October 11, 2018 Months after his exit from e-commerce major Flipkart, co-founder Sachin Bansal is planning to invest up to $100 million in Indian ride-hailing firm Ola, said a report in The Economic Times quoting sources. It was recently also reported that South African internet conglomerate Naspers LLC was in talks to invest in ANI… Continue reading Flipkart’s Sachin Bansal looks to invest $100m in Ola – Report

Tag: M and A

Ferrari stock target raised by nearly 40 percent as SocGen says firm now has a better plan

CNBC

Ferrari's renewed focus on high-end clients is a “game changer” for its valuation said Societe Generale on Wednesday, as the French bank raised its price target for the stock by almost 40 percent.

Italy's most famous supercar maker first listed on the New York Stock exchange in October 2015 with an Initial Public Offering (IPO) price of $52. At Tuesday's close the stock was worth $128.95.

After long questioning the stock's value, the bank said they have now changed their mind, upping their price target for the luxury car manufacturer of $130 from $94 and shifting their recommendation from “Sell” to “Hold”.

“The facts have changed and so we have changed our mind on Ferrari,” read the note penned by equity analyst Stephen Reitman.

What's ahead for Ferrari under Louis Camilleri

11:36 AM ET Mon, 23 July 2018 | 01:52

Reitman argued that Ferrari's initial plan to reach its 2022 sales target by turning to the SUV market would be difficult because of widespread competition. He added that any “dash for growth” could risk damaging the brand's exclusivity.

That strategy was put in place by former CEO Sergio Marchionne who died in July this year following surgery. His successor, Louis Camilleri, updated markets in September with a new earnings target range for 2022 of between 1.8 and 2 billion euros ($2.1 -2.3bn).

That represented a slight pull back from Marchionne's 2-billion-euro figure, but Reitman said that while the target numbers were largely unaltered, the company strategy has now changed.

“The new mid-term plan broadly repeats the key financial objectives laid out in February, but the way Ferrari plans to achieve them appears to have fundamentally altered,” he said.

Ferrari unveiled two new car models on September 18 2018. They are titled the Monza SP1 and Monza SP2.

The analyst said Ferrari has doubled-down on high end customers after it debuted two brand new road cars, the Ferrari Monza SP1 and SP2 last month.

Ferrari have said that the latest models are part of a limited series called “Icona.” The name has been chosen to reference the firms famous racing cars of the 1950's. The cars will retail at a starting price of 1.6 million euros.

Ferrari said the limited edition would run to a maximum of 499 cars but that there will be further model releases as part of the Icona range.

On plans for an SUV release, Ferrari have now pushed back the release date by two years to 2022. Reitman described the change of strategy as a “game-changer” for the firm.

Societe Generale added that Ferrrai's fundamentals ought now to be valued somewhere between the weighted average of the European luxury goods sector and the French high fashion luxury goods manufacturer, Hermes.

Average CO2 emissions grow 1.8% so far this year

The average carbon dioxide (CO2) emissions of new cars sold in Spain stood at 117 grams per kilometer traveled so far this year, representing an increase of 1.8% compared to the average of the same period of the year. last year, according to data from the consultancy MSI for the dealers’ management, Faconauto. In this… Continue reading Average CO2 emissions grow 1.8% so far this year

Geely and Daimler want to create a car-sharing and VTC joint venture

Unity is strength. The Chinese manufacturer Geely seeks to associate with Daimler, of which he is already the largest shareholder, to tackle the car-sharing and VTC market. The two companies are currently in talks to create a car pooling and on-demand vehicle joint venture in China, reports Bloomberg. The objective would be compete with Didi,… Continue reading Geely and Daimler want to create a car-sharing and VTC joint venture

Vinfast signs $950m agreement for machinery

Representatives of Vinfast and Euler Hermes shake hands at the signing ceremony. — Photo Vingroup Viet Nam News HÀ NỘI — VinFast Trading and Production Limited Liability Company (VinFast) has entered into a US$950 million financing agreement guaranteed by Euler Hermes and the German Export Credit Agency (ECA), to support the country’s first automotive and… Continue reading Vinfast signs $950m agreement for machinery

Daimler and Geely discuss ride sharing JV – report

Zhejiang Geely Holding – which owns Volvo Cars, is in talks with Daimler, in which billionaire owner billionaire Li Shufu took an almost 10% stake earlier this year, to set up ride-hailing and car-sharing services in China, sources told Bloomberg. A 50-50 venture that would take on market leader Didi Chuxing was under discussion, one source… Continue reading Daimler and Geely discuss ride sharing JV – report

Elon Musk’s ultimatum to Tesla: Fight the SEC, or I quit

21st Century Fox CEO James Murdoch would make a good Tesla chairman, says NY Times' Stewart

10:36 AM ET Wed, 3 Oct 2018 | 04:47

Securities and Exchange Commission officials were understandably taken aback on Thursday morning when Tesla's board — and its chairman, Elon Musk — abruptly pulled out of a carefully crafted settlement.

After the S.E.C. responded by accusing Mr. Musk, but not the company that he had co-founded, of securities fraud, the board further defied regulators, issuing a provocative statement saying that the directors were “fully confident in Elon, his integrity, and his leadership of the company.”

It was a stunning reversal: The board had rejected a settlement that was extraordinarily generous — it would have allowed Mr. Musk to remain as chief executive, and required him to step down as chairman for only two years. Now, the company was at risk of losing Mr. Musk as chairman and chief executive if regulators prevailed in court.

More from The New York Times:

Unraveling a Tesla Mystery: Lots (and Lots) of Parked Cars

Tesla Reports Progress on Model 3 Car Production

Elon Musk Settled With the S.E.C., but Tesla's Troubles Aren't Over

“What it tells us is this board, as a strategic plan, must be using the Jim Jones-Jonestown suicide pact,” Jeffrey Sonnenfeld, a professor at the Yale School of Management, said Friday on CNBC. “They are drinking the Kool-Aid of the founder. It is completely as self-destructive as Musk is.”

But Mr. Musk had given the board little choice: In a phone call with directors before their lawyers went back to federal regulators with a final decision, Mr. Musk threatened to resign on the spot if the board insisted that he and the company enter into the settlement. Not only that, he demanded the board publicly extol his integrity.

Threatened with the abrupt departure of the man who is arguably Tesla's single most important asset, the board caved to his demands, according to three people familiar with the board's decision.

The next day, Tesla's lawyers were back at the S.E.C., all but groveling for a second chance — this time with Mr. Musk's grudging approval.

One factor in Mr. Musk's change of heart: Tesla's stock plunged Friday morning as investors absorbed news of the rejected settlement and the possibility that the S.E.C. would force Mr. Musk to step down. It would finish down almost 14 percent on Friday.

Patrick T. Fallon | Bloomberg | Getty Images

Elon Musk, co-founder and chief executive officer of Tesla Inc.

On Saturday, the company and Mr. Musk finally agreed to settle the matter, ending a crisis that began with Mr. Musk's now-infamous Twitter post saying that he had “funding secured” for a buyout at $420 a share.

Mr. Musk's 48 hours of obstinance came at a significant price to him and the company. They had passed on Thursday's generous offer, and the S.E.C. felt compelled to extract greater concessions. The ban on Mr. Musk's serving as chairman went from two years to three, and his fine doubled to $20 million. Tesla will also pay a $20 million fine, and Mr. Musk agreed to personally buy the same amount in Tesla stock.

The S.E.C. is also requiring the company to add two independent directors and to elect an independent director as chairman.

“Rejecting such a favorable settlement is proof that he needs monitoring,” said John C. Coffee Jr., a professor at Columbia Law School. “He didn't have a legal leg to stand on, and I'm sure his lawyer told him that. But he got very touchy about not being able to proclaim his innocence.”

From Mr. Musk's view, that had been a crucial problem with a settlement from the beginning. Mr. Musk neither admitted nor denied guilt as part of the agreement, and he cannot publicly contest the S.E.C.'s allegations. He cannot say, as he did on Thursday, that “I have always taken action in the best interests of truth, transparency and investors” and “the facts will show I never compromised this in any way.”

Tesla's stock has rebounded this week, reflecting investors' relief that Mr. Musk will remain as chief executive while the company puts mechanisms in place to curb his increasingly impulsive behavior. The board will closely watch Mr. Musk's communications with investors, and establish a permanent committee responsible for, among other things, monitoring disclosures.

But it remains to be seen how effective the board can be, given Mr. Musk's erratic temperament and his dominant role in the company.

Tesla's made positive progress since turning down SEC settlement, says former Nasdaq chairman

2:38 PM ET Wed, 3 Oct 2018 | 02:59

People involved in the board's deliberations this week told me that some directors have proposed their fellow director, James Murdoch — the chief executive of 21st Century Fox, most of which is being sold to the Walt Disney Company — as chairman. But Mr. Murdoch hasn't volunteered for the post nor has he discussed it with any other director. And another person close to the selection process said the board hadn't yet engaged in any “serious” discussions of who should be chairman. The people spoke on the condition of anonymity because the board discussions were private.

Under terms of the settlement, the board has 45 days before Mr. Musk must resign. Whether it is Mr. Murdoch or another similarly qualified candidate who takes over as chairman, managing Mr. Musk will be no easy challenge.

Independent directors frequently face difficulty asserting themselves in any company with an outsize figure like Mr. Musk, whether it be a founder, controlling shareholder or powerful chief executive, said Lucian Bebchuk, a professor at Harvard Law School and an expert in corporate governance. Such people can often replace any director who crosses them, he said.

“Adding two independent directors can be expected to help, but its impact is likely to be limited,” Professor Bebchuk said. “As courts and governance researchers have long recognized, the presence of a dominant shareholder is likely to reduce the effectiveness of independent directors as overseers of the C.E.O.'s decisions and behavior.”

In the end, it took legal action by the S.E.C. to accomplish what had been increasingly obvious to most Tesla observers, including many of Tesla's own directors: For all his brilliance, Mr. Musk's reckless impulses must be kept in check.

Foremost among those should be threats to quit if he doesn't get his way.

WATCH: Three experts on the future of Tesla after Elon Musk settled with SEC

Three experts on the future of Tesla after Elon Musk settled with SEC

5:55 PM ET Mon, 1 Oct 2018 | 01:35

DIS

—

FOXA

—

TWTR

—

TSLA

—

To view this site, you need to have JavaScript enabled in your browser, and either the Flash Plugin or an HTML5-Video enabled browser. Download the latest Flash player and try again.

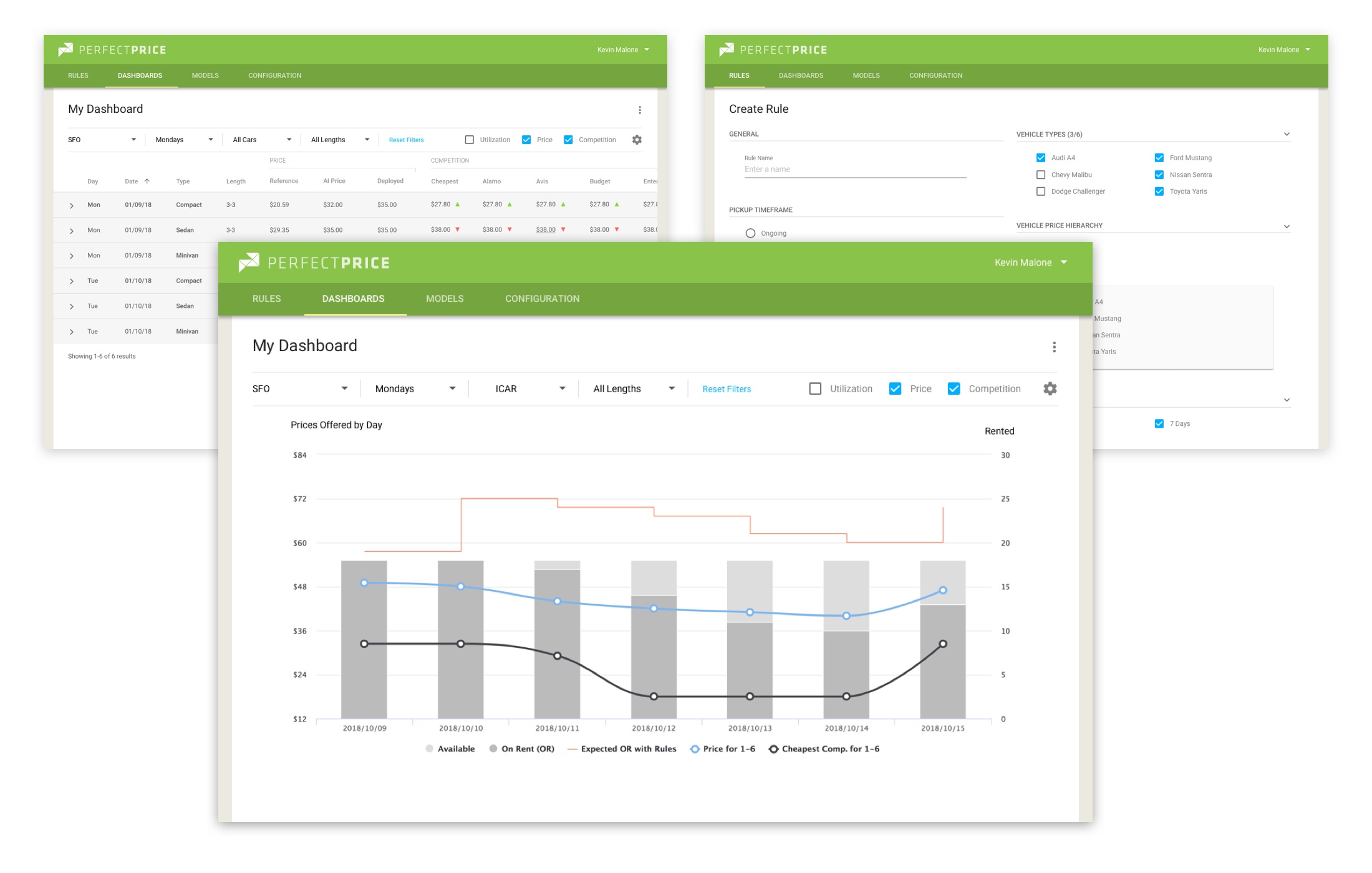

Car Rental Dynamic Pricing Platform Open to Public

The Perfect Price platform, previously in beta, uses a combination of machine learning and big data analysis to anticipate the prices consumers are willing to pay for specific goods and services at any given moment in time. Screenshot courtesy of Perfect Price. Perfect Price, the company using AI to make pricing and revenue management effortless… Continue reading Car Rental Dynamic Pricing Platform Open to Public

Ford hires US firm as its lead ad agency in a major blow to WPP

Ford hired advertising agency BBDO as its lead creative shop in a move that the auto company calls a new global marketing approach.

After a five-month process, Ford announced that WPP — the largest ad agency in the world — will continue to run “activation,” or functions such as in-store advertising, website development and marketing for its dealerships. It will also retain media planning and buying.

But BBDO, part of rival group Omnicom, will run brand advertising, which means it will create overarching big ideas for Ford and its vehicles. Brand advertising is often seen by creative agencies as more prestigious than promotional or retail-focused campaigns, and it means that WPP's agencies will now have to follow BBDO's creative lead. Andrew Robertson, CEO of BBDO Worldwide said in an emailed statement: “Today is a big big day. We have a wonderful new brand to help build.”

Ad agency Wieden + Kennedy will also work with Ford as an “innovation partner” on specific projects, Ford said in an online statement.

Significant challenges ahead for WPP: Advertising CEO

3:42 AM ET Tue, 4 Sept 2018 | 02:09

WPP-associated agencies have worked on Ford's advertising for decades, starting with J. Walter Thompson (JWT) in 1943, according to industry website Ad Age. WPP bought JWT in 1987 for $566 million and has since created Global Team Blue, a collection of agencies within WPP that solely worked on Ford's ad business.

In an online statement, Ford said the new setup will reduce costs, representing “$150 million in annual efficiencies” and that it would use more technology to personalize its ad campaigns. Ford hired Jim Hackett as CEO in May 2017, tasked with restructuring the automaker, but is yet to give details of his turnaround plan.

“Ford already is one of the most recognized and respected brands in the world,” said Joy Falotico, Ford group vice president and chief marketing officer, in an online statement. “In this pivotal moment of reinvention and transformation, we're excited to partner with world-class creative agencies to unlock the full potential of the iconic blue oval.”

Andrew Harrer | Bloomberg | Getty Images

Jim Hackett, president and chief executive officer of Ford Motor Co., speaks during a discussion at the Automotive News World Congress event in Detroit, Michigan, U.S., on Tuesday, Jan. 16, 2018.

Brian Wieser, a senior research analyst at Pivotal Research, said in an analyst note emailed to CNBC that Ford's account was likely worth $500 million to $600 million a year, and that less than half the business would be leaving WPP. For BBDO parent company Omnicom, this might mean a 2 percent increase in organic revenue from November, Wieser added.

In a note seen by Ad Age, WPP's Satish Korde, who is CEO of Global Team Blue, said: “WPP is assessing the impact and implications of this decision, which cannot be fully determined until more detail is known.”

“As you all know, we gave this review everything we had: It was an extraordinary effort by the entire global team over many, many months. We accept this difficult decision with our heads held high and thank everyone for their contributions,” Korde added.

WPP, which recently appointed Mark Read as CEO, said in an online statement: “WPP agencies will continue to handle activation, including media planning and buying, digital and production. These responsibilities also include tier two advertising work in the U.S., the China advertising operations with its joint venture partner, all Lincoln advertising, and all the Ford public relations business.”

“WPP will work closely with Ford on the shape of its future relationship and the impact on its people,” it added.

Predicting the World Around Autonomous Vehicles: Our Investment in Perceptive Automata

Predicting the World Around Autonomous Vehicles: Our Investment in Perceptive Automata As I’ve said before, cars are “social.” They exist alongside other human-operated vehicles, cyclists, and pedestrians. When we’re behind the wheel, we constantly survey the roads looking for clues to help predict what other people will do. Will that teenage skateboarder jaywalk? Will the… Continue reading Predicting the World Around Autonomous Vehicles: Our Investment in Perceptive Automata