The BNetzA has presented new proposals for stabilizing the power grid. A complete shutdown of wall boxes and heat pumps is therefore not permitted. (electric car, Federal Network Agency) Go to Source

Category: Automotive

Tesla factory: “Total chaos” should prevail in Grünheide

The Tesla factory in Grünheide is still far behind its production targets. There are not enough staff or the employees quit again. (Gigafactory Berlin, electric car) Go to Source

Audi India opens its 20th pre-owned car facility in Indore

Audi India today inaugurated a new pre-owned car facility, Audi Approved: plus in Indore, Madhya Pradesh. The inauguration marks the opening of the luxury carmaker’s 20th Audi Approved: plus facility in India. Speaking at the inauguration, Balbir Singh Dhillon, Head of Audi India said, “Indore is an important market for our brand and has great growth potential. With Audi Approved:… Continue reading Audi India opens its 20th pre-owned car facility in Indore

Greaves Electric Mobility to reveal five new EVs at Auto Expo 2023

Greaves Electric Mobility Pvt Ltd (GEMPL), the e-mobility business of Greaves Cotton, is to reveal five new electric vehicles – across Ampere two-wheelers and GEMPL three-wheelers – at next month’s Auto Expo 2023 in Greater Noida. The new range of EVs is targeted at the growing B2B and B2C market. According to the company, the… Continue reading Greaves Electric Mobility to reveal five new EVs at Auto Expo 2023

Greaves Electric Mobility to reveal five new EVs at Auto Expo 2023

Greaves Electric Mobility Pvt Ltd (GEMPL), the e-mobility business of Greaves Cotton, is to reveal five new electric vehicles – across Ampere two-wheelers and GEMPL three-wheelers – at next month’s Auto Expo 2023 in Greater Noida. The new range of EVs is targeted at the growing B2B and B2C market. According to the company, the… Continue reading Greaves Electric Mobility to reveal five new EVs at Auto Expo 2023

Greaves Electric Mobility to reveal five new EVs at Auto Expo 2023

Greaves Electric Mobility Pvt Ltd (GEMPL), the e-mobility business of Greaves Cotton, is to reveal five new electric vehicles – across Ampere two-wheelers and GEMPL three-wheelers – at next month’s Auto Expo 2023 in Greater Noida. The new range of EVs is targeted at the growing B2B and B2C market. According to the company, the… Continue reading Greaves Electric Mobility to reveal five new EVs at Auto Expo 2023

BorgWarner opens new tech centre in Bengaluru

Sustainable mobility solutions company BorgWarner has inaugurated a new Technical Center in the Kundalahalli suburb of Bengaluru. Spread across 2,460 square metres, the facility will focus on systems software development, fuel handling design and mechanical simulation for internal combustion engines, and H2 engine management systems. In addition to meeting the needs of commercial and passenger vehicle… Continue reading BorgWarner opens new tech centre in Bengaluru

BorgWarner opens new tech centre in Bengaluru

Sustainable mobility solutions company BorgWarner has inaugurated a new Technical Center in the Kundalahalli suburb of Bengaluru. Spread across 2,460 square metres, the facility will focus on systems software development, fuel handling design and mechanical simulation for internal combustion engines, and H2 engine management systems. In addition to meeting the needs of commercial and passenger vehicle… Continue reading BorgWarner opens new tech centre in Bengaluru

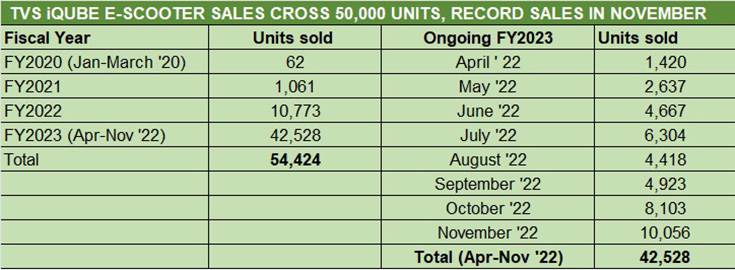

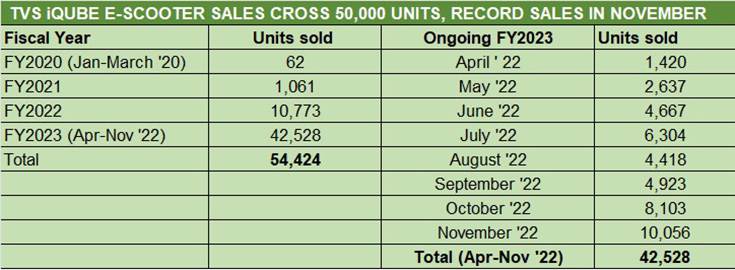

TVS iQube records its best-ever sales in November: 10,058 units

Thirty-five months after it was launched, the TVS iQube, TVS Motor Co’s first electric vehicle and scooter, has recorded its best-ever monthly sales. In November, the iQube logged a total of 10,058 units, which beats the previous best of 8,103 units in festive October 2022 and points to growing demand for the eco-friendly scooter. What’s… Continue reading TVS iQube records its best-ever sales in November: 10,058 units

TVS iQube records its best-ever sales in November: 10,058 units

Thirty-five months after it was launched, the TVS iQube, TVS Motor Co’s first electric vehicle and scooter, has recorded its best-ever monthly sales. In November, the iQube logged a total of 10,058 units, which beats the previous best of 8,103 units in festive October 2022 and points to growing demand for the eco-friendly scooter. What’s… Continue reading TVS iQube records its best-ever sales in November: 10,058 units