To gauge the impact of WLTP, an Autocar survey of car firms revealed that, while most were expecting no issues or delays due to WLTP, several have been forced to suspend production or axe models to meet the new rules. Volkswagen Group brands have been particularly affected by the change in tests. Audi, Seat, Skoda… Continue reading VW Group hit hard by new emissions test

Tag: BMW

Unterschleißheim applies for Autonomous E-Bus

The city of Unterschleißheim plans to introduce an autonomous electric bus in the city. The city Unterschleissheim in the north of Munich is especially known for the BMW location. Because BMW there bundles his ambitions regarding autonomous driving. Since it seems logical that the city wants to have to do with the technology. Autonomous E-Bus… Continue reading Unterschleißheim applies for Autonomous E-Bus

China’s Byton is sending its electric SUV prototypes to the U.S.

That’s when self-driving vehicle technology startup Aurora will take over. Kirsten Korosec 7 hours Byton, the new China-based automaker founded by former BMW and Infiniti executives, has produced the first 10 prototypes of its tech-centric all-electric SUV and some of them will be in the U.S. before the end of the year, company president and co-founder… Continue reading China’s Byton is sending its electric SUV prototypes to the U.S.

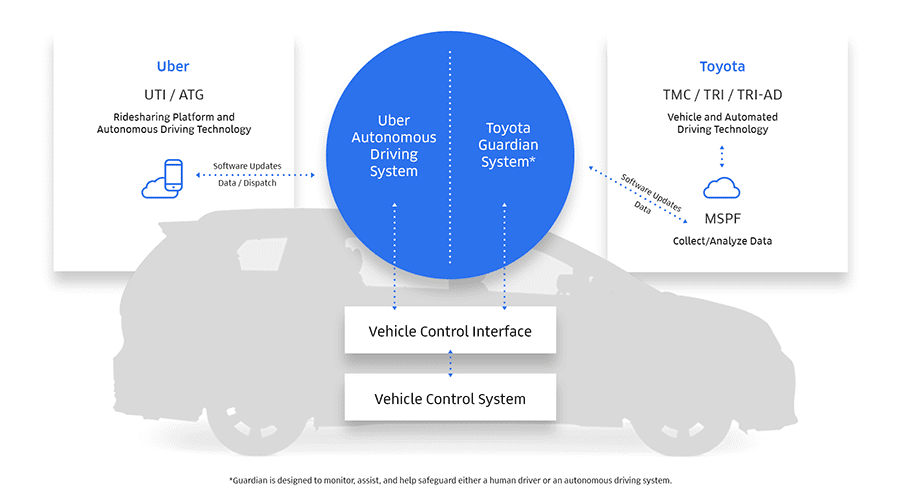

Toyota and Uber Extend Collaboration to Automated Vehicle Technologies

Aug. 28, 2018 August 28, 2018―TOKYO, Japan―Toyota Motor Corporation (TMC) and Uber Technologies, Inc. (Uber) today announced that they have agreed to expand their collaboration with the aim of advancing and bringing to market autonomous ride-sharing as a mobility service at scale. To accomplish this, technology from each company will be integrated into purpose-built Toyota… Continue reading Toyota and Uber Extend Collaboration to Automated Vehicle Technologies

So much do BMW, Mercedes and VW really earn with their cars

by Andre Borbe conclude New cars are expensive, but how much money do manufacturers make and who earns the most? This shows a study. Two brands even make losses. Those who buy a new car pay attention to the price and try to get discounts from the car dealer. Sometimes the dealers go down with… Continue reading So much do BMW, Mercedes and VW really earn with their cars

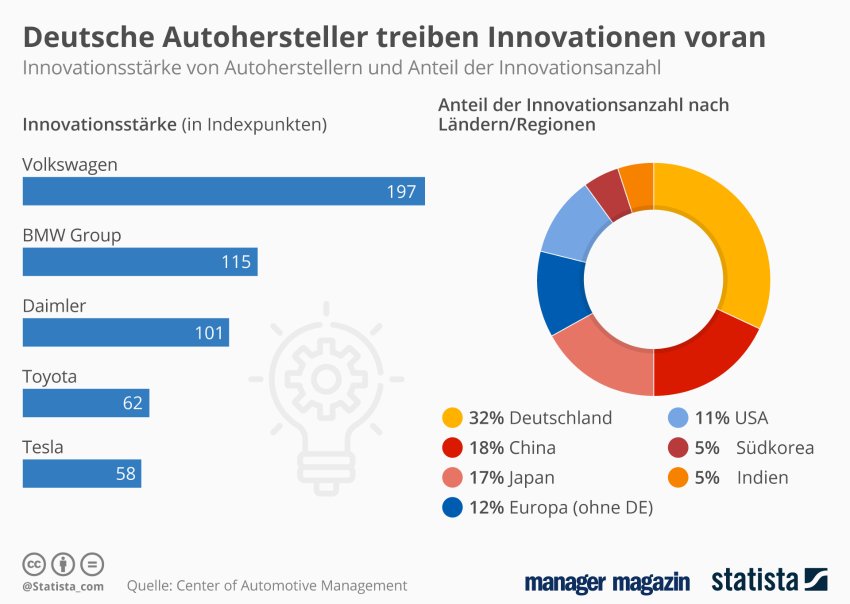

Car companies in the innovation check: The most innovative car in the world comes from Neckarsulm

All articles and backgrounds 08/25/2018 Car companies in the innovation check The most innovative car in the world comes from Neckarsulm The world’s most innovative volume manufacturer is based in Wolfsburg; the most innovative premium manufacturer is based in Munich; The most innovative car is running in Neckarsulm off the line – the “Center of… Continue reading Car companies in the innovation check: The most innovative car in the world comes from Neckarsulm

Elon Musk will sabotage his own plans if he takes Tesla private, Tesla bull says

Tesla investor writes open letter to Elon Musk on keeping Tesla public

5 Hours Ago | 02:43

Tesla CEO Elon Musk will sabotage his own goals for the electric car maker if he takes it private, said ARK Invest CEO Cathie Wood, who predicted Tesla stock could reach $4,000 per share.

“By going private [Musk] would deprive Tesla of reaching his own priorities — mobility as a service, autonomous truck platoons, utility energy storage, even air passenger drones,” Wood said Friday on CNBC's “Closing Bell.” “He's got big plans, and he needs to scale these plans. We don't think that it will happen nearly as effectively in the private markets as in the public.”

Tesla has battled widespread scrutiny, following Musk's Aug. 7 tweet that he was planning to take Tesla private and had “funding secured.” The Securities and Exchange Commission served Tesla with a subpoena last week, as it looks into whether Musk violated securities laws by claiming he had funding for the maneuver. In addition, Musk himself has been criticized for erratic behavior. He confessed in an interview with The New York Times the toll of the “excruciating” year he has had leading Tesla, particularly when crunching to meet Model 3 production goals.

Through it all, Wood, who is CEO of innovation-focused investment service ARK Invest, has remained bullish. Known for making bold calls, the money manager first revealed her $4,000 per share call in February. On Wednesday, she published a letter to Musk and Tesla's board of directors, imploring them not to take the company private. She sees the company trading anywhere from $700 to $4,000 per share within five years if it remains public.

Tesla closed the day up 0.85 percent at $322.82 per share, having gained 5.67 percent on the week.

Central to Wood's argument that Tesla could trade as high as $4,000 per share is the idea that Tesla will orient itself away from the capital-intensive vehicle manufacturing business toward software. And that's where Tesla excels, she said.

“We think he's already way ahead of the game. He's got the data, he's got the chip that's three years ahead of Nvidia's chip … He's got batteries, which are three years ahead of any other company's batteries. And he's had the vision about autonomous taxi networks from the very beginning,” Wood said on Friday.

Pierre Ferragu, head of technology infrastructure research at New Street Research, said, “Tesla will become one of the major premium car manufacturers, like Audi and Jaguar … within the next seven years,” but its success will be from a purely go-to-market perspective, as Tesla has lower costs for marketing and distribution than other automakers.

“Maybe one day mobility-as-a-service will be a thing, but today there is nothing tangible there,” he said.

New Street Research placed a 12-month price target of $530 on Tesla and sees it reaching $1,200 to $2,000 by 2025. It all hinges on production numbers.

“They have seven years to be able to produce 2.5 [million] to 3 million cars a year. As you can imagine, getting to the first couple hundred thousand is the most challenging part,” he said. “Once they are at scale of BMW, they will be significantly more profitable than” BMW.

On production, Wood was bullish, saying Tesla will “iterate and iterate until they get it right, and then, they are going to be able to scale enormously when they get it right.” But Wood's biggest hopes for the company concern software, and she worries those lofty mobility-as-a-service goals won't come to fruition if Tesla goes private.

Musk is “the kind of person you need, one with vision who ends up at times very frustrated with the short time horizon of public markets. But the public markets will reward him handsomely if he just sticks with it and starts performing with the production schedules,” she said.

Coup of cold stock on the automobile

Black day for Continental. The German equipment maker fell Wednesday about 14% on the Frankfurt Stock Exchange, its largest decline since 2009, causing in its fall the European automotive values. At the Paris Bourse, Michelin, Valeo, Faurecia or Peugeot also gave ground – but to a lesser extent -, just like Pirellli in Milan or… Continue reading Coup of cold stock on the automobile

UBS repeats: Tesla will lose money on $35,000 Model 3

Tesla analyst: The company needs to increase price of Model 3 just to break even

4 Hours Ago | 03:09

Buyers waiting for that long-promised $35,000 Tesla Model 3 sedan probably shouldn't hold their breath.

After UBS recently pulled apart a Model 3 and compared its quality and estimated costs with two competitors, UBS analyst Colin Langan said he thinks Tesla will never be able to make money at the $35,000 the company originally planned to charge for an entry-level model designed for the masses.

“This car needs to sell in the low $40,000's to break even, and I think they're a long way from the 25 percent growth margin target, unless they can sell it well over $50,000,” Langan said Tuesday on CNBC's “Power Lunch.”

UBS hired a team of engineers to pull apart three different electric cars to compare their technology and production costs: a new Tesla Model 3, a 2014 BMW i3 and a 2017 Chevy Bolt.

The team examined a $49,000 2018 Model 3 and were “crazy” about the powertrain, “highlighting next-gen, military-grade tech that's years ahead of peers,” Langan said in a note dated Aug. 15. But the costs were higher than expected, and the cars would lose about $6,000 each at Tesla's original plan to sell an entry model at $35,000, he said.

It is another sign Tesla may have trouble turning into the mass-market automaker it said it wants to become.

Plans to manufacture the lower-cost vehicle have been delayed since its announcement in 2016 as the electric car manufacturer struggled to meet demand. CEO Elon Musk said in May that manufacturing the Model 3 at that price “right away” would cause Tesla to “die.”

Instead, Tesla focused on higher-cost versions that yield better margins, and that move may help Tesla post the profit in the third quarter of 2018 Musk said he expected. The cheapest model available now is $49,000, and buyers can add options that hike the price up to $80,000. Langan estimated the profit margin on the $49,000 version UBS tore apart was about 18 percent.

The problem is those prices aren't sustainable for a midsize sedan like the Model 3, Langan said. Even though the Model 3 is a battery electric, Langan said at least some of its buyers will also be shopping midsize sedans with internal combustion engines that are priced in the mid-$40,000 range, such as the BMW 3-Series.

The UBS engineers gave a breakdown of each car's powertrain and battery, electronic controls, frame and body as well as interior and safety features. They evaluated each part's design, ease of manufacturing and cost.

Tesla beat its two competitors in cost, but the Model 3 didn't have as big a lead over the other automakers as UBS had expected. However, some of the Model 3's technology seemed to be far ahead of that found on the Chevrolet and BMW. In particular, Tesla's electric powertrain stood out as exceptionally simple and flexible.

UBS based its estimates on consultations with engineers and industry research.

Tesla was not immediately available for comment.

Chevrolet and BMW did not comment on the original UBS report.

WATCH: Tesla whistleblower tweets details about allegedly flawed cars

Tesla whistleblower tweets details about allegedly flawed cars

4:55 PM ET Thu, 16 Aug 2018 | 01:21

Toyota, Renault, VW: Japanese and French depend on German carmakers in terms of efficiency

Toyota production in Miyawaka In terms of operating profit, Japanese carmakers are even leaving Daimler behind. (Photo: AP) DüsseldorfThe world in Wolfsburg could actually be okay. With 5.5 million vehicles sold was VW also in the first half of the year the largest automaker in the world. Even the profit was lush with 8.16 billion… Continue reading Toyota, Renault, VW: Japanese and French depend on German carmakers in terms of efficiency