“Magna adds new customer and additional sports car to its complete vehicle assembly line-upProduction to begin in early 2019Further demonstrates the company’s unique position in the industryDETROIT, Jan. 15, 2019 (GLOBE NEWSWIRE) — As the global automotive industry convenes at the North American International Auto Show and automakers unveil future vehicles, Magna is proud to… Continue reading Magna to Build the Toyota GR Supra

Tag: Financial Results

Ford-VW sign memorandum to jointly develop EVs and self-driving vehicles

DETROIT, Jan 15 (Reuters) – VW CEO says in copy of speech: Ford and VW have signed memorandum of understanding to jointly develop electric and self-driving vehicles VW CEO says will share platforms and parts with Ford on pickups and vans in the alliance VW CEO says building vans in Ford’s turkey plant is an… Continue reading Ford-VW sign memorandum to jointly develop EVs and self-driving vehicles

McKinsey study RACE 2050

The consulting firm McKinsey has published the RACE 2050 report on the European auto industry. The report of McKinsey is divided into three parts. Changes, approaches and goals. This tripartition is mainly based on developments in the mobility field. Screenshot of the McKinsey study (PDF) The changes have been around for some time. This means… Continue reading McKinsey study RACE 2050

Hong Kong self-driving start-up in talks to raise US$100 million – South China Morning Post

Hong Kong-based autonomous driving start-up AutoX is in talks with investors to raise a new round of funding to finance its research and development into self-driving cars. The company said it is in talks with investors about a new round of financing, months after the company piloted autonomous grocery delivery services in San Jose, California,… Continue reading Hong Kong self-driving start-up in talks to raise US$100 million – South China Morning Post

Quanergy Completes Series C Financing with a Valuation Surpassing $2 Billion – Business Wire

SUNNYVALE, Calif.–(BUSINESS WIRE)–Quanergy Systems, Inc., a global leader in the development and manufacture of LiDAR sensors and smart sensing solutions, today announced it has secured Series C funding at a valuation exceeding $2 billion, with a global top-tier fund as the lead investor. Raising the Series C financing takes the company well beyond its planning… Continue reading Quanergy Completes Series C Financing with a Valuation Surpassing $2 Billion – Business Wire

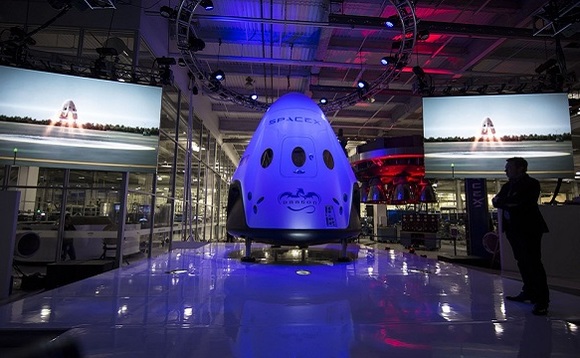

SpaceX plans to lay off 10 per cent of its workforce

SpaceX earns most of its revenue by launching satellite as well as two NASA contracts. Image via Pixabay Elon Musk’s rocket company SpaceX is planning to cut about 10 per cent of its workforce. The cuts were cited in an email to staff by the company’s president, Gwynne Shotwell, and revealed in a report in the Los… Continue reading SpaceX plans to lay off 10 per cent of its workforce

ASSA ABLOY to acquire a leading supplier of electronic and mechanical key management systems in the US

STOCKHOLM, 14-Jan-2019 — /EuropaWire/ — ASSA ABLOY has signed an agreement to acquire KEYper Systems, a leading supplier of electronic and mechanical key management systems in the US with a strong presence in the automotive segment.

KEYper Systems was established in 1993 and has approximately 25 employees. The head office is located in Harrisburg, North Carolina.

Sales for 2019 are expected to reach about USD 22 million (approx. SEK 195 million) with a good EBIT margin and the acquisition will be accretive to EPS from start.

The acquisition is conditional upon satisfaction of customary closing conditions and is expected to close during the first quarter of 2019.

“I am very pleased to welcome KEYper Systems into the ASSA ABLOY Group. The acquisition of KEYper Systems enhances our global product offering in this area and will provide synergy opportunities in North America and other markets,” says Nico Delvaux, President and CEO of ASSA ABLOY.

“KEYper Systems will complement our products within intelligent key and asset management solutions offered by Traka, which is part of the business unit ASSA ABLOY Global Solutions (previously Hospitality) as of 1 January 2019. The acquisition will also strengthen our position and installed based in the US as well as provide an attractive opportunity to accelerate our global growth,” says Christophe Sut, Executive Vice President and Head of Global Technologies business unit ASSA ABLOY Global Solutions.

For more information, please contact:

Nico Delvaux, President and CEO, tel. no: +46 8 506 485 82

Björn Tibell, Head of Investor Relations, tel. no: +46 70 275 67 68

About ASSA ABLOY

ASSA ABLOY is the global leader in door opening solutions, dedicated to satisfying end‑user needs for security, safety and convenience. Since its formation in 1994, ASSA ABLOY has grown from a regional company into an international group with about 47,500 employees, operations in more than 70 countries and sales of SEK 76 billion. In the fast-growing electromechanical security segment, the Group has a leading position in areas such as access control, identification technology, entrance automation and hotel security.

SOURCE: ASSA ABLOY

Tweet

Share

0

+1

0

Continental’s 4Q bolstered in part by strong sales of winter tires and the positive market development in the non-automotive industrial business

Continental AG

Stable operating performance in fourth quarter as expected

Annual sales rise to around €44.4 billion (organic growth at about 3 percent)

Adjusted EBIT for the year: around €4.1 billion (margin at about 9.2 percent)

Free cash flow was higher than expected at about €1.8 billion

2019 outlook: Consolidated sales of about €45 to €47 billion at constant exchange rates, adjusted EBIT margin of about 8 to 9 percent

Powertrain division successfully transformed into an independent group of legal entities

HANOVER, Germany/ DETRIOT, MI, USA/ NEW YORK, NY, USA, 14-Jan-2019 — /EuropaWire/ — Continental has achieved its targets for the previous fiscal year. Despite declining automotive markets, the technology company continued to grow profitably. The DAX-listed company announced that its operating performance was as expected in the fourth quarter. The final quarter was bolstered in part by strong sales of winter tires and the positive market development in the non-automotive industrial business.

“We achieved a respectable result and achieved our adjusted annual targets. We are continuing to grow profitably. As feared, the decline of the automotive markets intensified significantly once again in the fourth quarter. This, combined with the profound changes in our industries, is reducing our growth rate,” said Continental CEO, Dr. Elmar Degenhart, explaining the preliminary results for the year. “Against this backdrop, the strong performance of our around 244,000 employees at Continental worldwide is all the more remarkable. On behalf of the entire Executive Board, I would like to express my thanks for the outstanding commitment of our global team in 2018.”

Furthermore, the DAX-listed company also transformed its Powertrain division into an independent group of legal entities on schedule at the start of 2019, as announced. A possible partial IPO by the middle of the year is now being prepared.

In its automotive, tire and industrial business areas, the international technology manufacturer is forecasting global consolidated sales of about €45 to €47 billion at constant exchange rates and an adjusted EBIT margin of about 8 to 9 percent for the current fiscal year. Continental’s outlook is based in part on the assumption that the global production volume of cars and light commercial vehicles in 2019 will be about the same as that of the previous year.

Continental will release its preliminary 2018 business figures on March 7, 2019, as part of its annual financial press conference to be broadcast online.

Cautious market outlook

Continental believes the declining market development is likely to continue unchanged in the first half of 2019. “The main reasons for this are the continued weak demand in China, the trade dispute between the U.S.A. and China, and further decreases in call-offs as a result of the switch to WLTP in Europe. There is also the general uncertainty around Brexit,” said Continental CFO Wolfgang Schäfer, explaining the market outlook. In the second half of the year, the company expects slight market growth in comparison with the low baseline of the previous year: “For fiscal 2019, we expect the production volume of cars and light commercial vehicle to be on a par with the previous year,” said Schäfer.

Future annual forecasts in terms of ranges

For the current fiscal year, Continental is expecting sales of about €45 to €47 billion with constant exchange rates and an adjusted EBIT margin of about 8 to 9 percent across the entire corporation.

The Continental Corporation’s preliminary key data for fiscal 2018

© Continental AG

“We have decided to express the expectations we have for our business development in ranges, as is usual in our industry,” said Schäfer. The reason for this is that it is becoming much more difficult to predict the development of the ever-more volatile market environment with pinpoint accuracy. “In phases of such profound technological transformation in the automotive industry as at present and an increasingly ambiguous unstable economic environment, precise forecasts suggest an accuracy that is simply no longer possible,” Schäfer added.

Continental’s growth again higher than market in the fourth quarter

According to preliminary key figures, the reported sales growth for 2018 as a whole amounted to about 1 percent year-on-year (organic growth: about 3 percent). Consolidated sales thus increased to around €44.4 billion. The adjusted EBIT margin came to about 9.2 percent, which is equivalent to adjusted operating earnings of around €4.1 billion. In the fourth quarter, Continental generated sales of around €11.25 billion, which is the same level as the same quarter of the previous year. Adjusted EBIT amounted to around €1.1 billion in the final quarter of 2018 and the adjusted EBIT margin came to about 9.7 percent. At around €1.8 billion, free cash flow adjusted for acquisitions and funding of U.S. pension obligations exceeded expectations.

Adjusted for changes in the scope of consolidation and exchange rates, Continental’s sales growth was about 3 percent in the past fiscal year. This positive development was countered by further declines in the global production of passenger cars and light commercial vehicles, which materialized as feared and amounted to -1 percent in 2018, based on preliminary data. In the fourth quarter of 2018, global production decreased as well, down 4 percent year-on-year.

Powertrain successfully transformed into an independent group of legal entities

“After this initial key milestone in our realignment, we are now working at full steam to prepare for the partial IPO of our successful powertrain business, which could be possible from mid-2019,” said Degenhart, expressing his satisfaction.

On January 1, 2019, as announced, Continental completed the transformation of its Powertrain division into an independent group of legal entities on schedule. The new legal entity, whose new name is to be announced soon, is to be prepared for a possible partial IPO by the middle of the year. This move is part of one of the largest organizational changes in the technology company’s history.

The realignment provides for the creation of a holding structure of Continental AG under the new “Continental Group” umbrella brand. It will be supported by three group sectors, namely “Continental Rubber,” “Continental Automotive” and “Powertrain” The reporting structure and the new names are to be used starting 2020.

“Our realignment is a response to the profound changes in the automotive industry and the associated challenges,” said Degenhart. Continental is enjoying great growth potential thanks to new technologies, larger customer orders and new opportunities in software solutions and services. “We are realigning our organization to technological challenges and changing market requirements at an early stage. We are focusing our expertise and thus programming Continental for a successful future,” he added.

SOURCE: Continental AG

MEDIA CONTACTS

Henry Schniewind

Spokesman, Business & Finance

Phone: +49 511 938-1278

E-mail: henry.schniewind@conti.de

Vincent Charles

Head of Media Relations

Phone: +49 511 938-1364

E-mail: vincent.charles@conti.de

Tweet

Share

0

+1

0

Flipkart co-founder Sachin Bansal invests $21m in Ola, may inject more

January 14, 2019 Flipkart co-founder Sachin Bansal has invested $21 million in India’s largest cab-hailing platform Ola (ANI Technologies Pvt Ltd), marking his first investment following his ouster from Flipkart, which resulted in him selling his stake in the online retailer for nearly $1 billion. Part of a bigger round, Bansal is expected to infuse… Continue reading Flipkart co-founder Sachin Bansal invests $21m in Ola, may inject more

Auto parts supplier: “The party is over” – Continental management expects falling margins

Continental AG Automotive supplier Continental expects shrinking margins. (Photo: AP) DüsseldorfWith extreme caution, the auto parts supplier Continental into the just started year. Because of the worldwide Slowdown in car sales The Hanover-based company now calculates a further decline in operating return on sales (EBIT margin, adjusted). In 2019, the yield is expected to be… Continue reading Auto parts supplier: “The party is over” – Continental management expects falling margins