auto stocks

2:47 PM ET Fri, 19 Oct 2018 | 01:42

Other dealers tell CNBC they saw a significant drop in sales last weekend. One dealer in metro Tampa Bay, Florida, who asked not to be identified, said sales this month are down 13 percent.

“Customer traffic has moderated,” said Mark Scarpelli, president of Raymond Chevrolet and Kia in Antioch, Illinois.

Scarpelli said sales at his dealership are “keeping pace” with last October, but he has seen customers taking longer before buying a new car or truck. “There is a little bit more of a pause because of the higher interest rates,” he said.

Auto loan interest rates have moved steadily higher as the Federal Reserve has raised rates this year. In the second quarter of this year, the average new vehicle interest rate was 5.76 percent, up from 5.2 percent at the same time in 2017, according to Experian, which tracks millions of auto loans.

How taxpayers have boosted Elon Musk and Tesla

10:06 AM ET Mon, 22 Oct 2018 | 07:43

Gary Barbera, who sells Jeep, Ram, Dodge and Chrysler models in Philadelphia, said his sales team has to “dig a little deeper” to close a sale. Still, business is up more than 6 percent this month, he said.

The pace of auto sales for October is expected to be close to 17 million vehicles, according to the auto website Edmunds.

Jeremy Acevedo, Edmunds' manager of industry analysis, said the number might not be showing signs of weakness due to auto fleet sales. If automakers increase fleet sales to corporations and government agencies, it would offset weaker retail sales through dealerships.

For more than a year, analysts have said auto sales are primed to slow down for a variety of reasons, including a surge in 3-year-old models entering the used car market. That wave of pre-owned models with relatively low mileage gives potential buyers an attractive option at a far lower price. Still, auto sales have remained robust and are on pace to top 17 million vehicles for a fourth-straight year, which would be a record for the industry.

Dave Fischer, chairman and CEO of the Suburban Collection, which has more than 50 retail stores in Michigan, California and Florida, said if sales slowing around the country, he's not seeing it.

“We will be up over last year. People are still buying,” he said.

—CNBC's Meghan Reeder contributed to this report.

WATCH:How automakers sell a $71,000 version of a $27,000 car

How automakers sell a $71,000 version of a $27,000 car

10:40 AM ET Thu, 28 June 2018 | 02:46

Electrify America Adds A “Locate A Charger” Map: See If It Works Here

4 H BY STEVEN LOVEDAY As Electrify America’s presence grows, a map and charger location tool is a welcome addition. While it’s clear from the image above, Electrify America has a long way to go in developing and implementing its charging network, though any updates are appreciated. The best part about the entire situation is… Continue reading Electrify America Adds A “Locate A Charger” Map: See If It Works Here

Ford CEO Jim Hackett says fixing carmaker’s problems starts with identifying them

Andrew Harrer | Bloomberg | Getty Images

Jim Hackett, president and chief executive officer of Ford Motor Co., speaks during a discussion at the Automotive News World Congress event in Detroit, Michigan, U.S., on Tuesday, Jan. 16, 2018.

When Tesla delivered a rare and unexpected profit on Wednesday, investors went wild. Even some of CEO Elon Musk's harshest critics sounded surprisingly bullish.

The California carmaker's stock surged by 9.1 percent the next day and another 5 percent Friday.

Ford also reported better-than expected earnings for the third quarter, sending the shares up 9.9 percent the next day. But the celebration was short lived. The shares fell slightly on Friday as the Detroit automaker's stock continues to languish below $10 a share, in territory it hasn't seen in years.

At $991 million, Ford's profit was more than three times that of Tesla's. The electric carmaker's earnings, however, told a very different story than Ford.

CEO Elon Musk finally appears to be delivering on expectations that Tesla can revolutionize the auto industry, or at least reliably turn a profit. With Ford, analysts and investors are yet to be sold on the $11 billion grand turnaround plan first promised by Jim Hackett when he was named Ford CEO in a broad management shake-up nearly 18 months ago. Its $991 million in profit fell 37 percent from the prior year.

Following the May 2017 ouster of Mark Fields, Hackett launched what was billed as an intense, 100-day deep-dive aimed at addressing Ford's problems. Yet, as 2018 rapidly comes to a close, the former CEO of furniture-maker Steelcase has offered relatively few, and often inscrutable, indications of what he has in mind, leaving not only outsiders, but insiders at all levels, trying to understand precisely what directions he wants them to move in.

“A lot of us are asking the same question,” a senior Ford executive, who asked not to be identified, told CNBC. “I just have to work on rallying my troops and hope we're all moving in the same direction

Critical moves

Hackett himself left plenty of folks scratching their heads during an earnings conference call with analysts and reporters Wednesday. Asked about his strategy, the former University of Michigan football player said “it's not a restructuring plan it's a redesign plan. First we have to identify the areas that need to be fixed, then we have figure out how to fix them and then execute.”

Under his guidance, Ford has made several critical moves. Hackett announced a shake-up of its struggling Chinese operations last week, appointing Anning Chen, an experienced auto executive, as the unit's new president and CEO. And Hackett's also formed several potentially far-reaching alliances. One with Mahindra Group, could help it crack into the promising Indian market. Another, with Volkswagen AG, ostensibly will focus on the lucrative commercial vehicle market.

The latter alliance has peaked interest across the auto industry, the always-active rumor mill questioning whether it could lead to a broader tie-up. Just don't expect a latter-day equivalent of the ill-fated Daimler Chrysler “merger of equals,” or even something on the order of the Renault-Nissan-Mitsubishi Alliance, Ford chief spokesman Mark Truby told CNBC. “We are not considering any equity swap or cross-ownership.”

For those truly familiar with the history of Ford, that should come as no surprise. There are few who truly believe the controlling Ford family, heirs of founder Henry, would willingly relinquish control. Indeed, insiders say that was a key reason the second-largest domestic automaker chose not to follow cross-town rivals General Motors and Chrysler into bankruptcy at the beginning of the decade, despite the potential of wiping out billions of dollars in debt.

Ford family

Ultimately, all things Ford Motor Co. must win the approval of the Ford family and, for the moment, CEO Hackett appears to retain their confidence. But for how long is the question if he cannot deliver on expectations of a turnaround.

To pull it off, the 63 year-old executive has a handful of key issues he will need to address but, to a large degree, one-time Ford President Lee Iacocca might have summed it up best when he long ago explained that, “There are just three things that matter in the auto industry: product, product and product.”

That's never been more obvious than in North America. Ford largely has it right on the truck side of its line-up. For more than three decades, the big F-Series pickup has been the best-selling product line in North America, and the automaker is a force to be reckoned with in the utility vehicle market, as well. But even here, there are unwelcome holes in the mix.

Ford was one of the many manufacturers who abandoned the midsize pickup segment after shutting down the Twin Cities plant in Minnesota that built its dated Ranger model in 2012. While General Motors and Honda rushed back into what turned out to be a resurgent market, Ford planners dithered like Hamlet and the company will only launch a new generation Ranger in January.

“We can't go back and change the past,” Ford President of the Americas Joe Hinrichs said at an event last week marking the relaunch of Ranger production in the U.S. “But we think the market is big enough that there will be room for everybody.”

Trucks over sedans

The reborn Ranger will be joined in 2020 by the return of the Bronco, a once-popular Ford SUV that was discontinued in the late '90s. Both models will be assembled at the Wayne plant which was, until recently, producing both the compact Focus sedan and C-Max people-mover. With the exception of the classic Ford Mustang “pony car,” those and the rest of the automaker's passenger car line-up are in the process of being phased out, perhaps the single boldest – and controversial – move authorized by Hackett.

There's no question that sedan sales have tumbled as millions of American buyers have shifted to sport-utility vehicles and crossovers. But key competitors, including GM, as well as import powerhouses Toyota, Nissan, Honda and Hyundai, are, if anything, redoubling their focus. And Stephanie Brinley, a principal analyst with IHS Markit, is skeptical of Ford's decision. “The sedan market isn't great, but it's still large and Ford simply didn't do what's necessary to compete” by letting once-strong models like the Focus and bigger Fusion go years without necessary updates, she said.

Even as Ford let its sedans grow old, Joe Phillippi, head of AutoTrends Consulting, contends the carmaker waited far too long to rebuild its once-powerful Lincoln brand. The luxury division will be tested over the next 12 months with the launch of two critical SUVs which will, notably, abandon the unloved and confusing alpha-based naming strategy adopted a decade ago. The new version of the MKT, for one, will now be called the Aviator.

China

Product problems also catch the blame for Ford's struggle in China, though it didn't help that the automaker waited for a number of years after key competitors GM and Volkswagen entered what has become the world's largest car market. When you're playing a game of catch-up, said Brinley, you better have the products that can make a difference.

Chinese new vehicle sales dipped 11.6 percent in September, the third consecutive monthly decline in a market used to strong, double-digit growth. Ford, however saw a 43 percent drop last month and was off 6 percent for all of last year.

Earlier this month, Ford announced plans to launch what it is billing as a new core model for China, the Territory SUV, with a total of 50 all-new or updated products in the works.

“We're in really good shape for the launch of these new products,” Jim Farley, president of Ford's Global Markets said during the earnings call Wednesday. “We have tremendous opportunity to drive better margins in China. “Our turnaround in China is really up to us. It's about our new products and our costs. The opportunity is in our control,” said Farley.

Whether his optimism proves valid is far from certain, especially in light of Ford's ongoing promises to fix its China problem.

Confusion

And it has plenty of issues in other key markets, including Latin America and Europe. The Dearborn-based maker insists it won't walk away from its endlessly troubled European operations, unlike GM which last year completed the sale of its Opel subsidiary to France's PSA Group. Some observers question whether Ford may try to partner with VW in both Latin America and Europe in hopes of stemming its losses.

Following Hackett's appointment last year, many observers questioned whether he would remain as committed to Ford's so-called “new mobility” program as his predecessor Fields. Considering Hackett was a key strategist behind the company's autonomous driving ef..

VW plans electro-favorable model from 2020: What’s tuned to Diess’ price announcement for Tesla

Volkswagen The Electric Vehicle Study I.D. is the basis for the Golf-style Stromer “Neo”, the VW sold from 2020 He warned more objectivity in the diesel debate and explained in detail the potential pitfalls of hardware retrofits: For long stretches was the appearance of VolkswagenGroup CEO Herbert Diess rather expectable, as he went Thursday night… Continue reading VW plans electro-favorable model from 2020: What’s tuned to Diess’ price announcement for Tesla

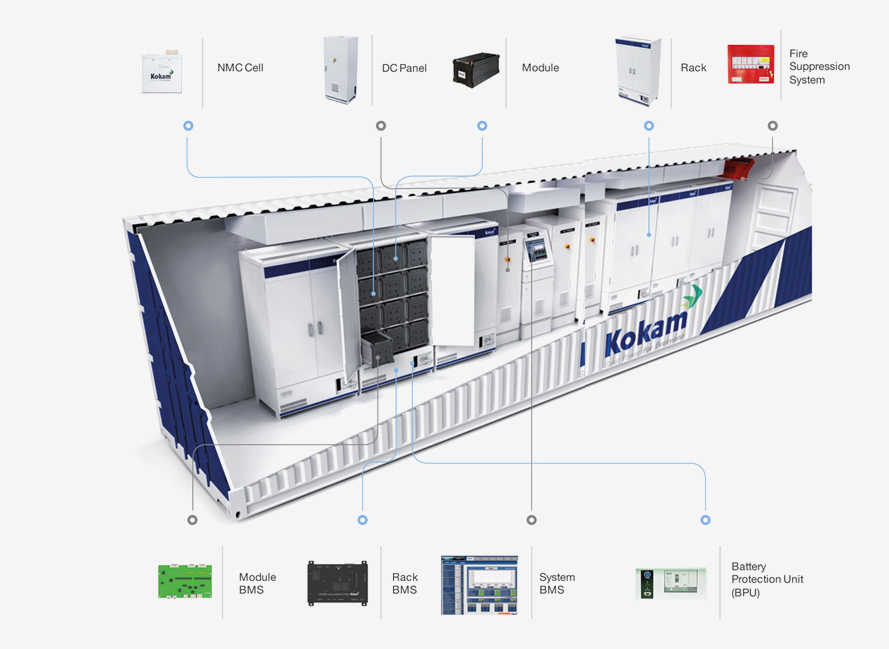

SolarEdge Acquires Battery Maker Kokam

2 H BY MARK KANE SolarEdge, a solar inverter supplier, now will be able to produce ESS in-house. SolarEdge Technologies acquired this month Kokam – the South Korean manufacturer of lithium-ion battery cells, battery packs and energy storage systems. According to SolarEdge, about 75% of outstanding equity shares were bought for approximately $88 million, including… Continue reading SolarEdge Acquires Battery Maker Kokam

Elon Musk: Tesla’s Model 3 for $ 35,000 currently impossible

Tesla boss Elon Musk has admitted that starting at $ 35,000 base model of the electric cars Model 3 still can not deliver. October 26, 2018, 7:59 am, Andreas Donath Model 3 (Photo: Tesla) Company boss Elon Musk has affirmedthat Tesla can not deliver the basic version of the electric car Model 3 for $… Continue reading Elon Musk: Tesla’s Model 3 for $ 35,000 currently impossible