Jeep has wasted no time in making use of the new partnership between FCA and PSA by starting development on a new ‘ultra-compact’ SUV that will be pitched as a more rugged alternative to the likes of the Nissan Juke and Volkswagen T-Cross. And Auto Express can reveal that it’s going to be offered as a fully electric vehicle, too. Senior… Continue reading New baby Jeep SUV set for 2022 launch

Tag: FCA

Tesla Is The Most Valuable Auto Company In The History Of America*

Invest

Electric Cars

Electric Car Benefits

Electric Car Sales

Solar Energy Rocks

RSS

Advertise

Privacy Policy

Cars

Published on January 8th, 2020 |

by Vijay Govindan

Tesla Is The Most Valuable Auto Company In The History Of America*

Twitter

LinkedIn

Facebook

January 8th, 2020 by Vijay Govindan

Barron’s noted on January 7th, 2020, that Tesla had become the most valuable auto company in the history of America. Let me repeat: Not just currently. We are talking about the most valuable American auto company since America was born. Congratulations to Elon, Tesla, and the team for unlocking this achievement!

Tesla beats out the old automaker market cap record held by Ford in 1999, at $81 billion. How valuable is Tesla? After January 8th’s surge, Tesla is valued at nearly $89 billion. Sure, the purists will argue it’s not an inflation-adjusted peak or the largest enterprise value (enterprise value includes equity and debt). Let’s call it a non-inflation-adjusted peak and market cap only. It’s impressive, nonetheless.

Tesla transformed the push for sustainable energy and became the most valuable American auto company within 10 years. We are not talking about high-margin phones. We are talking about a capital-intensive, low-margin, ruthless, heavily entrenched, lobbyist-backed industry.

Another way to note the importance of Tesla’s accomplishment is comparing Tesla with General Motors, Ford, and Fiat Chrysler’s market cap. According to Yahoo Finance, as of 1/8/20, GM was worth $52B, Ford was valued at $38B, FCAU at $25, and Tesla at $85B. Tesla’s value is larger than GM and Fiat Chrysler put together, and very close to being larger than GM and Ford put together. (On Google Finance, a bit different, Tesla is worth more than GM and Ford combined). In fact, Tesla is not too far off from being worth more than GM, Ford, and Fiat Chrysler combined.

As Frugal Moogal and I have speculated over the last few weeks, there are many reasons for Tesla’s surge. One reason that’s rarely discussed is the expected surge in Tesla auto sales over the coming two years. The below chart excludes the growth of Tesla Energy in the next two years, but it attempts to forecast Tesla’s coming auto sales.

My personal forecast.

Noted Tesla bear and Credit Suisse analyst Dan Levy states, “The framework contextualizes the lofty assumptions embedded in the stock – to justify the current stock price one arguably must assume that by 2025 Tesla will grow annual volume to 1.2mn units.” The same analyst raised his 12-month Tesla price target from $200 to $350 in an attempt to move from totally absurd to semi-reasonable.

I expect Tesla to produce 150,000 units in China and produce another 150,000 Model Y this year. As the ramp continues, I expect both to double production next year, joined by production of the CyberTruck and the Berlin factory coming online. Sometime during 2021, Tesla will have produced more than a million vehicles within a year. This is remarkable. I am hesitant to estimate beyond 2021 because Tesla is growing so fast. I don’t consider these super bull numbers, rather numbers based on what is genuinely possible.

*The asterisk in the title is mentioned since everyone is treating Tesla as simply an auto company. I disagree with that simplification, as do many of the writers here on CleanTechnica. Tesla is an energy and technology company, which happens to masquerade as an auto company. This is one reason why Wall Street analysts are completely befuddled. Most of them stick to one industry segment. Tesla crosses multiple major segments. That’s hard for the spreadsheet jockeys to model. What they miss is that the energy and technology markets are vastly larger than the auto market. At its, peak Exxon traded close to $500B in value. Microsoft and Apple are worth more than $1,000B at the moment. For more on this topic, see: “No, Tesla Is NOT The Largest US Automaker Ever.”

Disclosure: I bought back my Tesla shares a few days ago and am long on Tesla cars. The FUD didn’t reach the levels I expected. Don’t worry, I got pilloried hard for buying and selling Tesla from comments in my last post. I expect the same in this one. Keep it up!

Use my referral link to receive 1,000 free Supercharger miles with the purchase and delivery of a new Tesla vehicle, or earn a $100 award after system activation by purchasing or subscribing to solar panels: https://ts.la/vijay59877

Follow CleanTechnica on Google News.

It will make you happy & help you live in peace for the rest of your life.

About the Author

Vijay Govindan Vijay Govindan is a Cleantechnica writer part-time. Through his writing Vijay seeks to elevate the realized potential of humankind.

Against human trafficking. Tesla Model 3 LR owner. His claim to fame is Tesla and Elon have commented, liked or re-tweeted an article he wrote with the Tesla community. Just once. 😉

https://cleantechnica.com/2019/06/23/our-new-tesla-myths-page/

#WeChooseTesla, #RenewableEnergy and #YangGang supporter. Long Tesla shares. Has a healthy skepticism of the Q branch of the Tesla investment community. Made it to one $tslaq block list.

Follow him on Twitter @vijaygovindan17. If you read this far, wow, 👏🏽 and 🙏🏽.

Back to Top ↑

Advertisement

Support CleanTechnica – $3/Month

Advertise with CleanTechnica to get your company in front of millions of monthly readers.

Top News On CleanTechnica

Advertisement

Cleantech Press Releases

20 Utah Communities Committed To 100% Renewable Energy In 2019

15 New Electric Articulated Buses Deployed In NYC — 500 Planned To Serve All 5 Boroughs

The Volkswagen ID.3’s Battery

Our New Electric Car Driver Report

Read our new report on electric car drivers, what they desire, and what they require.

CleanTechnica Clothing & Cups

Listen to CleanTech TalkTesla News

30 Electric Car Benefits

Our Electric Vehicle Reviews

EV Charging Guidelines for Cities

Read & share our free report on “EV charging guidelines for cities.”

Advertisement

Follow CleanTechnica Follow @cleantechnica

© 2020 CleanTechnica

Invest

Electric Cars

Electric Car Benefits

Electric Car Sales

Solar Energy Rocks

RSS

Advertise

Privacy Policy

This site uses cookies: Find out more.Okay, thanks

Hundreds of GM temp workers were just made permanent

CLOSE General Motors worker Adarrey “Ace” Humphrey was blindsided Sunday. That’s when his life changed. Humphrey, 27, has been a part-time temporary worker at GM’s Flint Assembly for the last three years. Sunday morning, he and about 250 of his co-workers crowded into UAW Local 598’s union hall. Most thought they were there for a routine meeting. But when the local’s president stepped to… Continue reading Hundreds of GM temp workers were just made permanent

Ferrari joins European auto lobby ACEA four years after spin-off – ETAuto.com

Ferrari is controlled by Exor , the holding company of Italy’s Agnelli family, which also controls FCA and industrial vehicle maker CNH Industrial , another ACEA member. MILAN: Italian luxury carmaker Ferrari has become the latest manufacturer to join the European carmakers’ association (ACEA), the auto lobby said on Tuesday. ACEA represents manufacturers of passenger… Continue reading Ferrari joins European auto lobby ACEA four years after spin-off – ETAuto.com

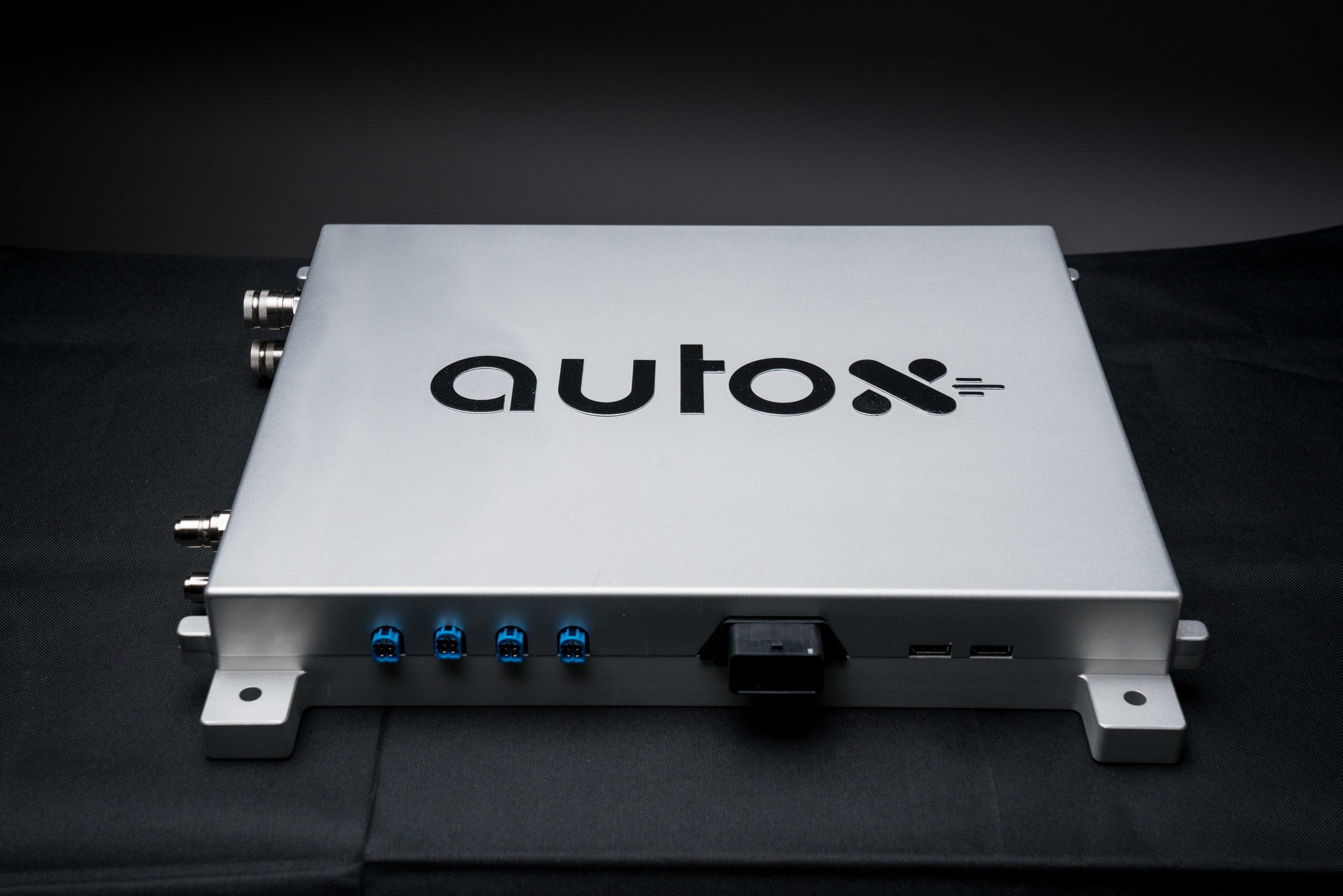

AutoX and Fiat Chrysler are teaming up on a robotaxi for China

Autonomous vehicle startup AutoX, which is backed by Alibaba, said Tuesday that it is partnering with Fiat Chrysler to roll out a fleet of robotaxis for China and other countries in Asia. A fleet of Chrysler Pacifica vans is going to be in service to the public in China in early 2020, according to AutoX.… Continue reading AutoX and Fiat Chrysler are teaming up on a robotaxi for China

New compliance solution to show areas of concern for dealers

A new compliance solution division for leasing companies, brokers, dealers and lenders has been launched by APD Global. The solution, Compliance 360, has been developed to monitor customer feedback in line with FCA guidelines to ensure suppliers proactively process responses in areas of non-compliance such as commissions, transparency and affordability. APD monitors feedback from customers… Continue reading New compliance solution to show areas of concern for dealers

Alfa Romeo Giulia and Stelvio Launch with TomTom Connected Navigation and Maps for Advanced Driver Assistance

Amsterdam, The Netherlands, January 7, 2020 Location technology specialist, TomTom (TOM2), today announced that its easy-to-use connected navigation has been chosen to feature in the new Alfa Romeo GIULIA MY20 compact saloon and the Alfa Romeo STELVIO MY20 SUV as part of a global deal, which includes China and Japan. GIULIA and STELVIO drivers will… Continue reading Alfa Romeo Giulia and Stelvio Launch with TomTom Connected Navigation and Maps for Advanced Driver Assistance

@FCA: FCA Appoints Sproule as Chief Communications Officer

January 7, 2020 , Auburn Hills, Mich. – Fiat Chrysler Automobiles N.V. (FCA) today announced Simon Sproule as its Chief Communications Officer. In addition, Sproule was named Head of North America Communications. The appointment is effective February 3, 2020. Sproule joins FCA from Aston Martin Lagonda where he served as Vice President and Chief Marketing Officer. In… Continue reading @FCA: FCA Appoints Sproule as Chief Communications Officer

Press Releases – Ferrari joins ACEA

Brussels, 7 January 2020 – The European Automobile Manufacturers’ Association (ACEA) kicks off the new year with Ferrari becoming its newest member company. ACEA is the advocate for the automobile industry in Europe, representing manufacturers of passenger cars, vans, trucks and buses with production sites in the EU. With the addition of the Italian luxury… Continue reading Press Releases – Ferrari joins ACEA

Ferrari joins European auto lobby ACEA four years after spin-off

FILE PHOTO: The new Ferrari Roma is senn outside the Quirinale Presidential Palace in Rome, Italy, November 15, 2019. REUTERS/Guglielmo Mangiapane/File Photo MILAN (Reuters) – Italian luxury carmaker Ferrari (RACE.MI) has become the latest manufacturer to join the European carmakers’ association (ACEA), the auto lobby said on Tuesday. ACEA represents manufacturers of passenger cars, vans,… Continue reading Ferrari joins European auto lobby ACEA four years after spin-off